Fed Debate Over $4.5 Trillion Balance Sheet Looms in 2017

This article by Christopher Condon for Bloomberg may be of interest to subscribers. Here is a section:

The dollar is a particular source of worry for U.S. policy makers, having appreciated 23 percent since mid-2014. The Fed expects to keep tightening while central banks in Japan and Europe hold steady or consider more accommodation. That could further strengthen the greenback and introduce a headwind for U.S. growth.

“Slowing down the economy a little bit at the long end of the market has some benefits if you think primarily that exchange rates are driven by short-term interest rates,” Rosengren said. “You might want some of the removal of accommodation to come at the long end, which would be done by the balance sheet.”

The Boston Fed released research on Jan. 19 that backs up this view of exchange rates and the yield curve. Former Fed economist Roberto Perli was more skeptical, pointing to global demand for longer-term U.S. Treasuries.

“If long U.S. rates were to increase significantly as a result of balance sheet shrinking, there would still be large inflows into U.S. assets, which would support the dollar,” said Perli, a partner at Washington consulting firm Cornerstone Macro LLC.

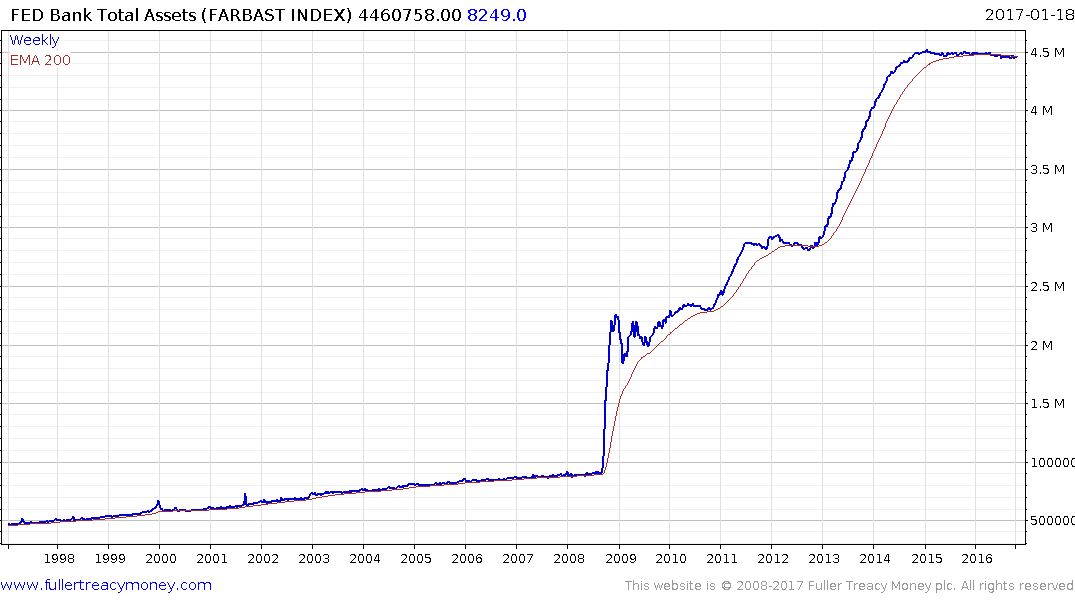

The Fed’s balance sheet at $4.46 trillion represents a potent source of supply for a bond market that shows increasing signs of topping out. As long as the balance sheet was increasing it was hard to argue with the rationale for pursuing the bullish momentum trade in Treasuries. However with interest rates now rising and the Fed no longer adding to its inventory of bonds a major source of fresh demand has been removed from the market.

True, the Fed is rolling over expiring bonds into new issues. However higher refinancing costs, associated with rising rates, in tandem with the knock-on effect that has for the US Treasury and bank profits suggests the issue of the Fed Balance sheet is going to be an increasingly political topic this year.

