Features of a Bitcoin Bear Market

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

The argument proposed by hard cryptocurrency advocates is that profits accumulated in the cryptocurrency world should be simply left in the system and only reinvested in other tokens or altcoins. The basis for eschewing fiat currency entirely is that the cryptocurrency market is evolving so quickly that it is only a matter of time before digital assets have widespread real-world utility and at that point the declining value of fiat currencies can be foregone completely in favour of accumulating real assets.

That’s a tantalizing argument and no doubt it will have many adherents within the cryptocurrency crowd. From a behavioural perspective it represents the hardcore bulls who will never sell regardless of what the price is.

Bitcoin represents by a proof-of-work blockchain which favoured miners more than anyone else. Ethereum is based on a proof of stake blockchain which favours owners of tokens. Meanwhile the evolution of DAC platforms is a fresh iteration and overcomes the scaling limitations of the previous two popular blockchain formats and is more equitable. For example, Hyundai just closed the ICO on its first cryptocurrency designed specifically to function with internet of things devices and is planned to us a hybrid blockchain based on HDAC technology.

It is for that reason I have compared bitcoin to Netscape. It was the early runner but it is unlikely to be able to iterate quickly enough to keep up with the pace of innovation elsewhere in the cryptocurrency field.

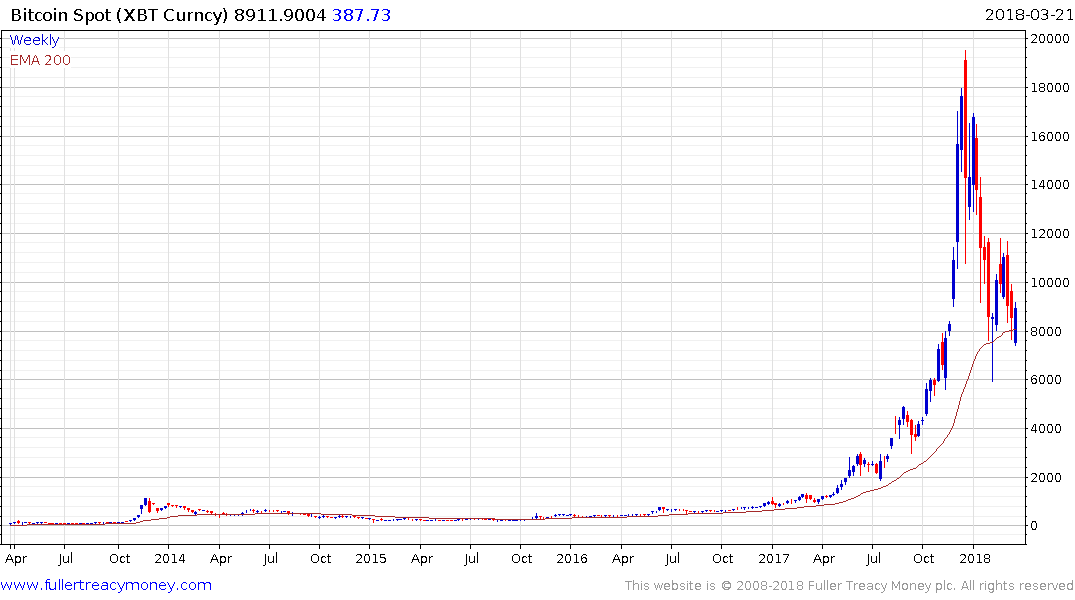

Bitcoin has at least stabilized in the region of the trend mean and will need to hold the low near $7500 if support building is to continue to be given the benefit of the doubt.