Fear of trade war between US and China

Thanks to a subscriber for this report from Commerzbank which may be of interest. Here is a section:

Here is a link to the full report.

Here is a section from it:

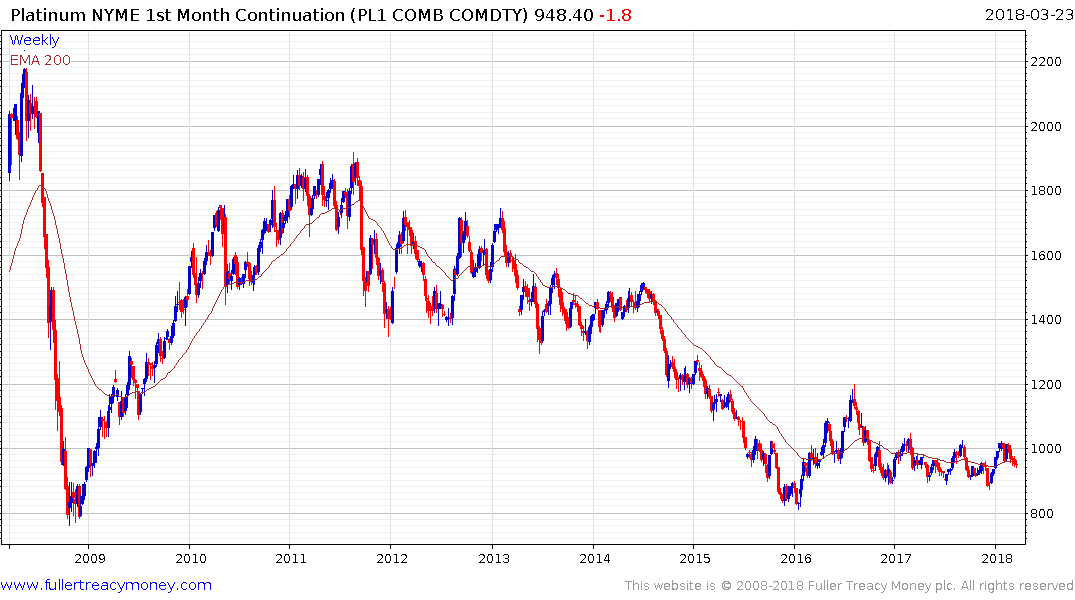

Various crises are pushing gold up above $1,340 per troy ounce this morning. Gold has thus gained almost $40 as compared with its low at the start of the week. First and foremost, it is the looming trade dispute between the US and China (see Base metals on Page 2) that is generating higher demand for gold as a safe haven. This is because it is causing stock markets worldwide to fall, bond yields to decline and the US dollar to weaken – all of these being factors that are positive for gold. What is more, US President Donald Trump now appears set after all to replace his former National Security Advisor Herbert Raymond McMaster with foreign policy hardliner John Bolton (see Energy above). This change could make new sanctions on Iran more likely, which no doubt would further unsettle market participants and lend support in turn to gold. Silver is being pulled up by gold, but has not made disproportionate gains. The falling base metals prices are presumably having a braking effect here, as silver is used primarily in industry. The gold/silver ratio has therefore climbed to over 81 again. Platinum is also recovering somewhat from the losses it incurred yesterday. All the same, the price gap between gold and platinum has widened this morning to $385 per troy ounce – the highest discount on platinum as vis-à-vis gold since platinum exchange trading began in 1987.

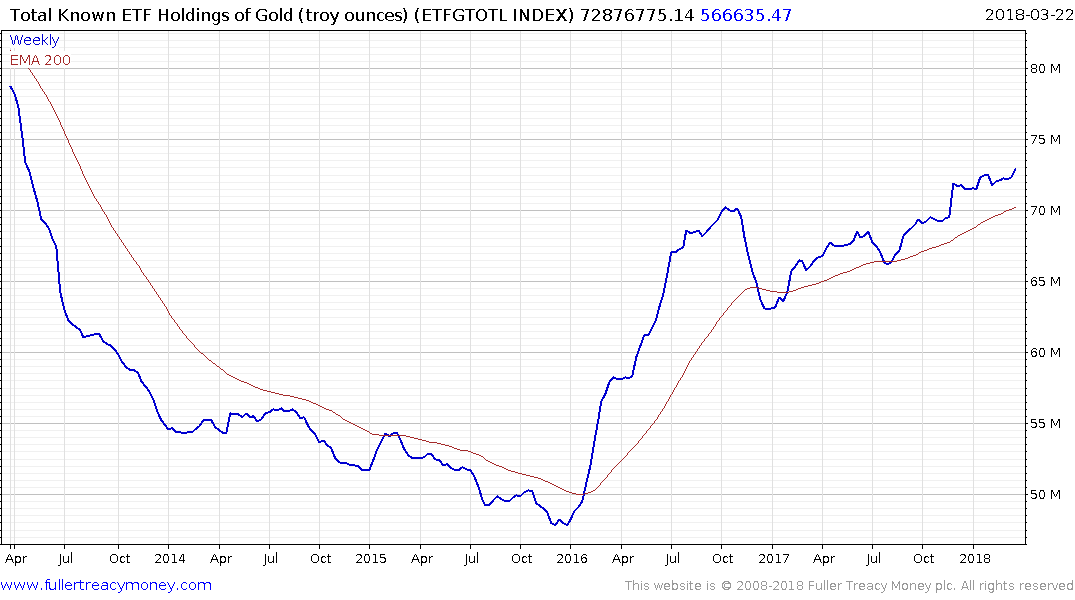

ETF Holdings of gold has been remarkably steady since the initial surge in 2016 suggesting investors were willing to continue to hold gold despite a lengthy period of consolidation. Holdings are now hitting new recovery highs and a clear move below 70 million ounces would be required to question the return to demand dominance.

Gold exhibits a saucering pattern over the last five years with a progression of higher reaction lows since early 2017. It is currently firming from the region of the trend mean and a sustained move $1300 would be required to question medium-term scope for additional upside.

Ranges are explosions waiting to happen and gold has a history of emphatic breakouts so despite the lengthy ranging phase the potential for additional upside remains intact; provided it can extend last week’s rally.

Platinum is about 11% denser than gold and tends to be quoted as 95% purity in jewellery versus 75% for gold. If we ignore the seller’s premium, a one-ounce 18Kt ring should cost in the region of the $1011. For a platinum ring to be the same size, at 95% purity, it would cost $1002. Therefore, for the sake of argument, a platinum ring should now cost less than a gold ring of the same size and appearance. That’s a very rare condition and can only occur when platinum prices are trading at a significant discount to gold.

.png)

Platinum prices have been ranging below $1000 as the fall-off in demand for diesel vehicles acts as a headwind and is at least partially offset by the value proposition compared to gold. It is currently steady near $950 but needs to sustain a move above $1000 to confirm a return to medium-term demand dominance.