Fed Minutes Reveal Divisions Over Decision to Pause in June

This article from Bloomberg may be of interest to subscribers. Here is a section:

Federal Reserve officials struck a tenuous agreement to pause interest-rate increases at their June meeting, all but committing to hike again later this month in a bid to keep fighting stubborn inflation.

The minutes from the Fed’s June 13-14 meeting show that while almost all officials deemed it “appropriate or acceptable” to keep rates unchanged in a 5% to 5.25% target range, some would have supported a quarter-point increase instead.

“It was a little surprising given that the decision was sold as unanimous from Fed officials,” said Lindsey Piegza, chief economist at Stifel Nicolaus & Co. “It’s pretty clear that there was a divergence of opinions, with some officials pretty clearly giving some reluctance for a one-month pause.”

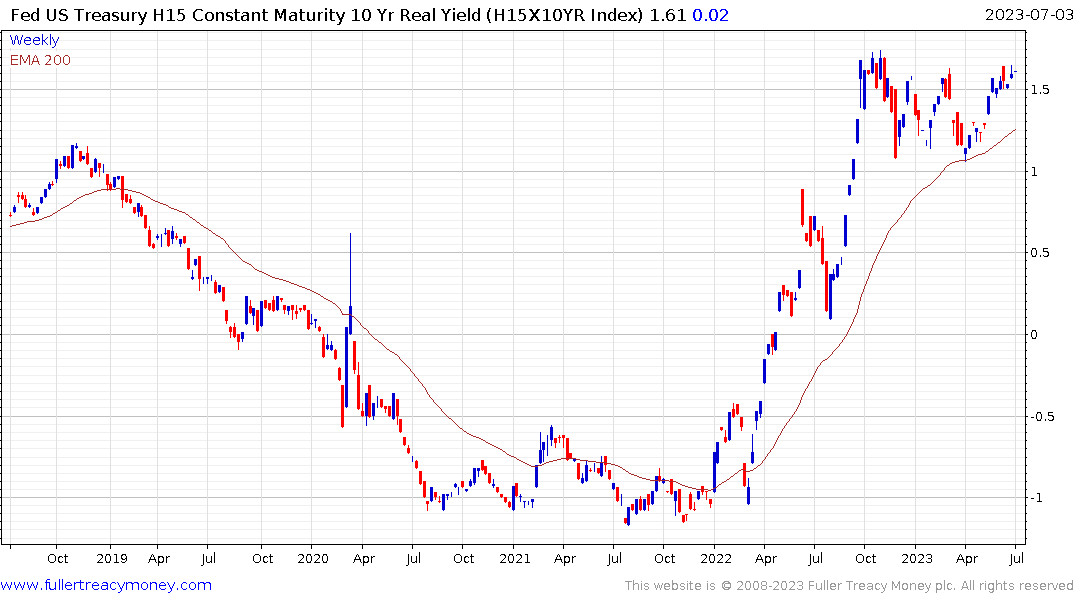

The likelihood of another hike in July is being priced into the Treasury market. Meanwhile, investors are betting the July hike will be the last because manufacturing data is underwhelming and the tide of higher rates will have a negative effect on consumer behaviour in due course. Student loan debt repayments starting up in October are an additional headwind.

The 10-year yield has rallied back to test the sequence of lower rally highs. This also reflects the positive real rate currently on offer with CPI at 4% and the Fed Funds upper bound heading to 5.5%

That’s weighing on the gold price as it tests the region of the 200-day MA.