Evergrande Liquidation Risk Rises After Creditor Meet Scrapped

This article from Bloomberg may be of interest to subscribers. Here is a section:

China Evergrande Group is running out of time to get what would be one of the nation’s biggest-ever restructurings back on track, after setbacks in recent days that raise the risk of liquidation.

The string of surprise developments include scrapping key creditor meetings at the last minute, saying it must revisit its restructuring plan, detention of money management unit staff and an inability to meet regulator qualifications to issue new bonds.

That last item is a major setback to its planned restructuring of at least $30 billion of offshore debt that would have creditors swap defaulted notes for new securities. Evergrande’s shares plunged as much as 25% Monday.

At the epicenter of China’s property crisis, Evergrande is under pressure to finalize a blueprint for its offshore debt restructuring as it grapples with an even bigger pile of total liabilities that amount to 2.39 trillion yuan ($327 billion)—among the biggest of any property firm in the world. The clock is ticking. The company faces an Oct. 30 hearing at a Hong Kong court on a winding-up petition, which could potentially force it into liquidation.

The distressed real estate giant said late Sunday it couldn’t satisfy requirements of the China Securities Regulatory Commission and the National Development and Reform Commission to issue new notes. It cited an investigation of subsidiary Hengda Real Estate Group Co., without elaborating. The unit said in August that CSRC had built a case against it relating to suspected information disclosure violations.

The challenge in observing trouble in property markets is how long it takes for the unwind. China Evergrande first collapsed two years ago. It may yet be restructured but the bigger emerging issue is Evergrande’s problems are probably the thin end of the wedge when it comes to China’s property sector.

The question everyone is wondering about is whether the cabinet reshuffle (ouster, disappearances) is associated with an internal argument about the need for reform or about the need to persist in deleveraging?

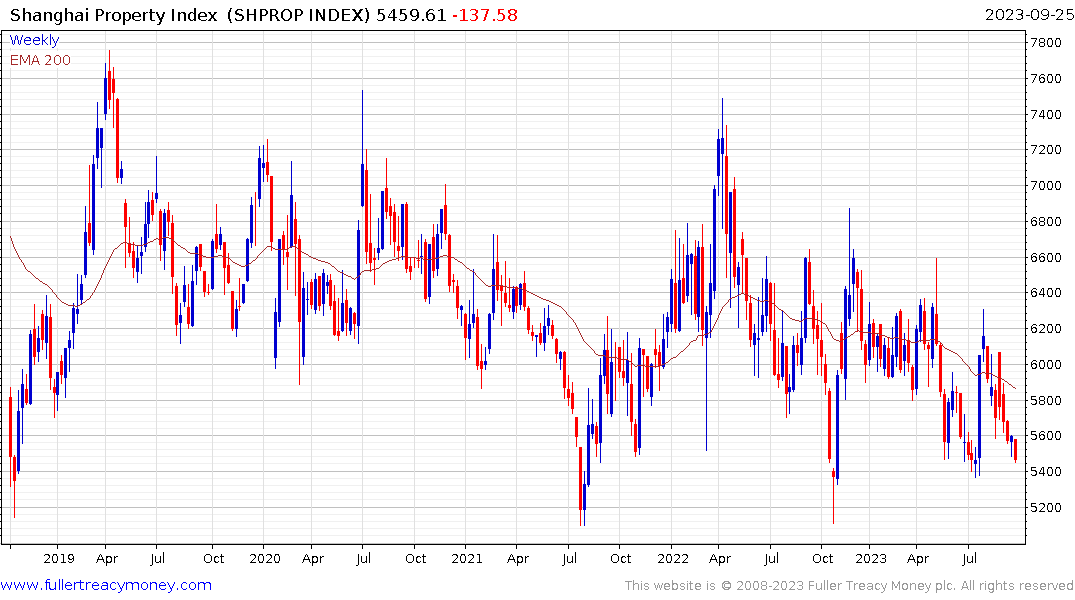

The stock market is not displaying a great deal of confidence that abundant new liquidity is about to be poured into the economy. There has, so far, been no follow through on the small upside key reversal posted on Friday and the Shanghai Property Index hit a new reaction low today.

I remain of the view that copper is the best barometer of how much contagion the Chinese market represents for the wider global market. Both Australia and New Zealand’s markets are heavily reliant on Chinese commodity demand for example.

Copper is barely steady above $3.60.