GDP Surprises Up - Tailwinds Are Here to Stay

This article from Bloomberg may be of interest to subscribers. Here is a section:

India’s GDP growth increased to 6.1% year on year in January-March, from an upwardly revised 4.5% in the final quarter of last year. The reading exceeded even our forecast of 5.7% — the highest in a Bloomberg News survey — and was 1.1 percentage points higher than the consensus estimate.

For fiscal 2022, which ended March 31, that translates into GDP growth of 7.2%, higher than the government’s second advance estimate of 7%. This was in line with our forecast, but 0.2 ppt higher than the consensus estimate.

Key drivers behind the positive data surprise included government subsidies that are energizing the electronics sector, multinationals shifting back-office business to India to reduce costs, and stronger real credit growth.

The Reserve Bank of India’s cumulative 250 basis points of repo rate increases in this cycle didn’t appear to have any meaningful impact. The construction sector, which is most sensitive to interest rates, also recorded higher growth in 1Q.

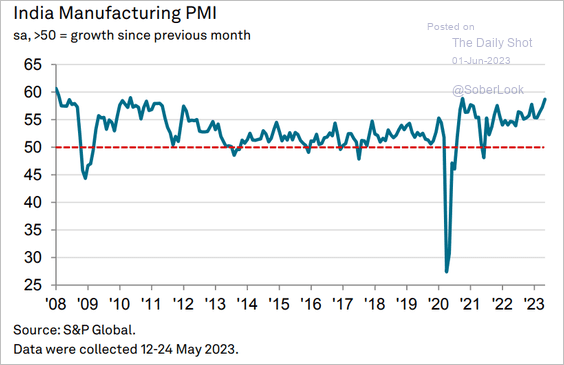

India’s Manufacturing PMI is in expansion territory and continues to trend higher. That is in sharp contrast to the negative readings in both China and the USA. Manufacturing capacity has been migrating for much of the last decade as China’s wage bill trended higher. The low end garment industry is now well established in places like Bangladesh, Pakistan, and Ethiopia for example.

Vietnam was an early beneficiary of investment flows exiting China and not least from Chinese companies looking for cheaper locales. However, it is reasonable to question whether Vietnam has the critical mass required to absorb additional significant flows compared to the vast young population of India or the proximity of Mexico to the US market.

Vietnam was an early beneficiary of investment flows exiting China and not least from Chinese companies looking for cheaper locales. However, it is reasonable to question whether Vietnam has the critical mass required to absorb additional significant flows compared to the vast young population of India or the proximity of Mexico to the US market.

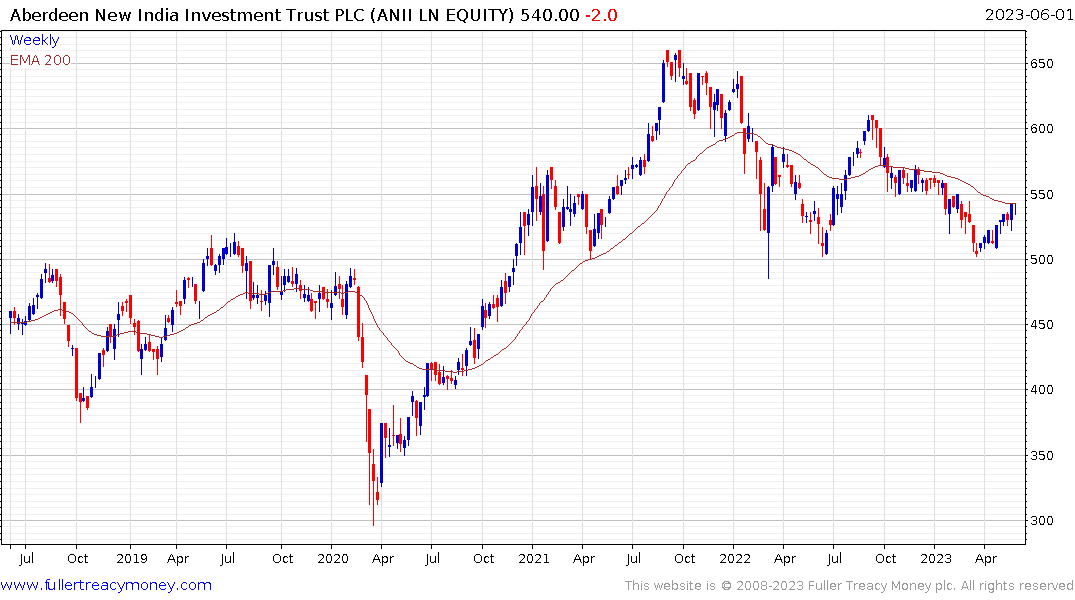

The Aberdeen New Index Investment Trust continues to firm from the lower side of its more than two-year range and the upper side of the underlying congestion area. It currently trades on a discount to NAV of 19.75% which is wider than the 5-year average of 15%.

The Aberdeen New Index Investment Trust continues to firm from the lower side of its more than two-year range and the upper side of the underlying congestion area. It currently trades on a discount to NAV of 19.75% which is wider than the 5-year average of 15%.

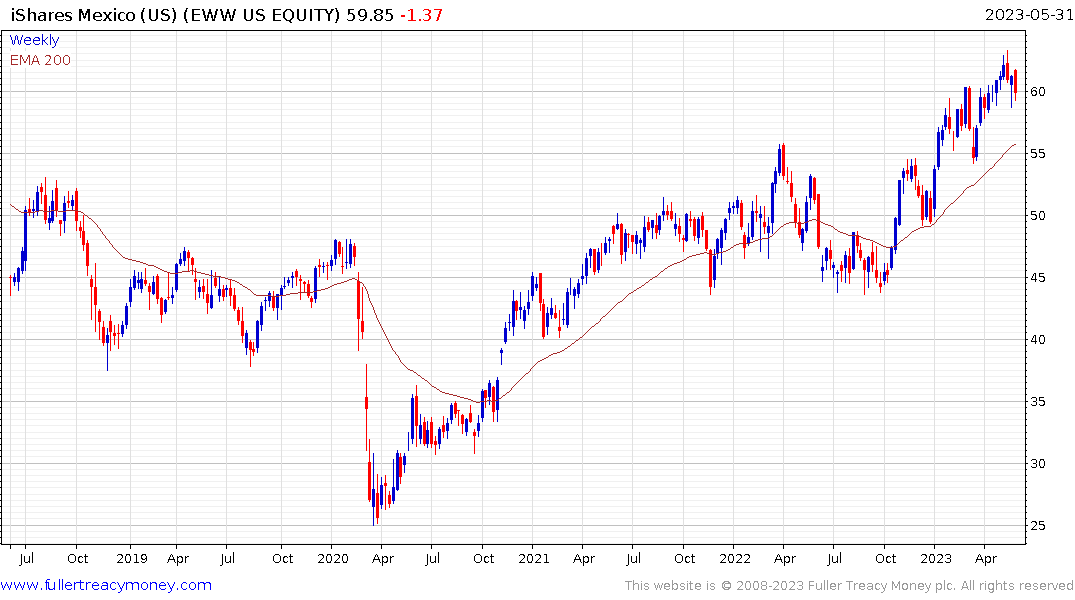

The iShares MSCI Mexico ETF is pausing but continues to hold a sequence of higher reaction lows within a medium-term uptrend.