GE Surges on $4 Billion Plan to Speed Cut to Baker Hughes Stake

This article by Brendan Case and David Wethe for Bloomberg may be of interest to subscribers. Here is a section:

“We like seeing GE’s new CEO Larry Culp hasten the pace of the company’s portfolio breakup to generate sale proceeds to de-lever the balance sheet,” Deane Dray, an analyst at RBC Capital Markets, said in a note to clients. “This is consistent with GE’s messaging that it has roughly $60 billion of potential sources of liquidity.”

Culp took over six weeks ago from John Flannery, who succeeded Immelt in August 2017.

GE was among Bridgewater’s new buys in the third quarter

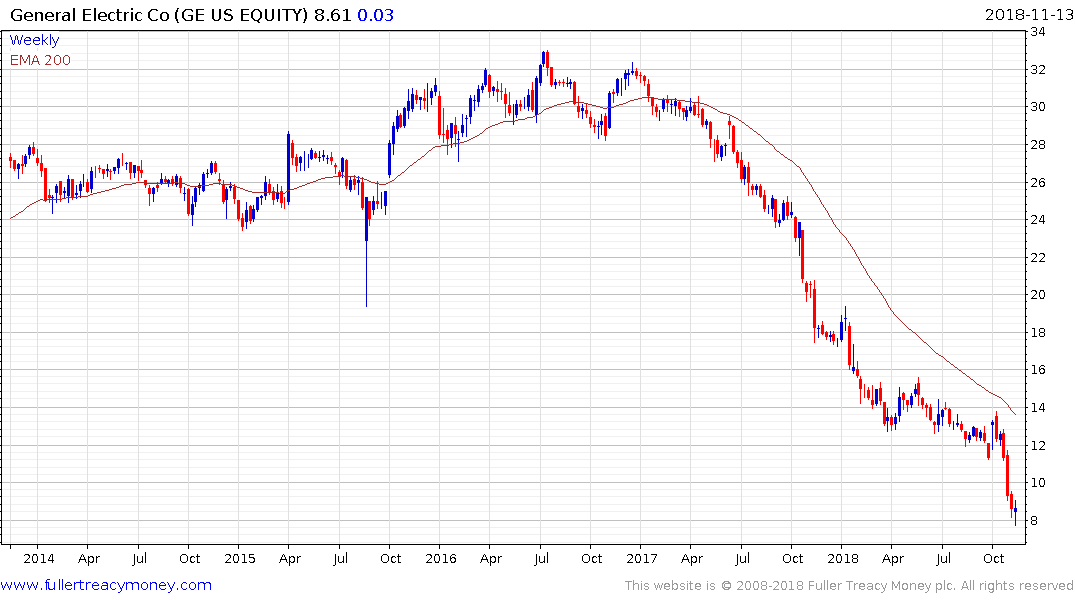

GE advanced 7.8 percent to $8.61 at the close in New York, the biggest gain in more than four months. The shares had tumbled 54 percent this year through Monday, the third-biggest drop on the S&P 500 Index.

General Electric has been accelerating lower and that also means that the issues assailing the company are becoming progressively better understood. The yield of the 5% junior subordinated perpetual bond have surged higher over the last week to 15%. That is a very accelerated decline so a lot of bad news has already been priced in.

With $5.6 billion outstanding in this issue investors are fearful the bond will be first to be defaulted on. However, it would be a major Rubicon if GE were to default on even one bond. If the company is correct in stating it has $60 billion in potential asset sales there is little chance of default. Even if the debt is called in, it would redeem at par. there is little chance of the bond being called in so investors are likely fearful that it will be the first issue to be defaulted on.

News yesterday that the company is to speed up asset sales helped to stem the decline. A wide overextension relative to the trend mean is now evident and upside follow through over the balance of this week would signal a low of at least near-term significance.