European Equity Strategy

Thanks to a subscriber for this heavyweight 153-page report from Deutsche Bank which is chock full of charts many of which are worthy of additional consideration. Here is a section on Europe:

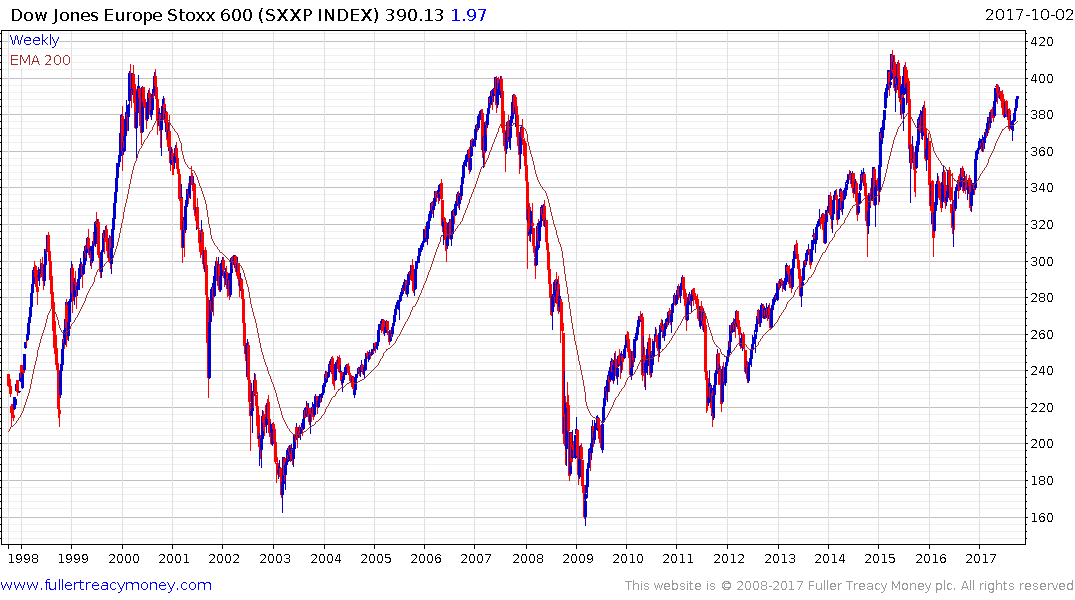

Flash Euro area composite PMI new orders rebounded to a six-year high of 56.3 in September, up from 55.5 in August and consistent with Euro area GDP growth of 3%+ (slide 6). However, PMI momentum – the six-month change in the PMI and a key determinant of European equity market momentum – remains close to zero, having peaked at +4 points in February. We think the current level of the PMI is unlikely to be sustained, given that: (a) PMIs are consistent with GDP growth significantly above our economists’ forecasts (2.2% for this year, 2.0% for 2018) and consensus (2.1% for 2017, 1.8% for 2018); and (b) the PMI has overshot the level suggested by the Euro area credit impulse, which, at 0.1% of GDP, is consistent with a PMI of 51. We expect the PMI to fade back to around 53 by year-end, consistent with our economists’ growth projections. This would imply PMI momentum turning negative over the coming months. Yet, because of the slower-than-expected fade in macro momentum and a sharper-than-expected fall in the European political uncertainty index, our models now point to a flat market by year-end (with temporary upside to 400 on the Stoxx 600, or 4% above current levels; slide 7), before renewed weakness in response to negative PMI momentum in Q1 2018 (with a projected trough below 360 on the Stoxx 600). We expect to turn tactically positive on European equities on signs that PMI momentum is troughing, which is typically associated with a strong rebound (slide 9). Our current projections imply a trough in PMI momentum in early Q2 2018.

Here is a link to the full report.

The Eurozone’s impressive Purchasing Managers’ Index (PMI) survey was also a subject covered by Jeff Gundlach at his talk last week. It reflects both the fact we are in a period of synchronised global economic expansion and that the ECB’s monetary largesse has in effect bought an economic expansion. If the PMI weakens it will represent another reason why the ECB should hold off on tapering.

There is another consideration. Mario Draghi’s term ends in two years so having steered the Eurozone through one of the most difficult times imaginable how likely is he to risk his legacy by raising rates and putting all his good work in jeopardy?

The Euro STOXX 600 is a serial laggard when compared with the vast majority of global indices. However, with the tailwind of monetary largesse it is likely to trend back up towards the upper side of the 17-year range with a view to breaking out over the medium-term. A sustained move below the trend mean would be required to question that hypothesis.

