Fed Raises Rates as Powell Keeps Options Open for Future Hikes

This article from Bloomberg may be of interest. Here is a section:

Officials will be looking for moderate growth, cooling inflation and supply and demand coming into better balance, particularly in the labor market, as they assess whether and when to raise rates again, Powell said.

“What our eyes are telling us is policy has not been restrictive enough for long enough to have its full desired effects,” he said. “We intend again to keep policy restrictive until we’re confident that inflation is coming down sustainably to our 2% target, and we’re prepared to further tighten if that is appropriate. And we think the process still probably has a long way to go.”

The bond market continues to expect one more hike but nothing more than that. The fact the Fed’s own internal economists no longer expect a recession was welcome news for stock market investors even as the “long and variable lags” of monetary policy tightening have yet to be felt.

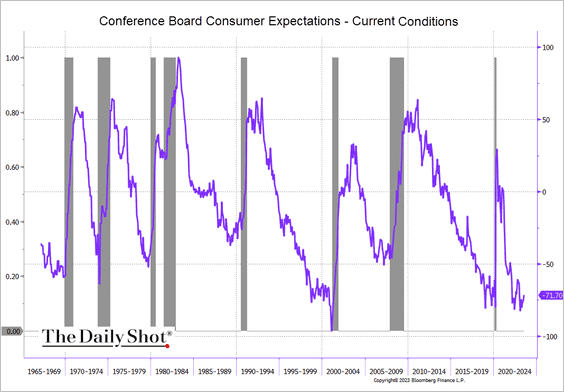

This chart of conference board expectations versus current conditions is just one more indicator that a recession is all but inevitable. The fact the Fed has been quite clear they do not wish to hurry into cutting rates suggests the catalyst for a change of trajectory will be sharply lower growth and or higher unemployment. If a recession is not immediately imminent, the actions of holding tight policy until one is observable is why the Fed is so often considered to be late in acting.

The 2-year yield’s inability to sustain a break above 5% suggests investors are betting the peak of the interest rate hiking cycle is near.

The Nasdaq-100 continues to pause below the 16000 level but the short-term trend is still reasonably consistent with a sequence of small ranges one above another. A break in that sequence would offer clear evidence a swifter pace of mean reversion is underway.