Financial Markets in 2018: The Times They Are A Changing

Thanks to a subscriber for this article by Pamela Rosenau for Forbes which may be of interest. Here is a section:

As correlations among stocks and other assets classes break down, there will be a significant divergence in the performance of “quality” assets versus “junk” assets. A prudent money manager should be prepared for this market shift by focusing on shorter duration assets, which goes for both credit and equities. I expect longer duration equities, such as growth stocks with lower near-term earnings to underperform more value oriented stocks such as consumer staples, telecom, and energy sectors, on which I have focused. Today’s market appears to be the inverse image to the early 1980s. Back then, investors were misled into hiding out in cash as stocks were perceived as too expensive in a high interest rate environment. Today, very few hold cash as stocks appear cheap relative to low bond yields. This is a backward looking strategy derived from a relative value argument that is no longer operable. I suggest more than a little risk aversion, as I have maintained, would be prudent in times like this. As I have often said -- preserving capital is paramount, not winning friends.

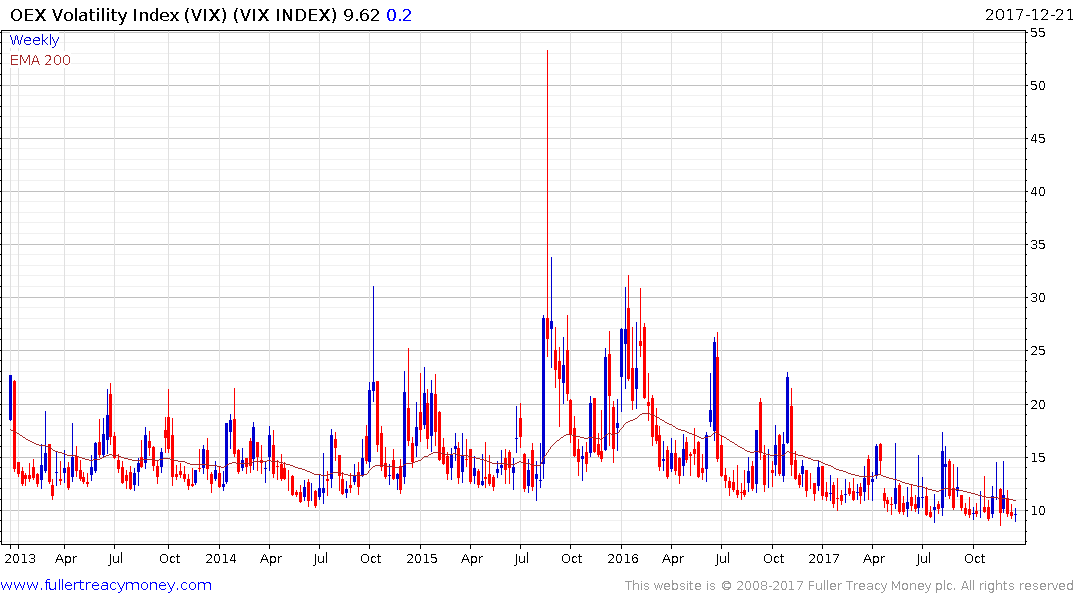

Money has been pouring into ETFs over the last couple of years which is a testament to the success of the low fee argument, against a background where the success of momentum strategies has reduced the allure of stock picking. The success of the ETF business has contributed to the consistency of the trends evident on the primary Wall Street indices and the low volatility condition that has prevailed over the last six months in particular.

The growth of the capital committed to ETFs and smart beta products in particular is accelerating.

.png)

The growth of the sector, coupled with the success of short volatility and risk parity strategies are all tied to the low interest rate / abundant credit conditions provided by massive central bank monetary intervention. As yields move upwards the quiescent condition of volatility markets is likely to change and that will represent a challenge for the legions of investors invested in ETFs.

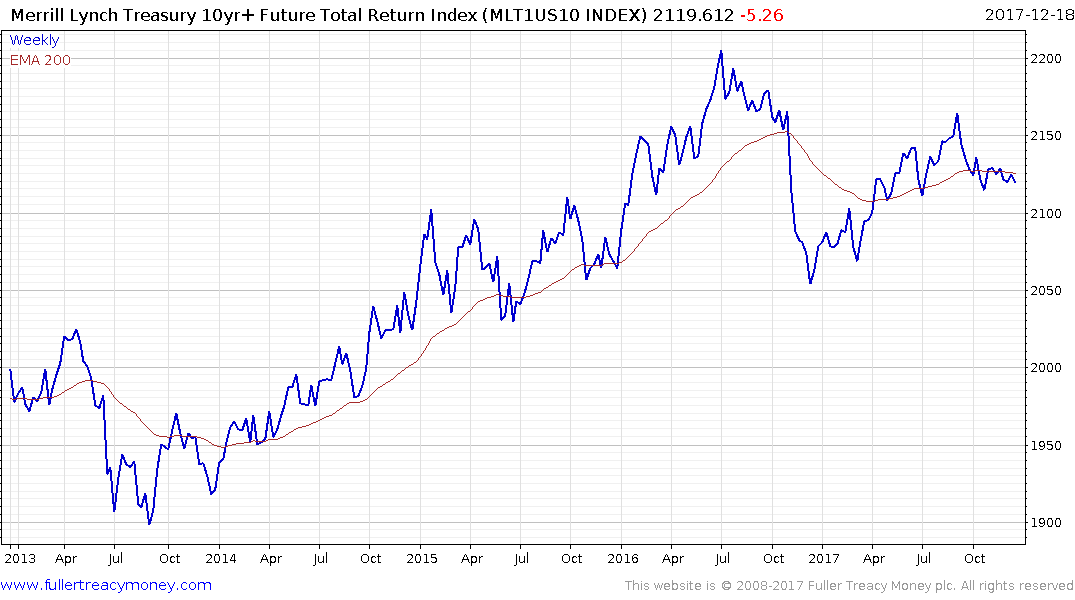

The Merrill Lynch 10-year Treasury Futures Total Return Index has evolving type-3 top formation characteristics. When that top is eventually completed, with a sustained move below 2000, the secular bull market in bonds will be conclusively over.