A number of charts in the above report are particularly worthy of consideration.

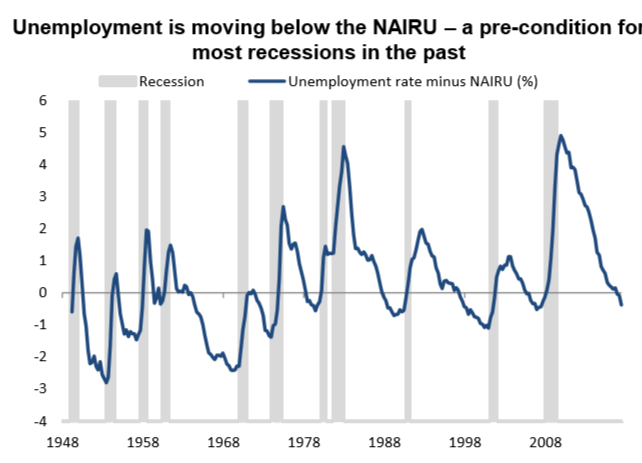

The first highlights the fact US unemployment begins to tick upwards a few months before the onset of a recession. Considering the fact we are at a very low level right now that is a figure well worth keeping an eye on. It occurs to me newspaper headlines are full of proclamations of the death of the shopping mall and big box retailers. What they don’t spend much time on is the fact these companies employ millions of people when aggregated. Could this expansion eventually fall victim to technology innovation?

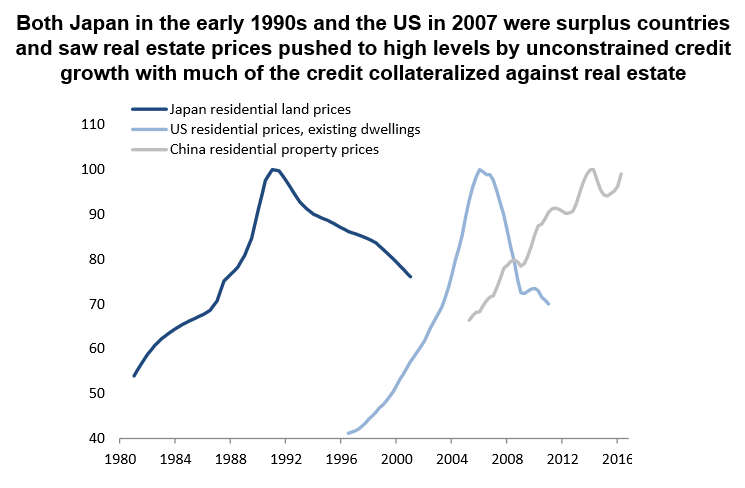

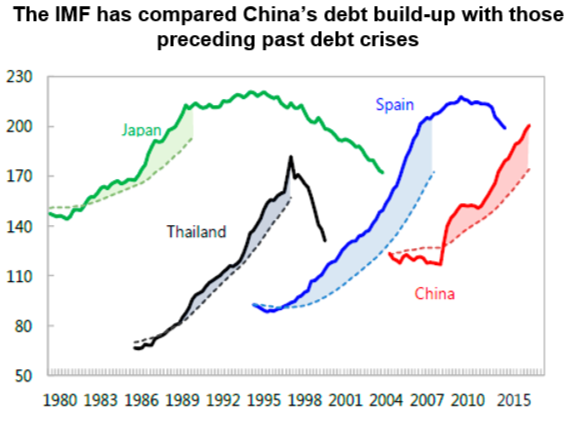

The second and third chart relate to China. The first highlights how high property prices are and the second how high debt levels are. Neither have yet turned down but two points are lodged in my mind. Having spent a couple of weeks in Guangzhou over the summer there is no denying it is a fun, friendly city but isn’t that always the case in a bull market? When capital is abundant and prices are rising everyone is making money and happy. Until of course it stops. The second point is that big China bears like Hugh Hendry have been decrying the state of the Chinese economy for years and been wrong about the timing. Now that an increasing number have both suffered huge losses and been forced to close their funds I wonder if we are closer to the time when their arguments might be correct.

The additional fact that the Chinese government is now suddenly eager to open its financial markets, internationalise the Renminbi, even backing oil contracts with gold and is encouraging investors to buy its bonds strikes me as highly suspicious. The important point about the above debt charts however is that even at extreme levels there is still room for further expansion. Therefore, while there is no evidence just yet of problems it is a time to be more vigilant.

Back to top