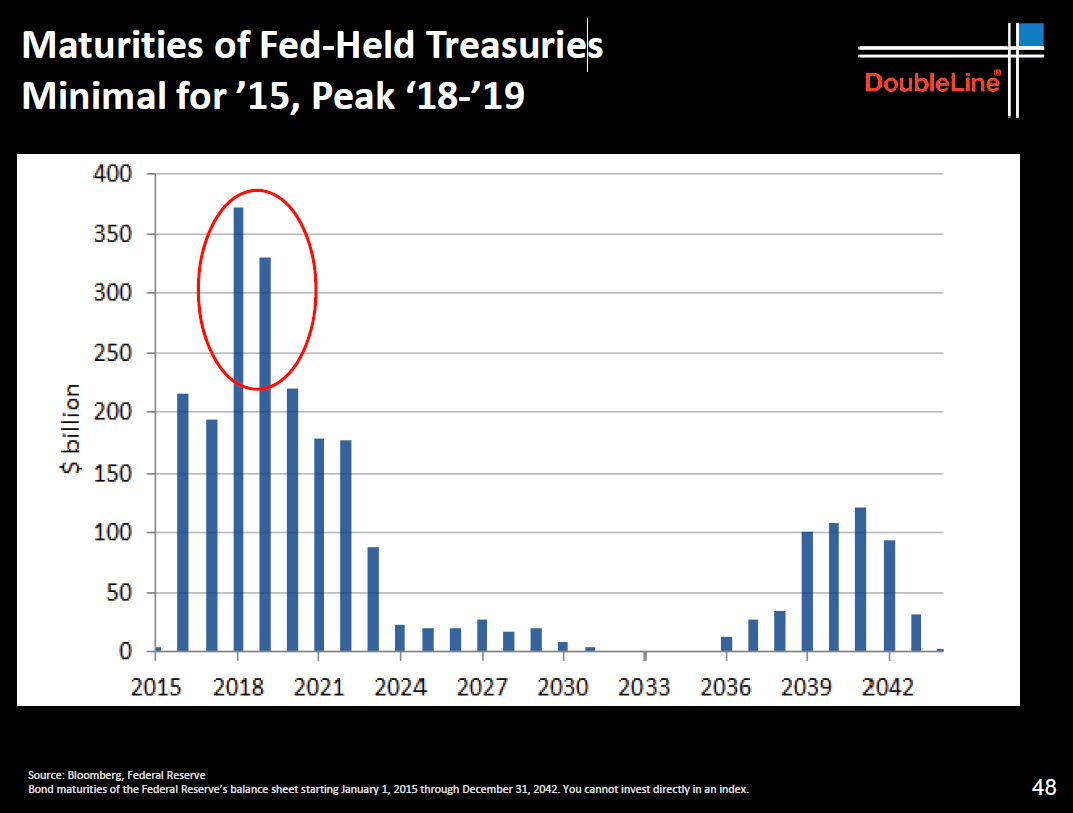

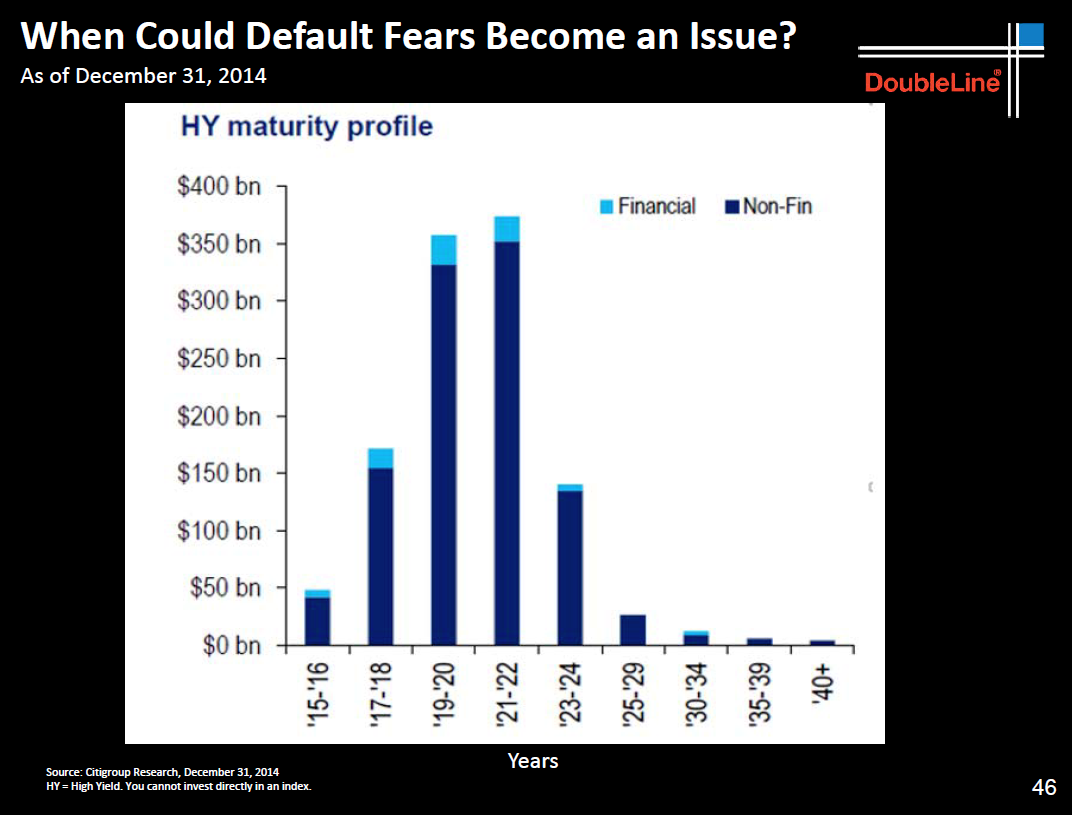

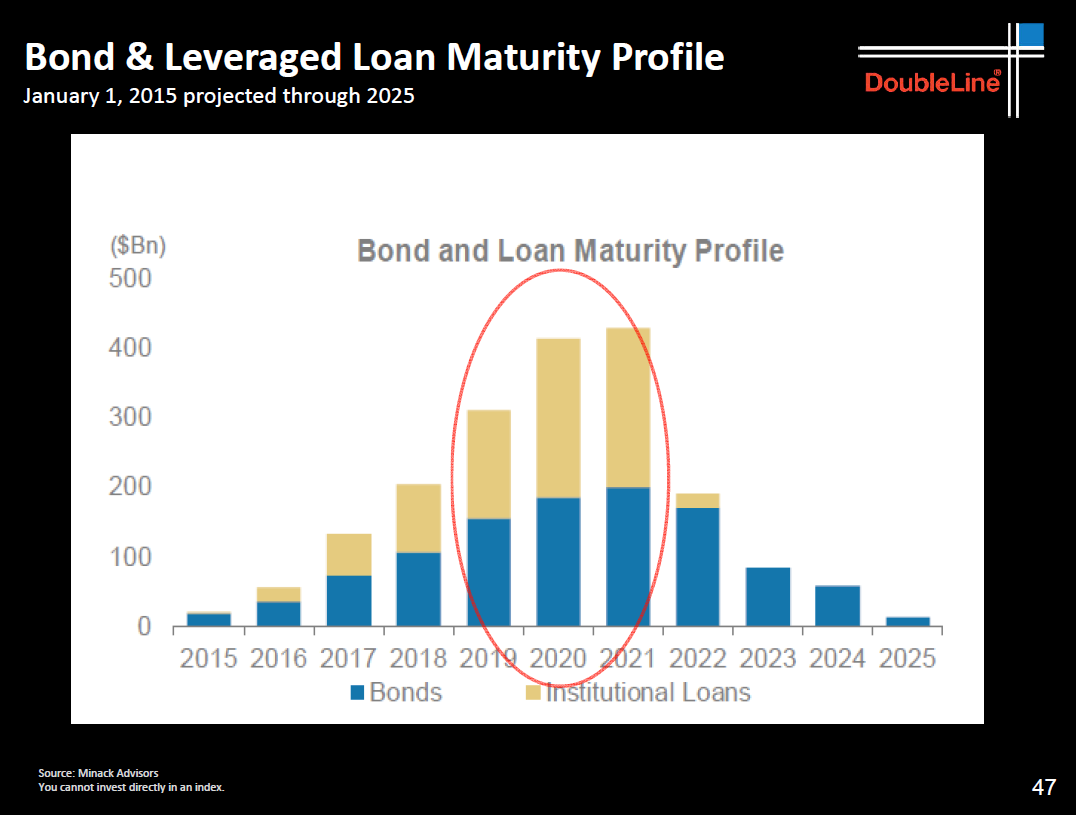

The Fed was a major source of demand and could become a major source of supply. It is also worthwhile considering the calendar of debt issuance. This report from DoubleLine posted in May 2015 contains a number of slides which are gaining increasing relevance as we consider the outlook for the Fed’s balance sheet. A great deal of debt needs to be refinanced between 2018 and 2021, with the majority falling due in 2019 and 2020. The Fed alone has more than $350 billion that needs to be either rolled over or allowed to mature in 2018.

Therefore the Fed is understandably concerned with reloading the interest rate gun now so that it will have some ammunition to deal with what is a predictable potential challenge. That is in addition to any potential unforeseen contractionary circumstances that may arise.

At this stage the most cautious approach would be to do nothing with the balance sheet because the private sector has so much debt which needs to be refinanced.