Fed Portfolio Runoff May 'Turn the Rally on Its Head,' RBC Says

This article by Alexandra Harris for Bloomberg may be of interest to subscribers. Here it is in full:

Fed balance sheet normalization might cause banks to shorten their asset mix, causing “enough of a portfolio adjustment this summer to turn the rally on its head,” RBC rates strategists Michael Cloherty and Ash Kamat say in note.

QE created bank deposits and balance-sheet unwind will eliminate them; while “massive 2003-style bank sales” are not predicted, the market “has become extremely sensitive to flows,” and risk of outsized price action is higher during summer months

Main issue isn’t a funding shortfall, but “how modeling of deposits changes” and when; deposits modeled on recent data show extremely long average life; shortening the expected life of a deposit puts pressure on banks to shorten their assets

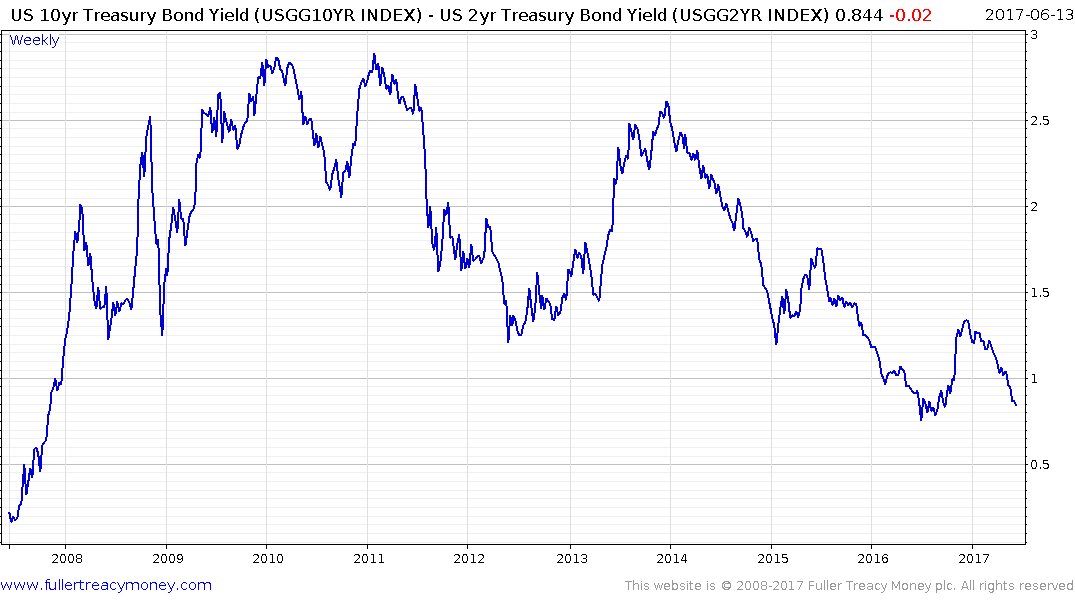

Bank buying of shorter-duration assets should lead to “outperformance of 15yrs and CMOs and a steeper curve”

RBC expects Fed likely to announce balance-sheet unwind in September, begin in October, with initial caps of $15b for USTs, $10b for MBS; they expect caps to rise by $15b and $10b every quarter and eventually be eliminated

When the biggest buyer in a market stops investing and starts divesting of its holdings it represents a sea change in the interaction between supply and demand. If high prices are to be sustained the remaining buyers need to increase their purchases to compensate for the absence of a once

stalwart buyer.

That’s a challenge when many buyers would have been following the Fed in making purchases in hopes of riding the momentum and would likely be less than eager to try and support the market on their own. Therefore, the potential for the Fed to begin shrinking the size of its balance sheet is likely to have far reaching effects on both the bond market and the banking sector.

US 30-year Treasury futures have been ranging in a relatively gradual process of mean reversion for the last six months. The price is currently testing the 155 area, which now coincides with the trend mean, but a sustained move above it would be required to signal a return to demand dominance.

10-year Treasury futures exhibit a better defined upward bias but are also now testing the region of the trend mean.

So is the 5-year.

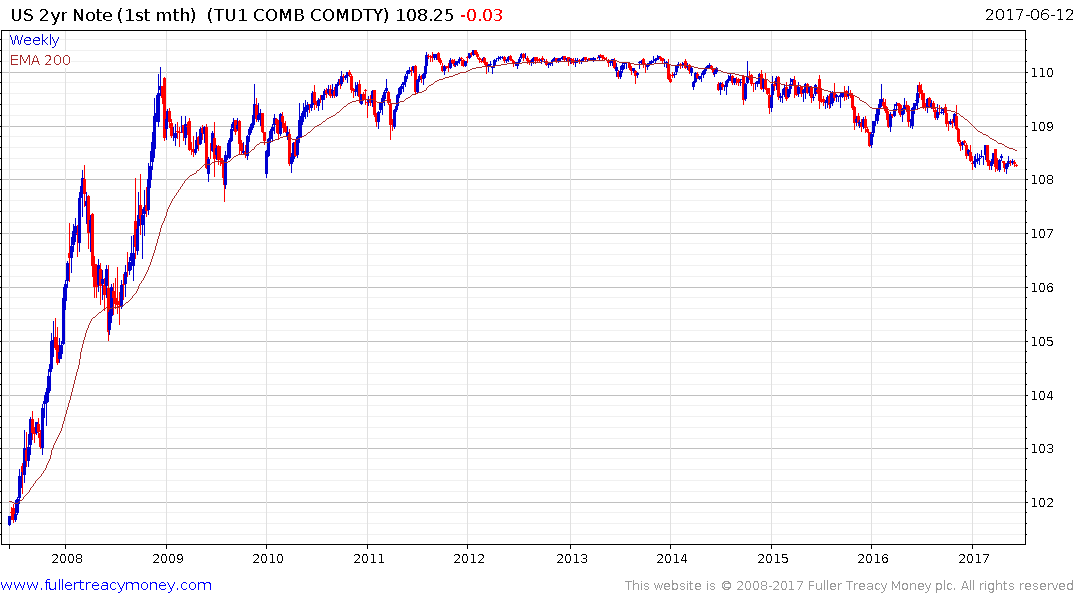

2-year futures have the clearest downward bias and continue to encounter resistance in the region of the trend mean.

That divergence between the long and short ends of the curve is contributing to the yield curve spread’s (10-2) contraction.