Fed Interest Rate Projections Increased

Thanks to a subscriber for this report from Commonwealth Bank of Australia focusing on yesterday’s Fed statement. Here is a section:

With asset purchase tapering close to completion and the turning point in the Fed’s monetary policy cycle approaching, focus on the Fed’s monetary policy normalisation process is growing. On this front, the FOMC released a supplementary document that outlined its “policy normalisation principles and plans”.

The FOMC stipulated that the recent discussion on the topic of normalisation is part of its “prudent planning” and did not imply it “will necessarily begin soon”. According to the FOMC, many of the normalisation principles adopted in mid-2011 remain applicable. However, in light of changes to the System Open Market Account (SOMC) portfolio in recent years and other enhancements in the tools available to the FOMC, some adjustment to the previous guide may be necessary.

All but one member of the FOMC agreed on the following key elements of the approach intended to be taken when monetary policy normalisation was deemed appropriate:(a) When less policy accommodation is warranted, the FOMC will raise the “target range” for the funds rate. During normalisation, the Fed intends to move the funds rate into the target range “primarily by adjusting the interest rate it pays on excess reserve balances” (IOER).

(b) The Fed also intends to use an overnight reverse repurchase agreement facility and other supplementary tools to help control the federal funds rate. In our view, this is designed to keep the effective fed funds rate from falling too far below the IOER rate.

(c) The size of the Fed’s balance sheet will be reduced in a “gradual and predictable” manner, primarily by ceasing to reinvest repayments of principal on securities. The FOMC expects to “cease or commence phasing out reinvestments” after it beings to raise the target range for the federal funds rate. Selling of Mortgage Back-Securities is not anticipated to be part of the normalisation process. But should limited sales be warranted in the longer run, such sales would be communicated in advance.

Here is a link to the full report.

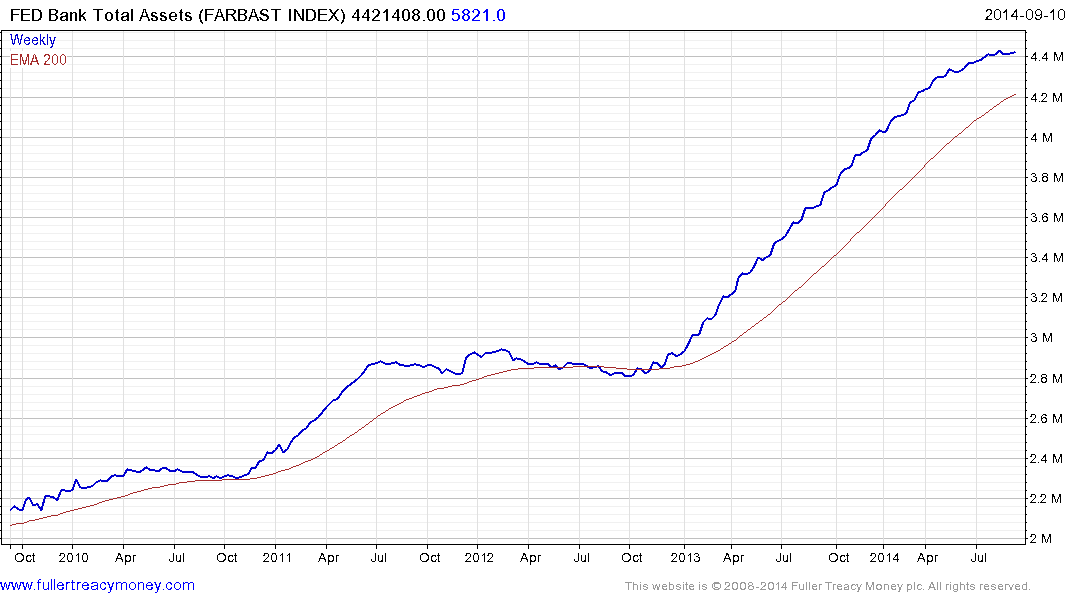

As we approach the end of QE tapering, it is logical to ask when the size of the Fed’s balance sheet is likely to contract. Since the rally on Wall Street has been fuelled in large part by liquidity, the answer is an important one.

