Felix Zulauf: "We have created the biggest excesses in generations"

Thanks to a subscriber for this interview of Felix Zulauf which appeared in market.ch. Here is a section:

Over the past decade, a huge mountain of Dollar denominated debt has been built up outside the U.S., especially in emerging markets, and particularly in China. According to the BIS, these loans increased from $5.8 trillion to more than $12 trillion between 2009 and 2019. When the crisis hits, short-term loans are often not extended because lenders turn risk-averse. Then debtors have to scramble to buy Dollars in the market. As the Dollar rises, the debt in the debtor's home currency increases, which in turn increases the pressure on them even more. Weak economies such as Turkey, Brazil and South Africa are caught in a vicious cycle. That's why I've been warning for some time about investing in emerging markets, including China. They just have a huge Dollar debt problem.

Do you expect a «Lehman Moment» in this crisis, the collapse of a major market player?

In every crisis there are companies that perish. It won't be any different this time. Given the excessive indebtedness in the corporate sector, one would have to expect some spectacular bankruptcies. But given the speed with which central banks have acted - much faster than in 2008 -, this will no longer threaten the financial system per se.

Swap lines have been extended to considerably more countries than during the global financial crisis. In 2007, the focus of attention was the developed market banking sector so swap lines were limited to G-7 central banks. At the end of March that list was expanded to Australia, Brazil, South Korea, Mexico, Singapore, Sweden, Denmark, Norway and New Zealand. The notable exceptions have been to countries like Turkey, South Africa and China.

It is reasonable to expect Dollar shortages are unlikely to be a problem for countries where FX swap arrangements have been agreed. However, that begs the question will other significant Dollar borrowers then come under greater pressure as traders probe for weakness?

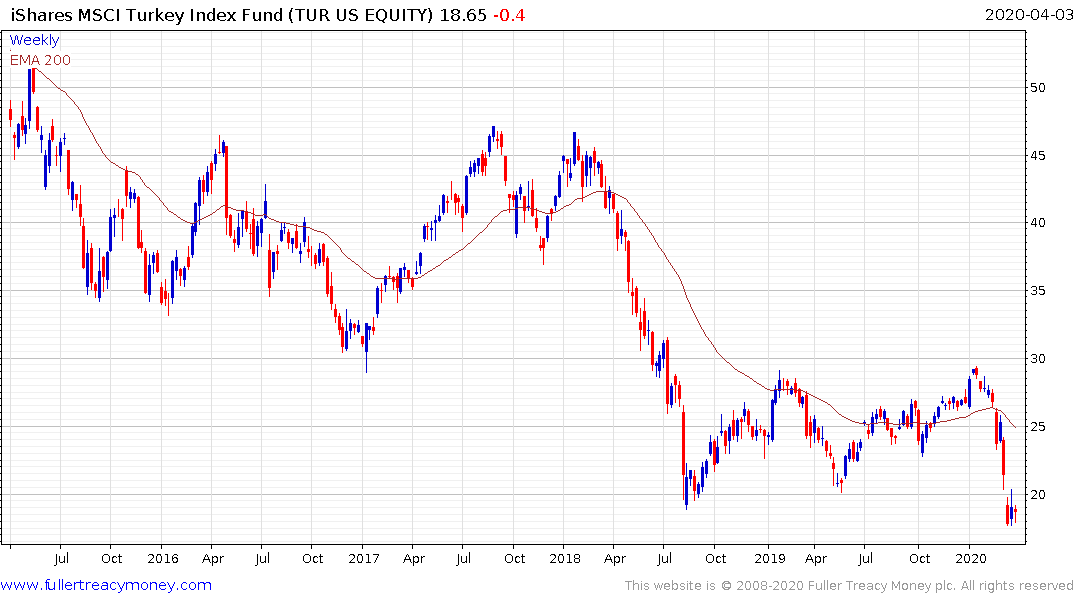

The Turkish Lira has a period of stability following the acceleration lower in 2018 but is now approaching its nadir again.

