Fed to Maintain Bond Buys Until 'Substantial' Economy Gains Seen

This article by Craig Torres for Bloomberg may be of interest to subscribers. Here is a section:

The FOMC “expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time,” policy makers said, repeating language from their November statement.

The central bank’s meeting builds on their earlier response to the coronavirus pandemic, in which officials cut interest rates to near zero while unleashing massive bond purchases and a multitude of emergency lending programs.

U.S. central bankers are still far away from their goals, and Powell has repeatedly called on Congress to pass another round of fiscal stimulus to help the economy through the winter as the pandemic continues to rage. The unemployment rate stood at 6.7% in November, while inflation remains below 2%.

There is little chance of additional Fed stimulus while the stock market is within a couple of percent of its all-time high. With the US government agreeing a fiscal stimulus yesterday, that takes some pressure off of the Fed to urgently provide assistance.

The most statement that buying longer-date bonds “was not high on the list” is a green light to initiate short positions at the long end of the curve. The yield curve spread continues to steepen.

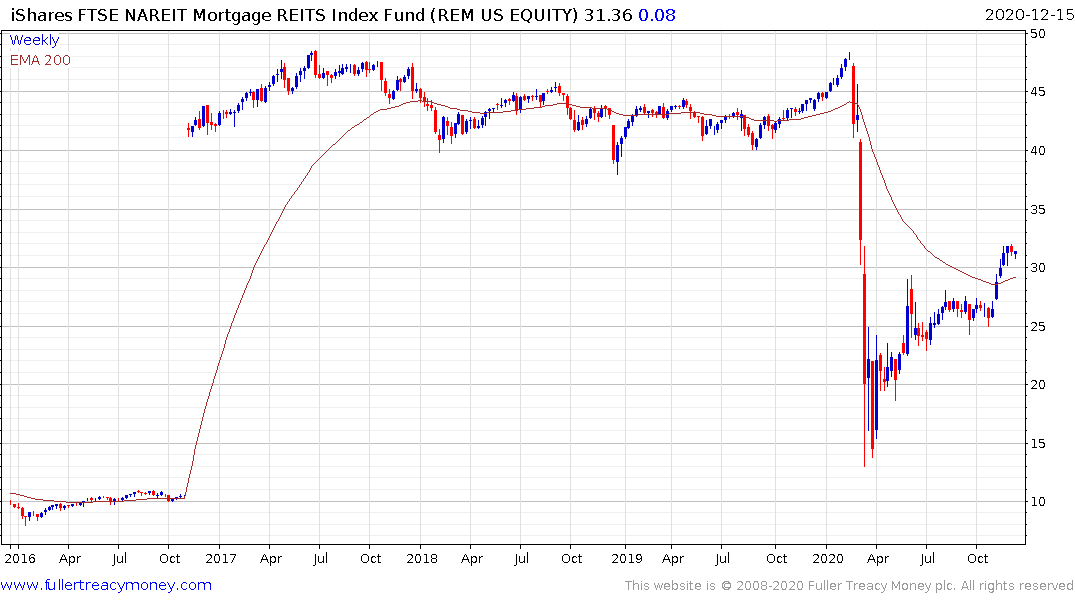

That is great news for banks and mortgage REITs which will pick up the spread.

It’s not great news for the cost of refinancing government debt. Nevertheless, the Fed is unlikely to intervene to supress yields until it has a clear reason to do so. It’s days of anticipating events are over. It will now go back to only reacting to issues as they appear. That means they are going to inflate another bubble. The Fed is serial bubble blower because it tends to leave liquidity in the market for much longer than is strictly necessary. On this occasion that is coming at the expense of the Dollar.

Silver has been outperforming gold over the last month and closed above the psychological $25 level today. A sustained move below the trend mean would be the minimum required to question medium-term scope for additional upside.