Expectations and the Role of Intangible Investments

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

The primary task of an investor is to anticipate revisions in expectations. This requires an understanding of price-implied expectations and having a sound thesis for why the market will revise those expectations. The primary purpose of financial accounting is to provide a company’s external parties, including current and prospective shareholders and creditors, with the information they need to make informed economic decisions.

Earnings are deemed to be “the single most important output of financial reporting.”42 It used to be that earnings were on the income statement and investments were recorded mostly on the balance sheet. The rise of intangible investments means that the bottom line is now a mix of earnings and investment. The goal of this report is to allow an investor to untangle these pieces and assess them properly.

Earnings are less relevant for value today than in the past. This is because of the rise of intangibles and the increase in non-recurring, or ancillary, items reported in earnings.43 We focus on the former, but investors seeking to understand value must thoughtfully deal with both.

Baruch Lev, a professor of accounting at New York University Stern School of Business, argues that earnings have become less relevant for value over time.45 He supports this claim by analyzing the correlation between contemporaneous earnings and market value. He further develops a proxy for intangible investment, R&D plus SG&A spending as a percentage of assets, which allows him to separate the universe of stocks into those that are above the median, the “top spenders,” and those below, the “bottom spenders.”

Exhibit 7 show the results of this analysis by decade from the 1950s through the 1990s and from 2000 to 2016. A couple of features stand out. First, there is a monotonic decline in earnings relevance for the top spenders. This coincides with the rise of intangible investment. Second, the relevance gap between the top and bottom spenders, which was modest in the 1950s, grows over time. The earnings relevance for companies that rely mostly on intangibles is low, and reclassifying investment improves the signal.

Here is a link to the full report.

The long-running underperformance of value versus growth has confounded many traditional fundamental investors. The continued outperformance of the technology sector, where there is a paucity of earnings but ample performance, raises important questions for value investors.

Either, history will be repeated and valuations will mean revert or the digitisation of the economy has forever altered what constitutes value and allowances have to be made for intangibles.

This is exactly the kind of pressure value investors come under in every secular bull market. Their methodology is attuned to discovering value in the detritus of a bear market where there are major mis-pricings. However, fundamentals don’t work when it comes to picking tops. The loud and repeated warnings about the high level of cyclically adjusted P/Es are a good example. Just because the valuation is high by historical standards does not mean it can’t go higher.

In fact, the assumption in any consistent trend has to be that it will go higher until their evidence to the contrary or some obvious catalyst is triggered.

The biggest challenge for investment in speculative new ventures is the cost of capital. Higher interest rates and reducing money supply have killed off more bull markets than all other factors combined. The Fed was on its way to doing that before the pandemic. The change today is they have completely changed direction. Any concern about over valuation is now overwhelmed by the task of managing the enormous debt accumulated to tackle the pandemic.

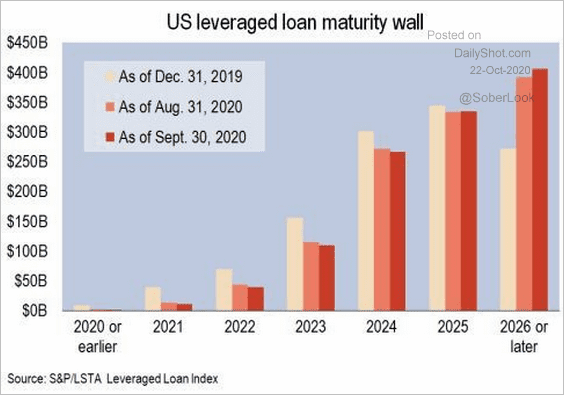

There are mixed signs we are in the early stages of a new credit cycle. Business formations are surging, savings are high, costs have been cut, expectations are low but liquidity is very high and the leveraged loans refinancing wall has been rolled forward about five years. Credit tends to lead the economy so while the economy may take time to respond it appears, we are in a recovery.

That suggests reflation plays have ample scope to outperform over the coming couple of years and not least because they are coming off such a low base. That assumption is based on the belief that central banks will act in a timely manner to support bond markets and stop yields from surging higher.

Back to top