German Inflation Slows as ECB Prepares for Interest-Rate Meeting

This article by Jeff Black for Bloomberg may be of interest to subscribers. Here is a section:

The ECB’s Governing Council, which meets next week to agree on interest rates, has warned it could take action if the medium-term outlook for inflation in the currency bloc deteriorates. At the same time, the arrival of Easter holidays in April this year has the potential to push price gains higher next month.

“The ECB cannot afford to see downside risks for inflation expectations to materialize,” said Annalisa Piazza, an economist at Newedge Strategy in London. Still, “the ECB is well aware that inflation will remain well below 2 percent for a prolonged period of time and some seasonal volatility is expected to be tolerated near term.”

The focus of Eurozone efforts in combating the effects of the sovereign debt and credit crisis has been inherently deflationary with fiscal consolidation foisted upon the governments of peripheral nations and little in the way debt forgiveness. While the ECB has taken on a number of additional roles since the beginning of the crisis its core mandate is to abide by an inflation target of 2%. With German inflation coming in below expectations, the ECB is unlikely to begin tightening lending standards any time soon.

Since Mario Draghi has made clear he will make unlimited credit available to the banking sector, this will be viewed as good news by investors. The Euro Stoxx Banks Index has been largely rangebound since January but is now rallying back towards the upper boundary and a clear move below 140 would be required to question medium-term scope for additional upside.

Italian banks are leading the sector and their domestic market higher. The pace of the S&P/MIB Index’s uptrend has picked up of late but a sustained move below 20,000 would be required to question medium-term scope for additional upside.

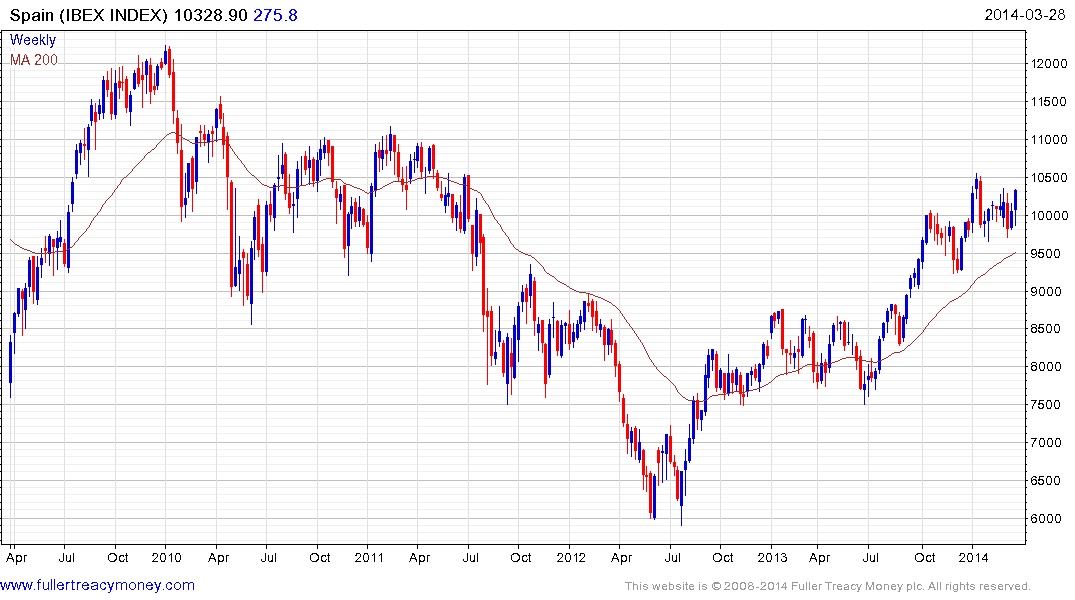

The Spanish IBEX Index also firmed this week and continues to hold an upward bias within a six-month range.