Fear Not, ETFs Control the Price of Gold

This article by David Fickling for Bloomberg may be of interest to subscribers. Here is a section:

That matches the big picture portrayed in demand statistics from the World Gold Council, an industry group. Bar and coin investors, industrial users and jewelry buyers purchase the yellow metal year-in and year-out; and central banks have been doing the same thing ever since they gave up their selling spree in 2009. As a result, ETFs and related funds are the key swing factor in the gold market, driving its slump from 2013 through 2015 when they became net sellers, and helping support its modest revival by turning into buyers in the years since.

That relationship seems to have intensified of late. The raw beta when gold is the dependent variable jumped to 1.65 in the past three months, suggesting moves in ETF holdings are now having an even bigger influence on the spot metal than usual.In some ways this doesn’t change the old argument for investing in gold, which is that the important beta isn’t related to ETF holdings but to stock-market returns. When fear rises and the value of your equity portfolio falls, the yellow metal still has a mild tendency to climb and offset the losses

elsewhere.Still, those who look on gold as a refuge from the madness of crowds shouldn’t get ahead of themselves. These days, the crowds are in the driver’s seat.

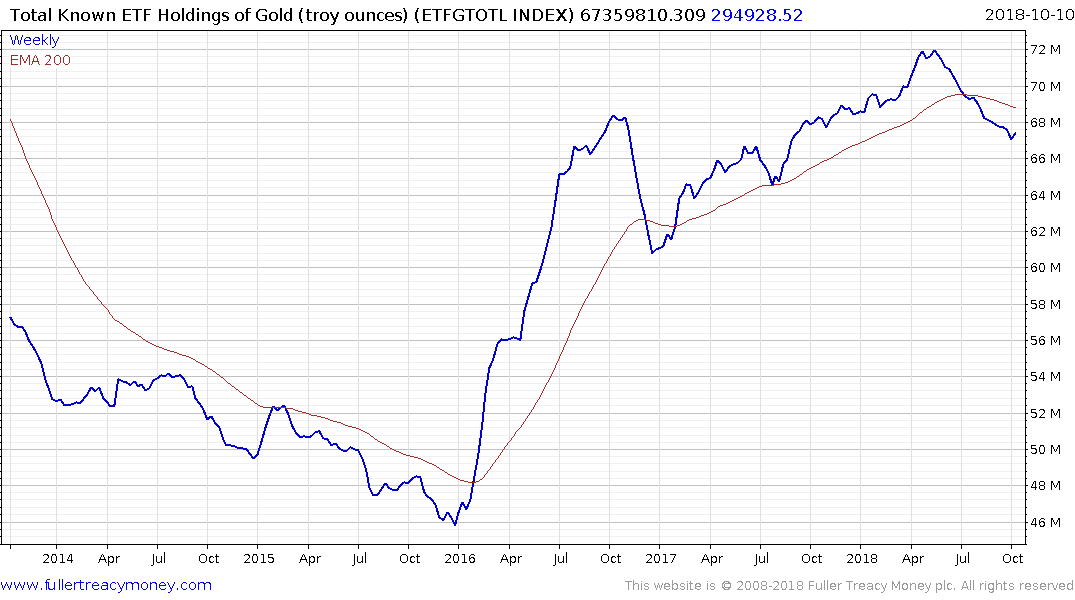

ETF Holdings of gold peak at 72 million ounces in May and the total fell by 5 million ounces by early October. That represented a 6.86% decline in the total but perhaps more significantly it represented the reversal of what had been a source of demand for the metal.

It is worth considering that the gold price hit at least a near-term low in August but ETF Holdings have continued to trend lower over that period. Despite the bounce seen this week, the ETF Holdings chart still has a consistent sequence of lower rally highs. That suggests while ETF investors are an important source of demand they are not a lead indicator but rather tend to react with at least a two-month lag to the changes in the trend for the gold price.

Gold broke upward yesterday and held the majority of the advance today.

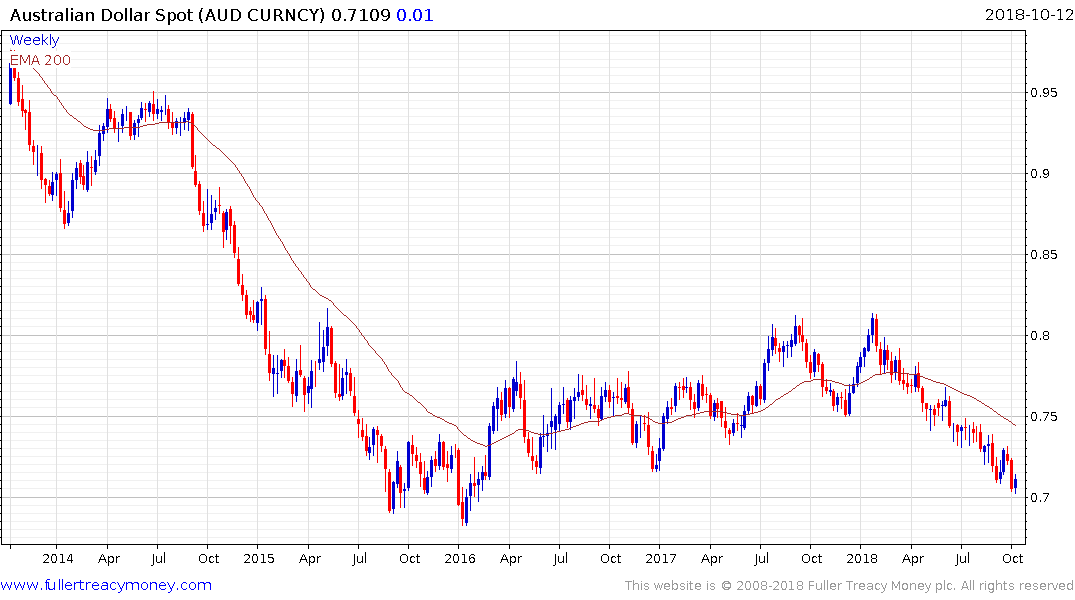

The relative weakness of the Australian Dollar continues to favour the country’s gold mining sector with Evolution Mining bouncing back above the trend mean today.

Resolute Mining is currently firming from the lower side of its range.

St. Barbara rallied this week to break a more than three-month progression of lower rally highs.

Among South African Miners, Sibanye Gold has been on an aggressive acquisition spree which has seen it become a major platinum and palladium producer in addition to its gold assets but that has resulted in the share collapsing over the last 2-years. It broke up out of a six-month base this week.