Feedback on Our Tactical Views and 2023 Outlook

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

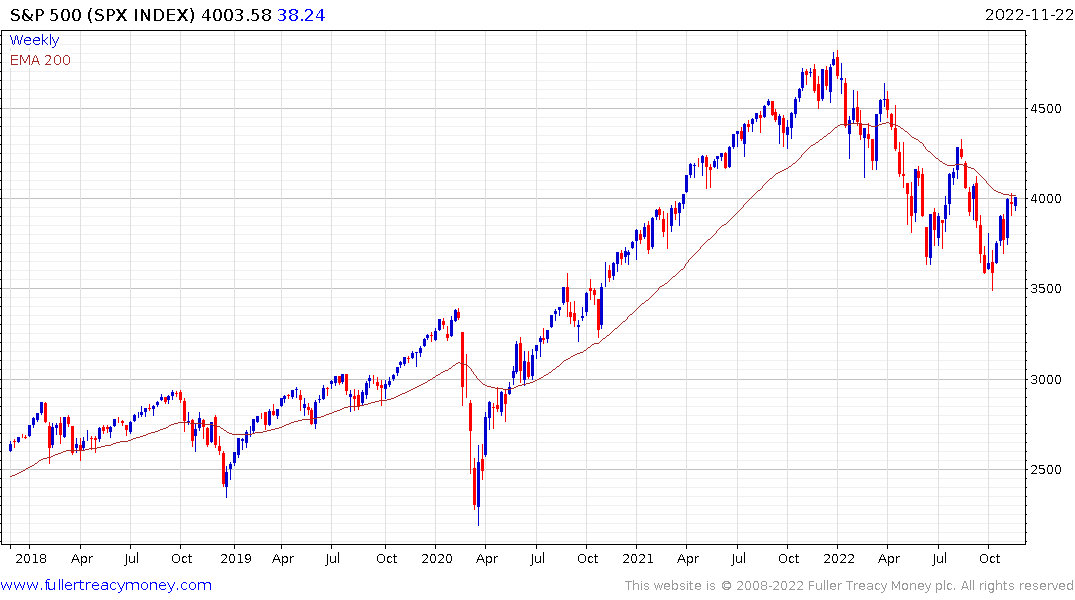

Technicals over Fundamentals for now…our tactically bullish call was always more about the technicals than the fundamentals. Today, we provide an update to those factors, some of which no longer justify higher prices although they provide support at current levels. The deciding factor is market breadth, which has improved greatly over the past month and argues for us to remain bullish into year end before the fundamentals take us to lower lows next year. Feedback on our call for the S&P 500 to reach a price trough of 3,000-3,300 in Q1 '23…we've gotten a fair amount of pushback on that our forecast on this front is too aggressive both from a magnitude and timing standpoint. While directionally bearish, many investors struggle to see even a retest of 3,500. In our view, what was priced at the October lows was peak Fed hawkishness, not material earnings downside. If we were forecasting a modest 5% forward EPS decline and a reacceleration off of those levels, we'd concede that the earnings risk is probably priced, but we're modeling a much more significant 15-20% forward earnings downdraft, which should demand a more recessionary type 13.5-15x multiple on materially lower EPS.

Here is a link to the full report.

This coincides with my view. The US yield curve is heavily inverted and the pace of tightening has been surprisingly quick. That suggests it is not unusual for the corporate profits to have been immune because there is a significant lag between tightening and when it shows up in the economy.

The epicentre of risk rests with the companies most dependent on access to free abundant liquidity. Tech companies shedding jobs first is therefore not a coincidence but reflects the most immediate point of stress in the market.

For now, the materials, energy and industrials sectors remain firm. However, that is unlikely to remain the case as the tightening bites. A subscriber at today’s Chart Seminar related how his wife is a senior lawyer serving the corporate sector. He said she has never spent so much time with nothing to do. Corporate demand for bank loans has dried up in response to tightening liquidity conditions. That means spending plans are being cancelled and hiring weakness will not be far behind.

The S&P500 continues to steady in the region of the 200-day MA but has a lot of work to do if the trend’s consistency is to be repaired.