Finally in Writing: U.K. and EU Will Have 'Financial Settlement'

This article by Alex Morales for Bloomberg may be of interest to subscribers. Here is a section:

“We will work with the EU to determine a fair settlement of the U.K.’s rights and obligations as a departing member state,” Brexit Secretary David Davis said in a statement to Parliament that referred explicitly to the “financial settlement” with the EU. “The government recognizes that the U.K. has obligations to the EU, and the EU obligations to the U.K., that will survive the U.K.’s withdrawal -- and that these need to be resolved.”

The Brexit negotiations have so far been about what the EU demands before they are willing to talk about trade. In agreeing to that format, the UK was already in a weaker position. Agreeing to the demand that there is a bill to pay highlights how the current administration does not wish to risk its trade with the EU but anyone with even a modicum of bargaining acumen knows you have to at least affect the look of someone willing to walk away if you want to achieve the price you want.

With the UK ceding ground on an increasing number of what were in its initial lines of negotiation they are obviously hoping they will be able to make up for some lost ground on the trade front. However, that may be a vain hope since the EU is in no mood to make concessions. In fact, fresh from Europhile victories in the Netherlands and France the EU is growing increasingly assertive.

Considering the complexity of exiting on a negotiated basis there is the real possibility that the process will run beyond the two-year deadline. Meanwhile the UK needs to demonstrate to the international community of investors that it can keep its fiscal situation under control. Against a background where inflation is picking up but wages aren’t, even in a full employment environment, the fiscal and monetary authorities are walking a tight line between tightening and avoiding stifling the economic expansion.

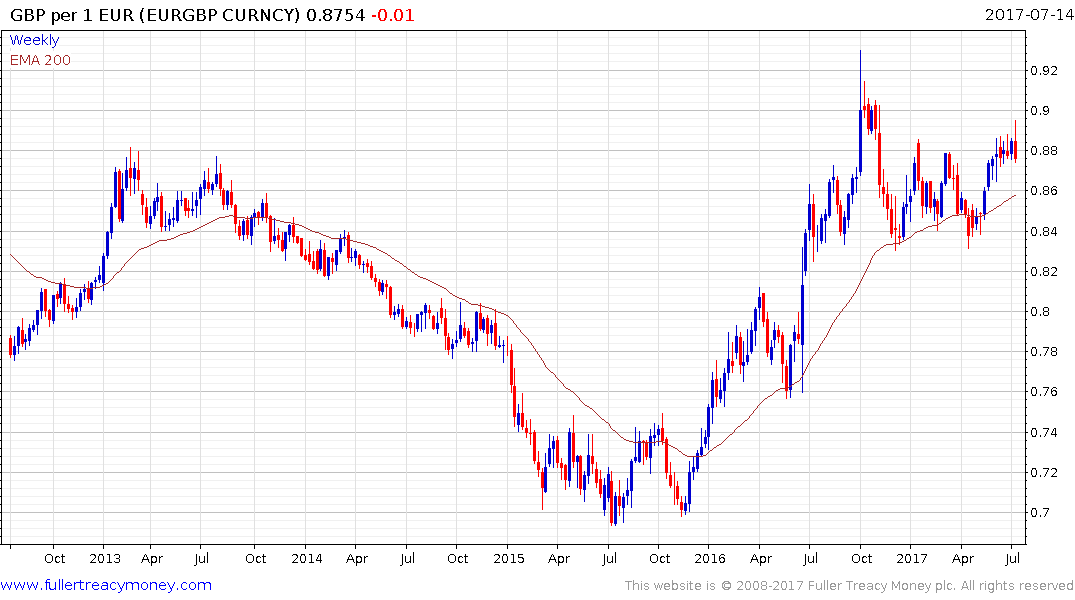

The Pound failed to hold the breakdown to new lows on Tuesday and rallied over the last three consecutive sessions to challenge the three-month progression of lower rally highs. Upside follow through next week would signal a failed break below €1.13 and would increase potential that a test of the upper side of the eight-month range is a possibility.

The Pound moved to a new recovery high against the Dollar today. In the absence of a clear downward dynamic potential for additional upside can be given the benefit of the doubt.

Meanwhile the UK is investing in a marketing campaign to highlight the country’s prowess in several technology sectors. https://qz.com/921194/these-four-projects-in-the-uk-exemplify-innovation/

Back to top