Freeport Slumps as Inflation Counters Bumper Copper Haul

This article from Bloomberg may be of interest to subscribers. Here is a section:

The company lowered its sales guidance for this year to 4.25 billion pounds of copper from a previous call of 4.3 billion, and raised its annual cash cost forecast to $1.44 a pound from $1.35 and ahead of the average analyst estimate.

Freeport sees the kind of dramatic cost inflation that is affecting miners now as temporary, although “time will tell,” Chief Executive Officer Richard Adkerson said on a call with analysts.

For now, cost increases are being offset by higher output and surging prices, translating into bumper profits. Adjusted earnings more than doubled to a better-than-expected $1.07 a share.

Freeport produced 1 billion pounds of copper in the first quarter, exceeding the 996 million-pound average estimate of six analysts tracked by Bloomberg. The result was well ahead of the same period last year, although slightly below a three-year high clocked in the fourth quarter. Freeport also produced more gold than expected in the quarter.

Reporting bumper production but rising costs is symptomatic of the challenge facing miners. They will be reluctant to spend the money necessary to radically increase supply when they do not have visibility on inflation and interest rates. That’s particularly true when rising production threatens to put a lid of the appreciation in metal prices.

If central banks succeed in deterring demand in the economy, that’s not great news for commodity prices in the short term. The London Metals Index has been consolidating for two months but remains at elevated levels.

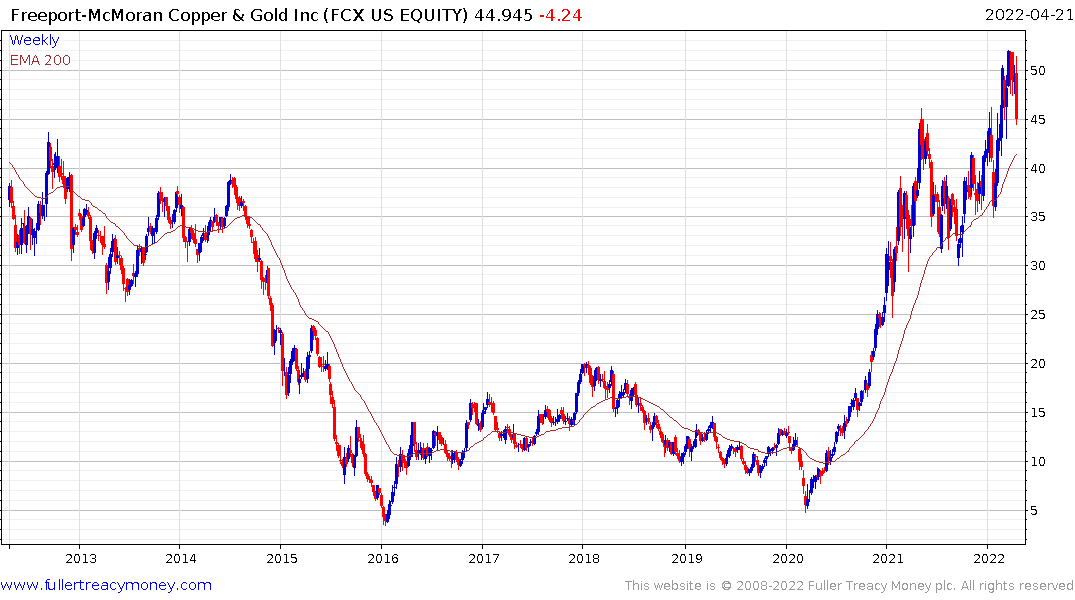

Freeport McMoRan pulled back in a dynamic manner today to confirm an unwinding of the short-term overbought condition is underway.

Freeport McMoRan pulled back in a dynamic manner today to confirm an unwinding of the short-term overbought condition is underway.

Anglo American’s results underwhelmed, and the share is also pulling back.

Anglo American’s results underwhelmed, and the share is also pulling back.

BHP also posted a downward dynamic today to signal some consolidation.

Rio Tinto and Vale has posted lower rally highs and remains in a corrective phase.

South Africa’s Rand is pulling back sharply as inflationary pressures mount and the central banks appears unwilling to act aggressively to counter them.