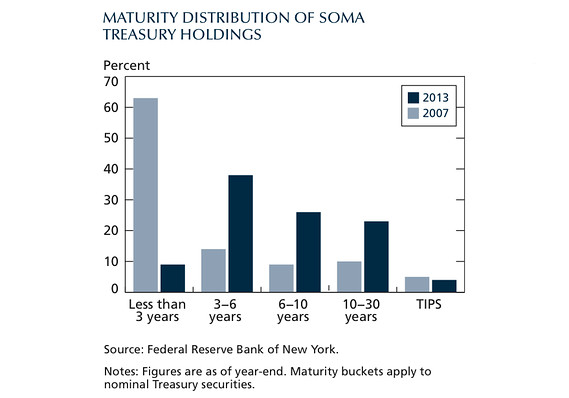

As part of its plan for unwinding QE gradually, the Fed engaged in a maturity extension program. Until 2012, it replaced expiring short-term issues with longer-dated notes and additionally increased positions further out on the yield curve. This has resulted in the average duration of the Fed’s Treasury holdings moving from less than 3 years to greater than 6 years since 2007.

If they simply allow bonds to mature without reinvesting the proceeds, the Fed’s balance sheet would not unwind half the QE expansion until at least 2020. Between now and then, there could be a need for further expansion to deal with unforeseen circumstances, so it is reasonable to conclude that the Fed’s balance sheet might never fully unwind the liquidity infusions of the last five years.

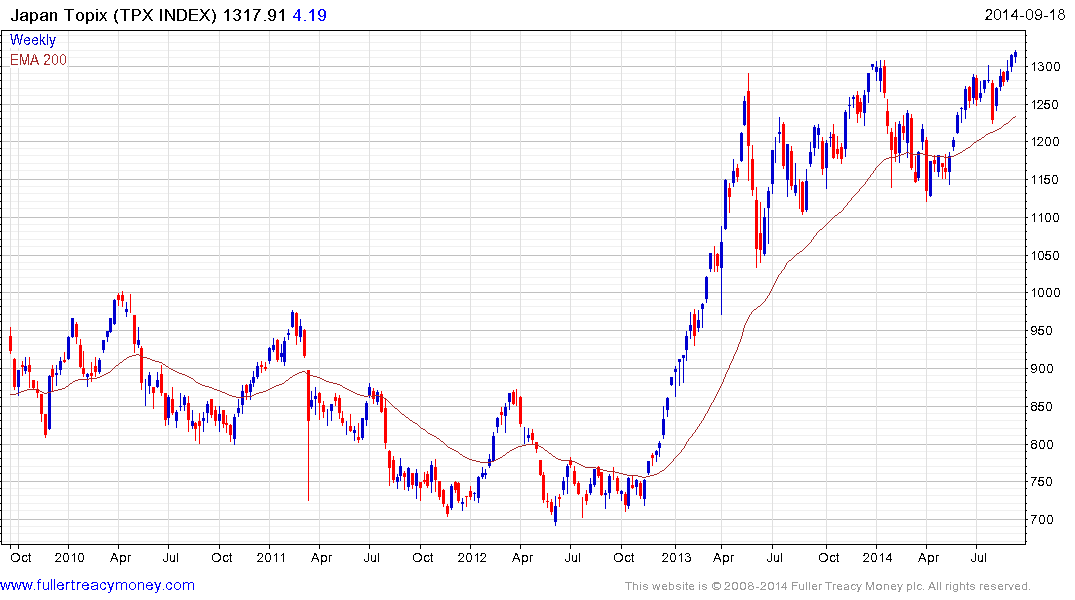

In a global market no country is an island and the end of Fed tapering is putting greater pressure on the USA’s trading partners to take on responsibility for stimulating their own economies. While Abenomics had weakening the Yen as one of its central policy objectives, the recent strength of the Dollar is helping achieve that goal without much additional help from the BoJ. The Fed might be close to the end of tapering but there is no shortage of global liquidity. This appears to be the lesson stock markets are taking from yesterday’s meeting.

The Yen Trade Weighted Index has held a progression of lower rally highs since 2012, encountered resistance in the region of the 200-day MA from July and moved to a fresh new low this week. A sustained move above 110 would be the minimum required to question the consistency of the downtrend.

The broad Topix Index broke out of an 18-month range last week and is extending the advance this week.