Gilead and Merck's Billion Dollar Bets Face Tests as Ink Dries

This article by Bailey Lipschultz for Bloomberg may be of interest to subscribers. Here is a section:

The European Society for Medical Oncology meeting, which begins this week, will be headlined by results from Immunomedics Inc. -- which Gilead is buying for about $21 billion; and Seattle Genetics Inc., which drew more than $1 billion dollars in an investment and partnership from Merck.

The meeting will offer investors a peek into the blockbuster hopes for Immunomedics’ lead cancer drug and provide Merck holders added details on the effectiveness of a cancer drug the company has signed on to help bring it to patients.

Innovation in the healthcare sector has long been outsourced to biotechnology companies. Experimentation tends to be resource hungry and it is difficult to predict what will eventually become a commercial product. The answer has been to allow early stage investors take the start-up risk with the promise of the best solutions being eventually bought out at a substantial premium. That model ensures a robust pace of M&A activity work.

The big question for biotechnology today is whether the proof of concept COVID-19 testing will deliver on a streamlined permissioning regime for genetic solutions going forward. At a minimum the pandemic has focused attention on the ability of the sector to provide solutions to intransigent problems. At best a new regulatory regime would greatly accelerate the pace of innovation.

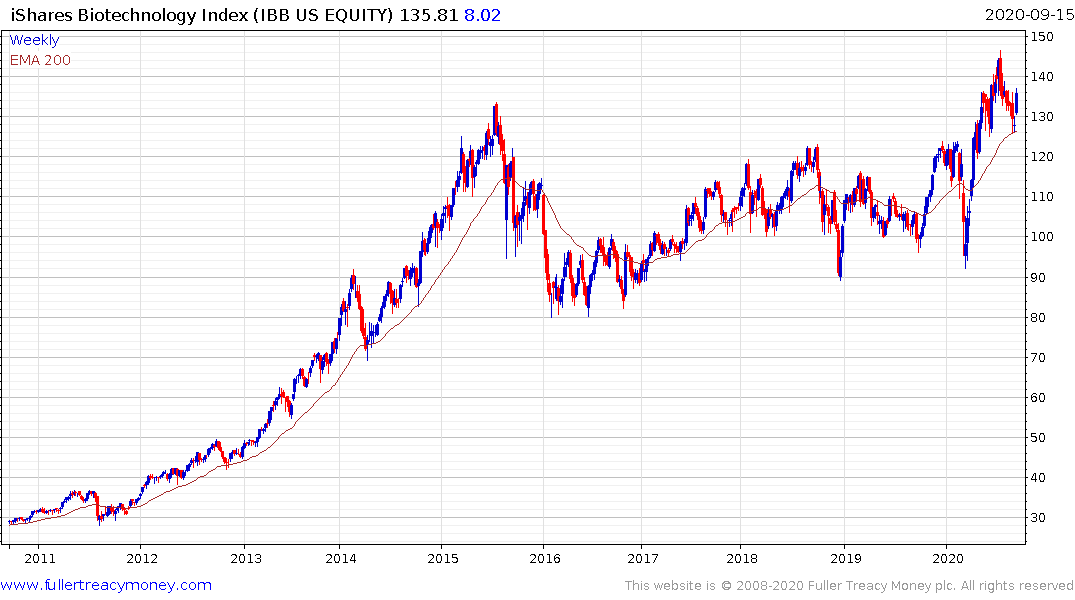

The Biotech ETF has first step above the base characteristics. It rebounded from the region of the trend mean and the previous peak this week to reassert demand dominance.