Floods Slow Ivory Coast Cocoa Harvest Amid Worries About Rot

This article by Baudelaire Mieu for Bloomberg may be of interest to subscribers. Here is a section:

Heavy rains in Ivory Coast’s cocoa-growing areas are slowing the harvesting and sales of beans and farmers say they’re worried about black-pod disease rotting their crops.

Roads to plantations in the southwestern area of Meagui have been cut off after rivers overflowed and farmers can’t access their crops, which means they don’t know how the flowers and pods on the trees are developing, according to local grower Dongo Koffi.

“Everything is stopped at the moment,” he said by phone. “The sales have slowed down because we can’t harvest. Some farmers have some stocks of beans with them but they can’t sell them, because the roads aren’t accessible.”

While it’s still unclear whether Ivory Coast output will be materially affected, any losses due to the heavier-than-usual rainy season in the world’s top cocoa producer may help ease some pressure on prices, which have dropped by more than a third in the past 12 months amid expectations for a global surplus. The country, which is currently harvesting the smaller of two annual crops, is expected to produce a record amount this year.

Cocoa is trading in contango throughout the futures curve but doesn’t change the reality that cocoa needs both abundant rain in the growing season and dry weather once harvested to allow the pods to dry. That kind of variability in growing and maturing conditions is why cocoa is only grown in a relatively small number of equatorial countries with well-defined wet and dry seasons.

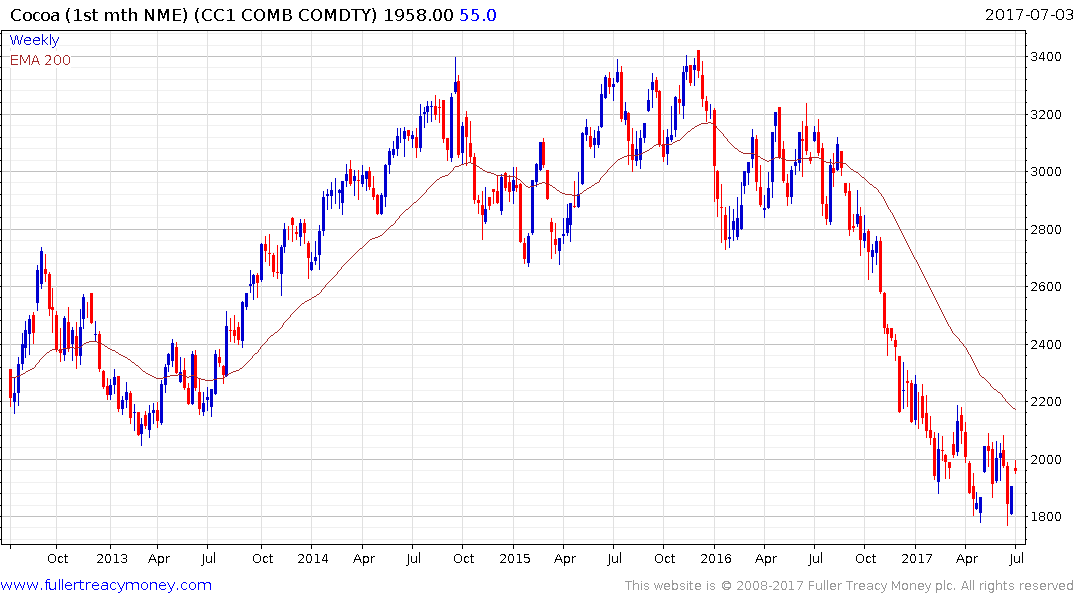

Cocoa pulled back sharply from the peak near $3500 in 2016 and has spent most of this year ranging with a downward bias. It steadied last week in the region of $1750 and a reversionary rally is now underway. A sustained move above the trend mean will be required to confirm a return to demand dominance beyond the short-term.

In the interests of full disclosure I have positions in cocoa and both Arabica and Robusta coffee.

Arabica has rallied to test its progression of lower rally highs and will need to sustain a move above 130¢ to confirm a return to medium-term demand dominance.

Robusta surged on Friday to briefly test the $2200 area which represented resistance in January and October. Some consolidation is looking possible in this area as the short-term overbought condition is unwound.