Evolving top formations

The swift run-up in government bond yields is curtailing risk appetite. More importantly it reintroduces the discount rate in the calculation of fundamental value. When money is both free and available in vast quantities, the discount rate on future cashflows goes to infinity. At that point, the most fanciful valuations are accepted as realisable because the time allowed to fulfill the goal is infinite. Higher rates reintroduce a time value of money argument and forces valuations down. That has resulted in a significant correct for many liquidity-dependent sectors.

The Russell 2000 small cap index has top formation completion characteristics. It lost momentum a year ago, failed to sustain the upward break in November and has now failed to demonstrate support at the lower side of the range.

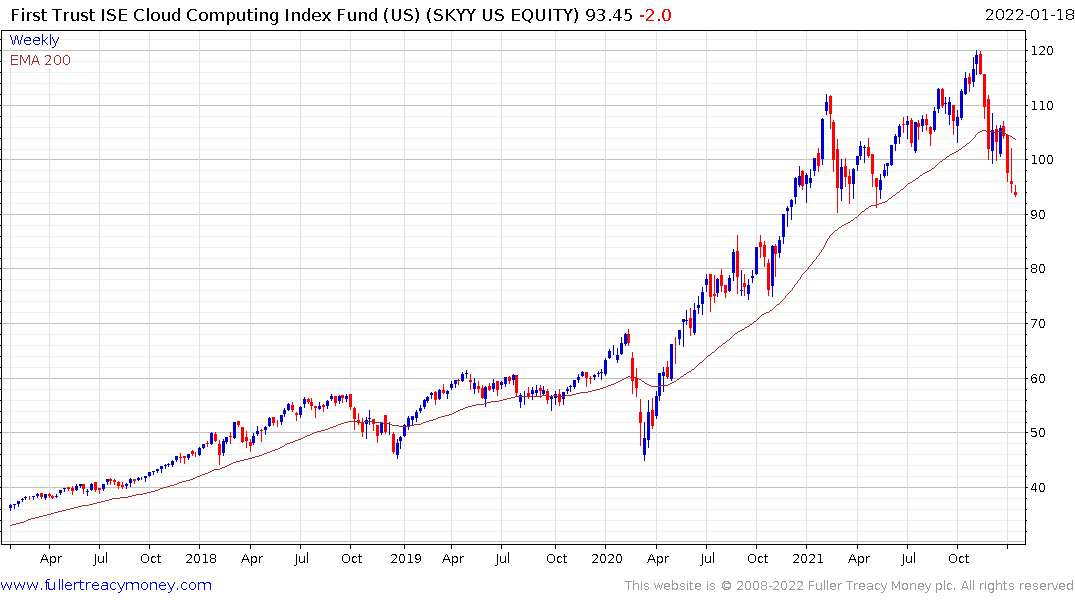

The Cloud Computing ETF also failed to sustain its upward break in November and encountered resistance in the region of the trend mean earlier this month. The moving average has also turned lower. It is currently holding in the region of the early 2021 lows.

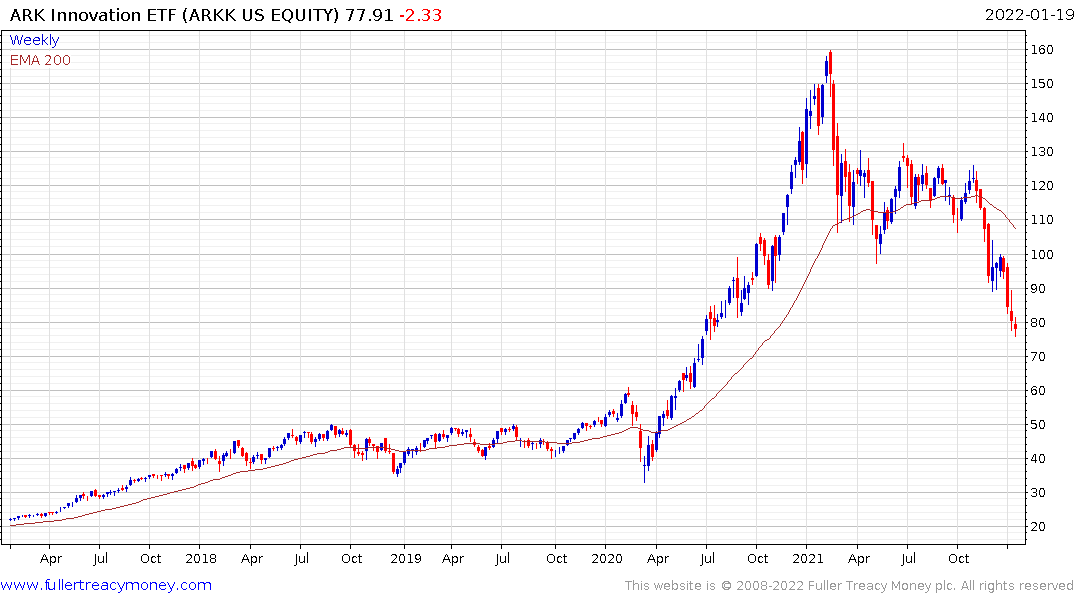

The ARK Innovation ETF is very short-term oversold.

These sectors have been heavily impacted by rising yields. A significant moderation in expectations for interest hikes this year will likely be required to stem selling pressure. At present traders are pricing in scope for more than four hikes this year. Considering the risk of contagion into the mega-cap shares, the current correction equates to betting the Powell Put is no longer in effect.

That seems to be a rash conclusion to me. I don’t expect to see more than two hikes this year because a good-sized pullback on the S&P500 would chasten the Fed’s aspirations for normalisation; just like it did in 2018.