Germany's Sleepy Savings Banks Play Wall Street With LBO Bets

This article from Bloomberg may be of interest to subscribers. Here is a section:

LBO lending offered Germany’s savings banks a higher-margin business in the years when ultra-low interest rates were crimping the amount they could earn from retail loans. It also opened up a new customer base in the form of acquisitive private equity firms and gave them a way to maintain historical ties with local businesses being taken over.

“Nearly half of the family-owned businesses in the Cologne-Bonn region will undergo a generational change in the next few years,” said Uwe Borges, head of corporate banking at Sparkasse KölnBonn, one of Germany’s biggest savings banks with an LBO book in the high double-digit millions of euros. “Where there are no successors, leveraged buyouts are an option.”

His comments are echoed by Kai Scholze, a board director at Kreissparkasse Esslingen-Nürtingen, who said his bank operates LBO financing in part because it doesn’t want to lose customers that get acquired to competing banks. “The margins are of course higher in this business than with corporate financing, but this is also associated with a higher risk.”

The generational change question is something every economy is dealing with because the baby boomer generation is aging out of management positions. Many of those businesspeople were instrumental in building thriving companies that occupy important niches in the broader economy. Compensating people for a lifetime of commitment to building a business is in no way cheap.

There are really only three options. The first is sell to a larger competitor or in a management buyout. The second is a family member takes over or the business assets are placed in trust and managers are appointed. The third is secular decline where no satisfactory answer is to be found.

Obviously, this hand over to new generations is a secular transition. It is a major business opportunity for credit providers, wealth management, private banking and leisure services.

The biggest challenge for lenders is in weighing the opportunity from generational change versus the risk from the regulatory and technological transition currently underway. Many mid-sized German companies are going to be affected by the transition to EVs and more tense relations with China and Russia.

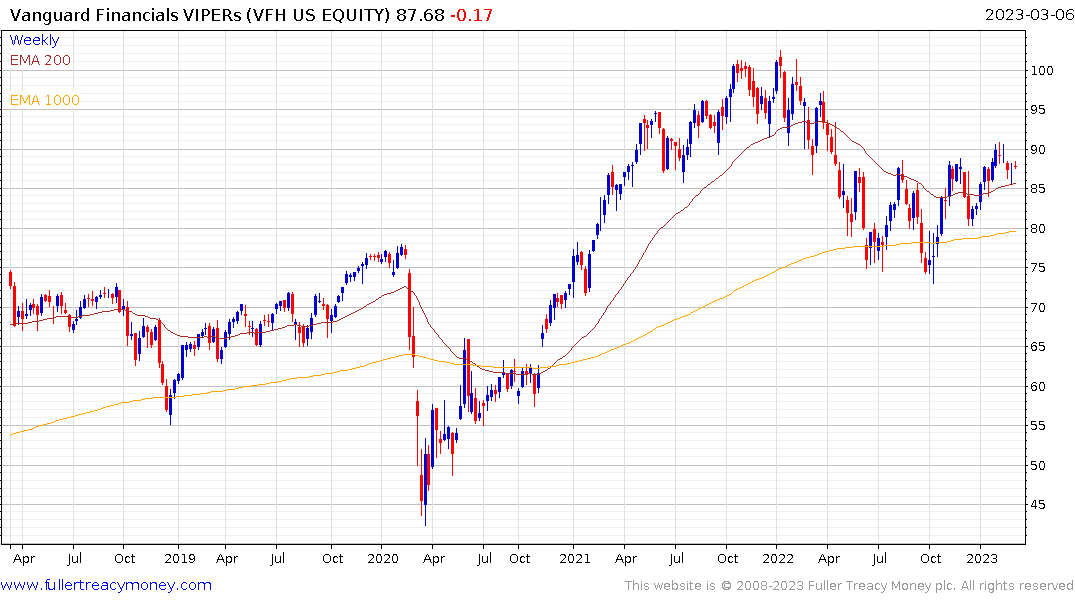

The Vanguard Financials ETF (VFH) is firmed from the region of the 200-day MA and has broken the yearlong downtrend.

