Flying recovery proves a tailwind for new Rolls-Royce boss's turnaround

This article from Bloomberg may be of interest to subscribers. Here is a section:

"There is good performance improvement opportunity in this business in all the divisions, especially in civil aerospace and power systems," he told reporters. "And that is ongoing and then strategic review will create the clarity."

He said he would focus on reducing its debt, which stood at 3.25 billion pounds at year-end, to obtain an investment grade, before resuming payouts to shareholders.

Rolls, which also has defence and power systems divisions, posted operating profit of 652 million pounds for 2022, up 57% and beating an analyst forecast of 478 million pounds.

It guided to underlying operating profit of 0.8-1.0 billion pounds and free cash flow of 0.6-0.8 billion pounds this year, based on a forecast for its engines to fly 80-90% of 2019's level.

Rolls Royce has three divisions. These are Civil Aerospace, Defence and Power Systems. Within each of those units it has maintenance contracts. Aftermarket service represents about 55% of all revenue. That means the company is highly leveraged to the number of miles flown by commercial and military aircraft and how much their power turbines are used. The pandemic obviously took a heavy toll and the share has been slow to recover but that is now changing.

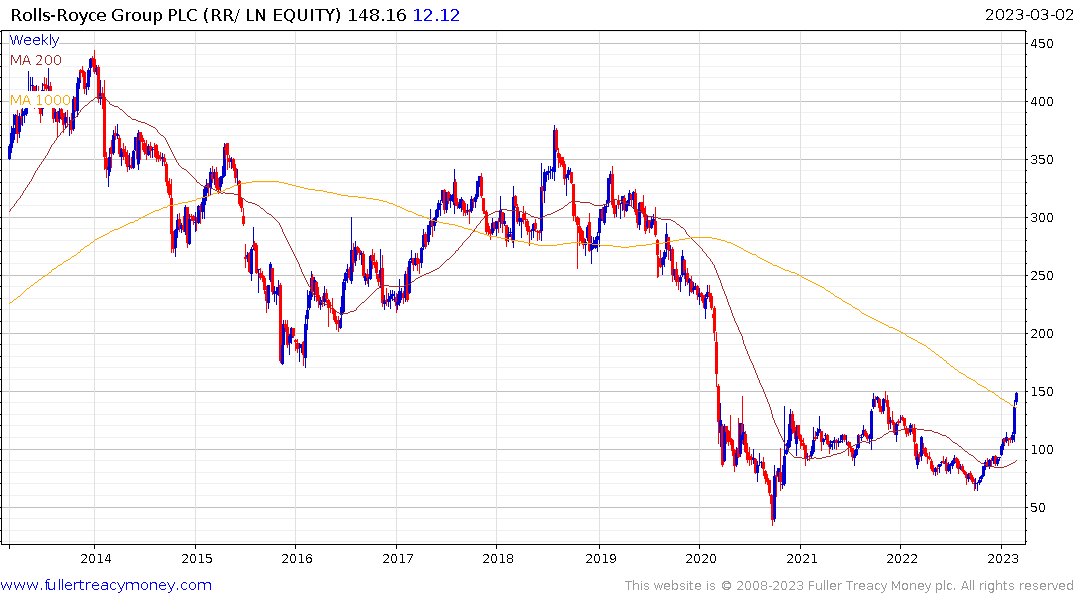

The big outstanding question will be how to pay to develop the UK’s line of small modular reactors. Nevertheless, the share is testing the upper side of its base and while some consolidation is likely, a sustained move below 100p would be required to question recovery potential.

GE has a broadly similar pattern as it also tests the upper side of its base formation.

GE has a broadly similar pattern as it also tests the upper side of its base formation.