Fraga-Backed Neves Reemerges in Bull Sign for Brazil Stocks

This article by Julia Leite and Ney Hayashi for Bloomberg may be of interest to subscribers. Here is a section:

Neves has said he would name Fraga as his finance minister if he becomes president. The Princeton University-trained economist has been a force in Brazilian finance for the past two decades, having served as chairman of the country’s main stock exchange, founded a hedge fund that was purchased by JPMorgan Chase & Co. and managed funds for billionaire financier George Soros. Yet it was his time at the central bank that earned him the most notoriety.

Market Volatility

Arriving in early 1999 in the aftermath of a currency devaluation, Fraga boosted benchmark interest rates to 45 percent in his first day on the job to staunch outflows and regain investor confidence. The real rebounded immediately, easing the financial crisis and allowing him to cut rates to 19 percent by the end of that year.While price swings will continue until the final result of the election, Brazilian assets should rally after yesterday’s results as some investors had expected Rousseff to clinch a victory in the first round, said Kunal Ghosh, a Singapore-based emerging-market money manager at Allianz Global Investors, which has $511 billion in assets under management.

?“The market is going to like that he’s going into a second round and that there’s a shot,” Ghosh said by phone. “It will be extremely volatile.”

A Peruvian delegate at The Chart Seminar in Chicago last week told the group how people in other family offices in Brazil were worried that the deterioration of Marina Silva in the polls was causing a great deal of angst among investors who are worried about further deterioration in the currency and the economy. The surge to second place by Aecio Neves was too much to hope for and his choice of Fraga as finance minister suggests he is serious about contesting the run-off scheduled for October 26th. In the intervening period we can anticipate additional volatility as poll results ebb and flow.

The Bovespa Index rallied today from the region of the 200-day MA and a sustained move below 54,000 would be required to question medium-term scope for additional upside.

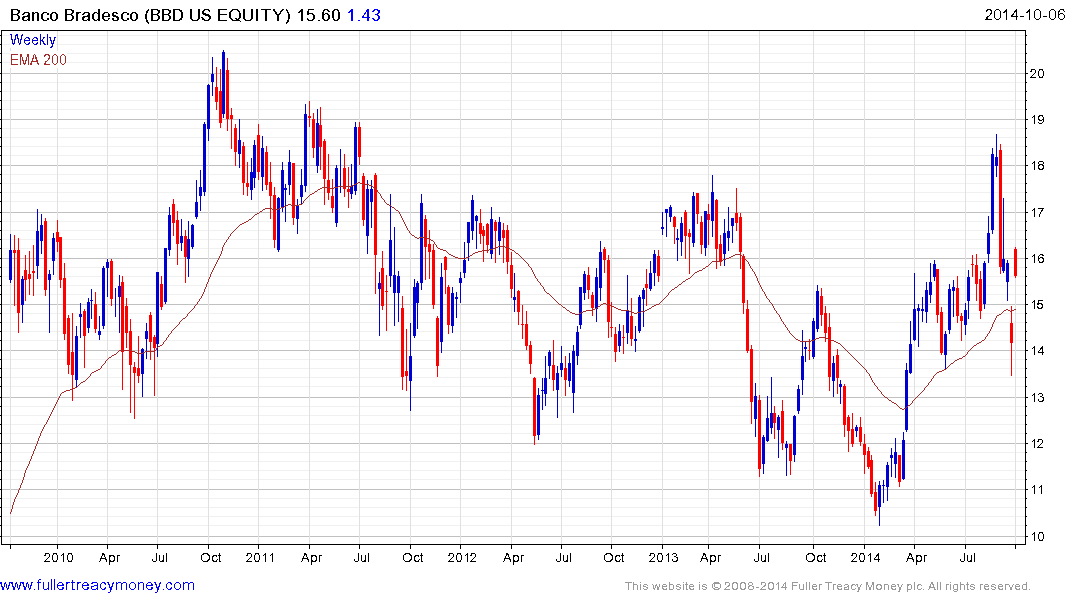

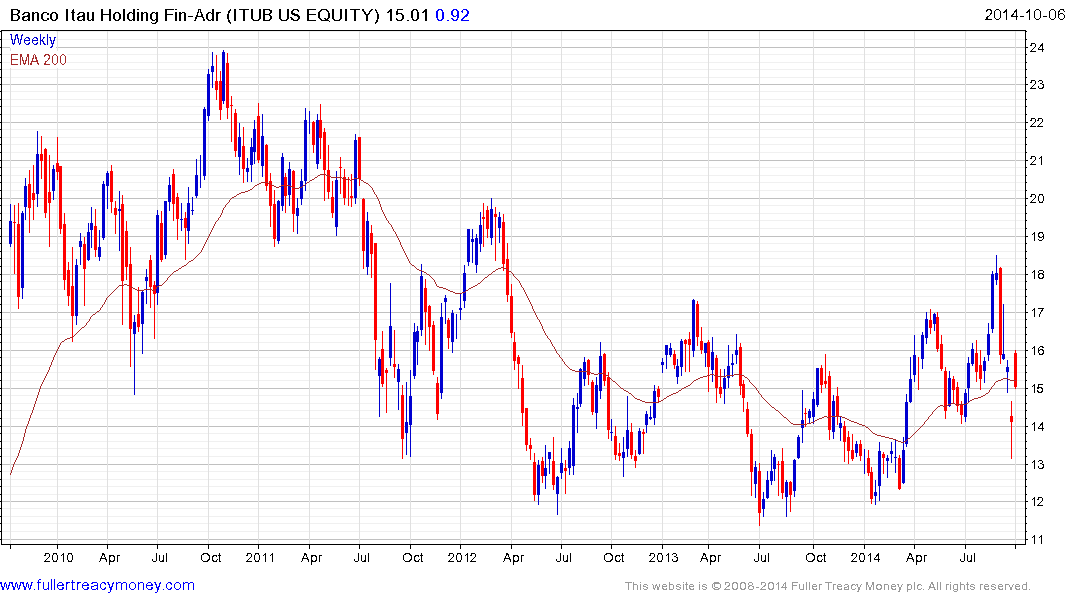

Banco Bradesco and Itau Unibanco also found support today in the region of their respective 200-day MAs.

Petrobras has become emblematic of the issues facing the Brazilian market and rebounded emphatically from a deep oversold condition following the result. There is scope for some additional short covering but we can anticipate additional volatility until after the 26th.

VALE also bounced today but the headwind of lower iron-ore prices remains a challenge to re-establishing demand dominance beyond the short-term.