Fed Sticks to Gradual Rate-Hike Approach Despite Slowdown

This article by Jeanna Smialek and Christopher Condon may be of interest to subscribers. Here is a section:

The widely expected decision contained no concrete commitment to the timing of the next rate increase. Even so, investors increased bets on a move in June after absorbing the Fed’s sanguine assessment of the outlook and its encouraging observations on inflation, following data showing first-quarter economic growth of 0.7 percent and monthly price declines in March.

“Nothing in the statement today, which was voted unanimously by the FOMC, leads me to believe that the Fed is even close to changing its mind on rates,” Roberto Perli, a partner at Cornerstone Macro LLC in Washington, wrote in a note to clients. “Base case is for a couple more rate hikes this year -- probably in June and September -- and for the beginning of balance sheet shrinkage in December.”

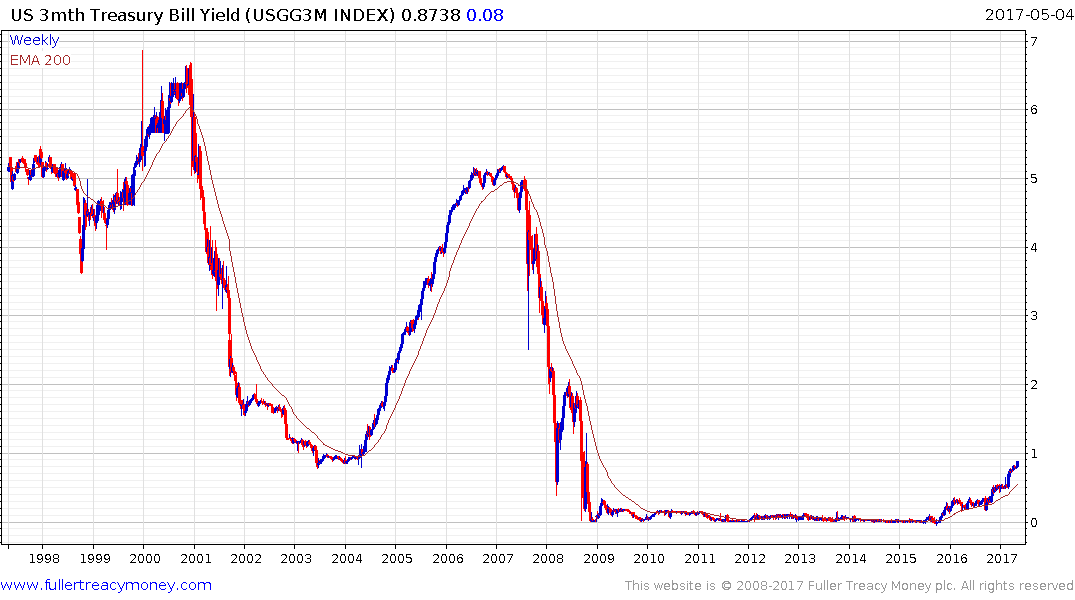

3-month Treasury bills are beginning to price in a rate hike in June but the rate is still only 86 basis points while the Fed Funds Target rate is 75 to 100 basis points. That highlights just how reluctant bonds traders have been to give credence to the Fed’s estimates of how often and by how much they are willing to raise interest rates.

The argument about whether this is the end of the secular bull market in bonds, do we have a few more months left or, the most diehard view, rates are going to stay low forever largely misses the point. US government yields on the short end of the curve have base completion characteristics. That means a new bear market in bond prices is already in evidence.

If we talk about the psychological perception stages of major bull and bear markets this is the disbelief stage. The biggest bond bears have been wrong for so long that they are considered crackpots by the bond market’s masters of the universe. That will not always be the case.

Back to top