European Stocks Surge on Fed Hike Bets With FTSE 100 at a Record

This article by Blaise Robinson for Bloomberg may be of interest to subscribers. Here is a section:

European stocks jumped the most since the U.S. election, led by banks and miners, as increasing prospects for a Federal Reserve rate increase and robust China factory data boosted optimism about global growth.

The Stoxx Europe 600 Index added 1.4 percent at the close, as all 19 industry groups gained. The benchmark extended gains in afternoon trading as U.S. equities scaled new peaks. The U.K’s FTSE 100 Index and FTSE 250 Index rose to all-time highs, while Germany’s DAX Index rallied 2 percent to close above 12,000 for the first time since April 2015.

Traders are betting there’s an 82 percent chance of a rate increase at the Fed’s March 15 decision, about double the odds from Friday, after two influential officials from the central bank signaled a greater willingness to tighten monetary policy.

With President Trump’s first speech to Congress out of the way attention has returned to the prospect of additional Fed tightening this year and when the first of three anticipated rate hikes is likely to occur?

This was one of the best earnings seasons in a while and corporate profits are helping support increased optimism about the economy amid speculation on the scale of deregulation, streamlining of the tax code and fiscal stimulus. Against a background where the economy is already close to full employment the argument for additional rate hikes is easier to make.

As I have pointed out in recent audios there is a high degree of commonality between the chart patterns of the Euro STOXX and the Nikkei-225. Both rallied in the final quarter of last year to break a medium-term progression of lower rally highs and have spent much of the last couple of months range.

The Euro STOXX broke up out of its short-term range today to reassert demand dominance.

The Nikkei-225 continues to range below the psychological 20000 level but a clear downward dynamic would be required to question potential for additional upside.

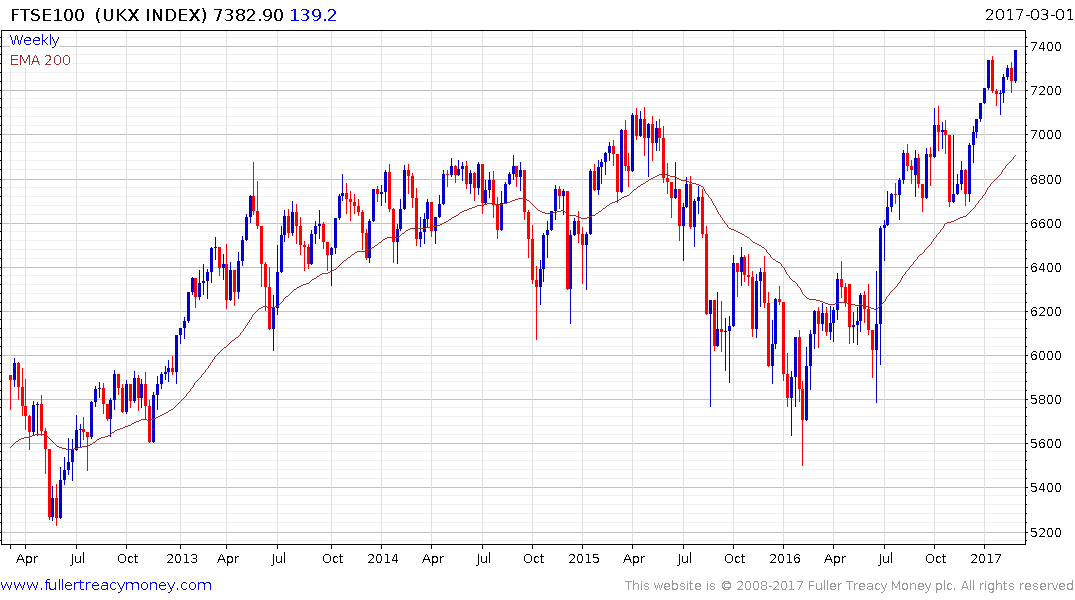

The FTSE-100 is extending its breakout to new all-time highs and a sustained move below 7000 is the minimum required to question medium-term scope for additional upside.

They are being boosted in nominal terms by anticipation the Dollar will remain firm, and could strengthen additionally against their respective currencies.

Back to top