The Vanguard Financials ETF (VFH) is firmed from the region of the 200-day MA and has broken the yearlong downtrend.

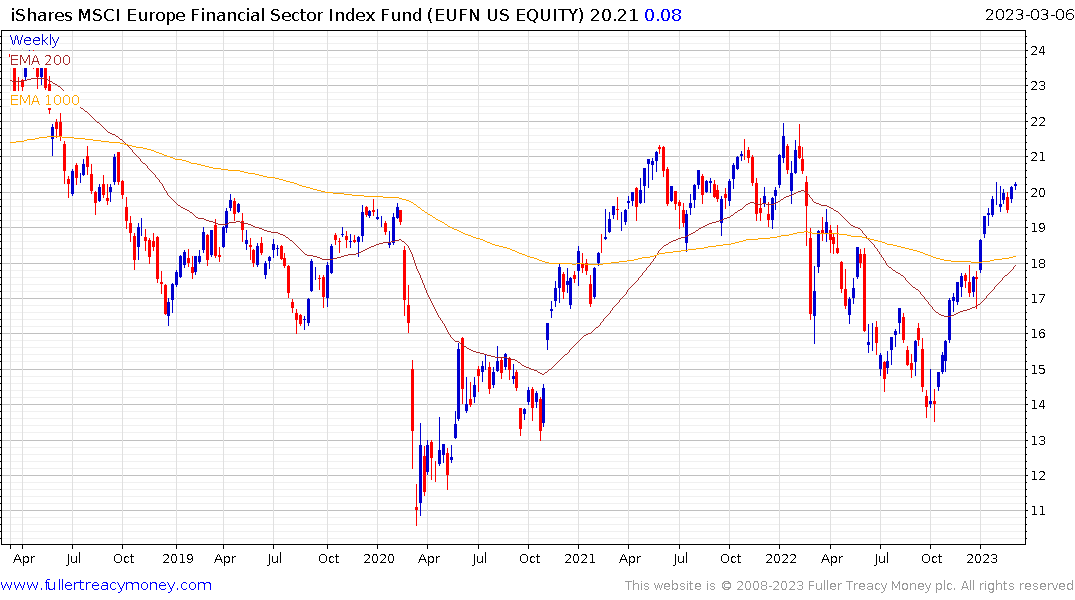

The iShares MSCI Europe Financials (EUFN) rebounded impressively as the cash set aside for losses was brought back into balance sheets following Europe’s avoidance of a true energy crisis. The ETF is back testing the upper side of a more than four-year base formation.

The iShares MSCI Europe Financials (EUFN) rebounded impressively as the cash set aside for losses was brought back into balance sheets following Europe’s avoidance of a true energy crisis. The ETF is back testing the upper side of a more than four-year base formation.

Cruise company leverage exploded during the pandemic. Carnival’s debt load more than tripled to $35.8 billion and occupancy is at 75% versus 106% in 2019. That suggests lower profitability for the next several years as the debt load is worked down. However, now every part of the travel sector has been equally affected. As bookings improve sentiment will become more benign.

The Defiance Hotel, Airline and Cruise ETF (CRUZ) focuses more on airlines and hotels. It continues to firm from the region of the 200-day MA.

The Defiance Hotel, Airline and Cruise ETF (CRUZ) focuses more on airlines and hotels. It continues to firm from the region of the 200-day MA.

Meanwhile, Airbnb and Booking are among the largest holding of the ETFMGH Travel Tech ETF (AWAY). These companies are more interest rate sensitive so it is underperforming at present.

Meanwhile, Airbnb and Booking are among the largest holding of the ETFMGH Travel Tech ETF (AWAY). These companies are more interest rate sensitive so it is underperforming at present.