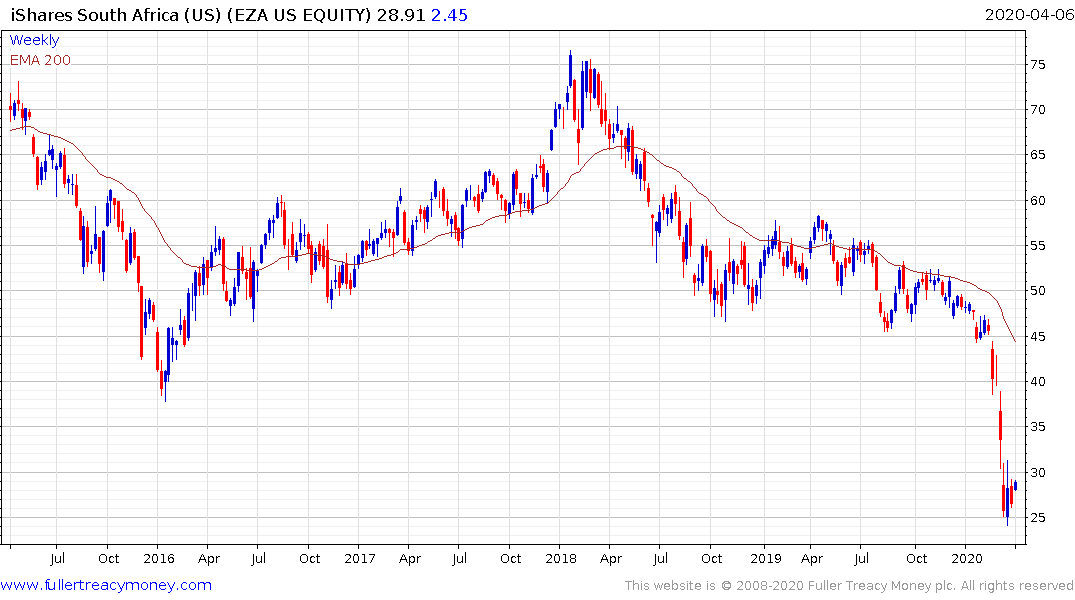

The South African Rand steadied toward from a short-term oversold condition but the overall trend means negative.

The Chinese Renminbi has been reasonably steady in the region of its lows, probably because the Chinese government has the financial wherewithal to ensure its Dollar funding issue does not become a systemic problem.

The Indian rupee also remains under pressure as it extends its downtrend following the breakdown from a prolonged range.

Turkey, at least has been reasonably successful in containing the spread of the coronavirus. It’s very much an open question how well India and South Africa can manage to keep their outbreaks from causing severe economic issues.

In US Dollar terms both South African, Turkish and Indian ETFs found near-term support today above their respective March lows. Deep overextension relative to the trend mean are still evident so there is scope for some additional steadying but the medium-term challenges of a dearth of Dollars and the viral outbreak are likely to contribute to continued volatility.

With competitive currency devaluation increasingly evident the strength of the Dollar is more about relative rather than absolute strength. Gold remains the barometer against which the purchasing power of fiat currencies is measured. Its relative strength confirms investor concerns about the trajectory of monetary and fiscal policy.

This additional portion from the above article also caught my attention:

So would you buy the growth stocks again – the Googles, Amazons and Apples of this world – that were the leaders of the previous bull market?

Yes, certainly with a view over the next six months. Then we'll have to judge what comes next. From this perspective, we are not at the end of a real bear market today, because that would only be the case if the leaders of the old bull market had been discredited and thrown out of the portfolios. We are not that far today. We have just had the longest economic expansion in the history of the United States, and we have had a stock market boom of more than ten years. A cycle like this does not end with a mere month-long correction. A real bear market is only over when no one is interested in stocks anymore. You must feel sick when you think of equities. That's when you know that the right time to buy stocks for the long term has arrived.

Technology has been the clear leader during the bull market over the last decade. The major data monopolies have continued to exhibit relative strength over the course of this bear market to date and rallied impressively today to confirm near-term support. They have weathered the virus-induced selling pressure best because their businesses are often predicated on replacing person to person contact.

There are definitely challenges in the reliance of data centres on business from the start-up sector, which is under extraordinary pressure right now but these companies are also in the best position to benefit from extraordinary monetary and fiscal stimulus.

The NYSE FANG+ Index continues to bounce from the region of the 200-day MA.