Fed Raises Rates; Officials Lift Outlook to Four 2018 Hikes

This article by Craig Torres for Bloomberg may be of interest to subscribers. Here is a section:

Federal Reserve officials raised interest rates for the second time this year and upgraded their forecast to four total increases in 2018, as unemployment falls and inflation overshoots their target faster than previously projected.

The so-called “dot plot” released Wednesday showed eight Fed policy makers expected four or more quarter-point rate increases for the full year, compared with seven officials during the previous forecast round in March. The number viewing three or fewer hikes as appropriate fell to seven from eight.The median estimate implied three increases in 2019 to put the rate above the level where officials see policy neither stimulating nor restraining the economy.

The Federal Open Market Committee indicated that even though it’s stepping up the pace of interest-rate hikes, economic growth should continue apace. “The committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the committee’s symmetric 2 percent objective over the medium term,” according to its statement following a meeting in Washington.

The statement omitted previous language saying that the main rate would remain “for some time” below longer-run levels.

Other changes included referring to “further gradual increases” instead of “adjustments.” Officials also said that “indicators of longer-term inflation expectations are little changed.”

Previously, the statement made separate references to survey- based and market-based measures of such expectations.

Unemployment is at its lowest level in years, inflation is moderate but supply constraints are appearing in the economy. The St. Louis Fed is predicting growth well in excess of the consensus and Fed is obviously worried that will eventually spill over into an inflationary environment.

There is also the concern, most recently voiced by Jeff Gundlach last night, that the fiscal stimulus is going to contribute to the next recession when the bump from the tax cuts runs off. Therefore, the Fed is likely raising rates in an attempt to re-arm so that it will have the firepower to have an outsized effect on the economy when it next needs to stimulate.

2-year yields hit a new closing high today near 2.6% which is pricing in a little more than two additional hikes in the next 24 months. With the Fed anticipating 2 more hikes this year it would appear the market has more work to do to price in those expectations.

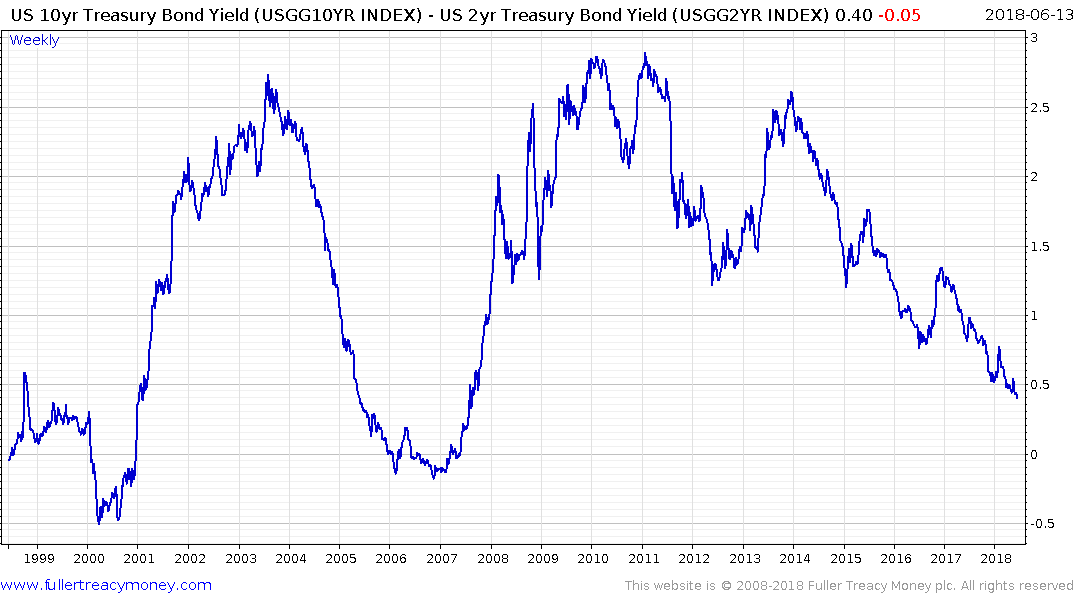

The yield curve spread moved to a new low of 40.6 basis points today which raises the question of whether it will be the Fed’s tightening of policy by simultaneously raising interest rates and reducing the size of its balance sheet which will eventually be the cause of the next recession.

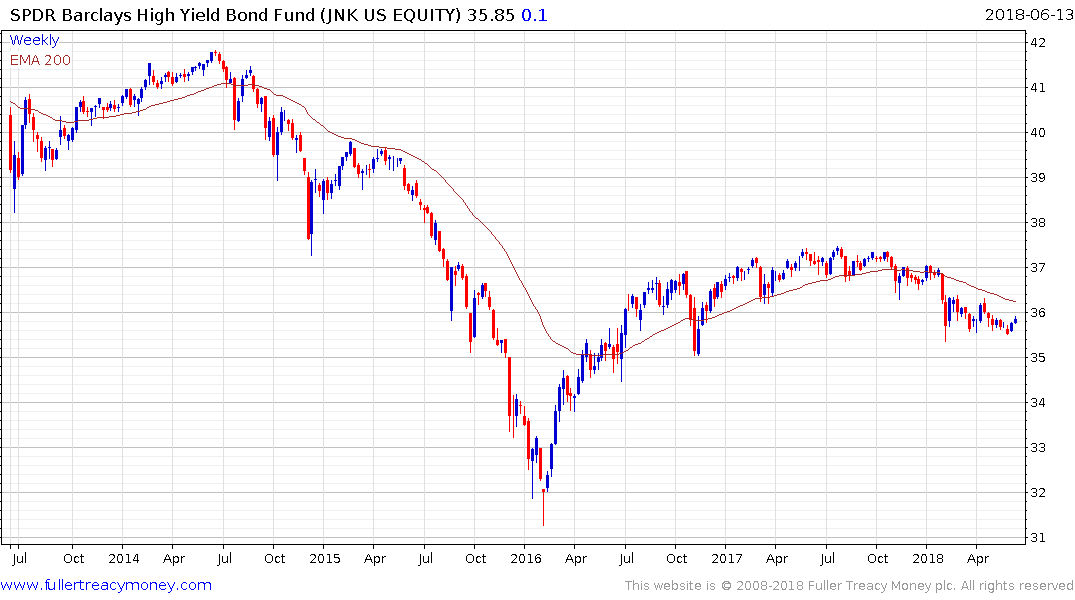

Jerome Powell was enthusiastic about the economy in his statement saying “I would say the economy is in great shape” which suggests the Fed is happy to raise rates. That not particularly good news for high yield bonds. The SPDR High Yield Bond ETF continues to distribute below its overhead top formation and a sustained move above the trend mean would be required to question medium-term scope for further downside over the medium term.

Meanwhile the Russell 2000 continues to extend the breakout from its five-month range and a sustained move below 1600 would be required to question medium-term scope for continued upside.