European Banks

Thanks to a subscriber for this report from Deutsche Bank which may be of interest to subscribers. Here is a section:

The first quarter of 2014 saw the end of capital upgrades. We believe there are clear trends in regulators attacking the models and we believe there is a real desire for backstops. The good news is that our report concludes that increasing RWA density is broadly manageable by most banks. However, some banks will be much more affected than others.

Worries over model risk and macro-prudential policy will drive RWA density up

We see drivers of higher RW density split into two broad categories: 1) model risk issues and 2) macro-prudential policy. Our key conclusions from our report are as follows:

The first quarter of 2014 saw the end of capital upgrades (see European Banks strategy Q1 earnings review). RWA densities are now increasing among European banks; a trend we believe will be long-lasting.We believe there is will among regulators to tackle model risk. We expect backstops to models could be among the policy options over the next few years. PD floors and higher LGD in our framework would lock EUR 51bn of equity or 5% of market cap (we forecast EUR 291bn of three-year earnings for large cap names).

?Swedish banks are most impacted by PD floors, a potential policy option for model risk. We expect Swedish bank management teams to run with higher core tier 1 levels than currently implied until clarification to avoid “getting it wrong” on capital planning. Regulators will keep uncertainty to cap payouts. As such, higher than 75% payout ratios look unlikely for the next few years.

Here is a link to the full report.

The European banking sector still has a long way to go before it can be considered healthy. However since the equity markets had priced in a disaster scenario, equities continue to benefit from a re-rating.

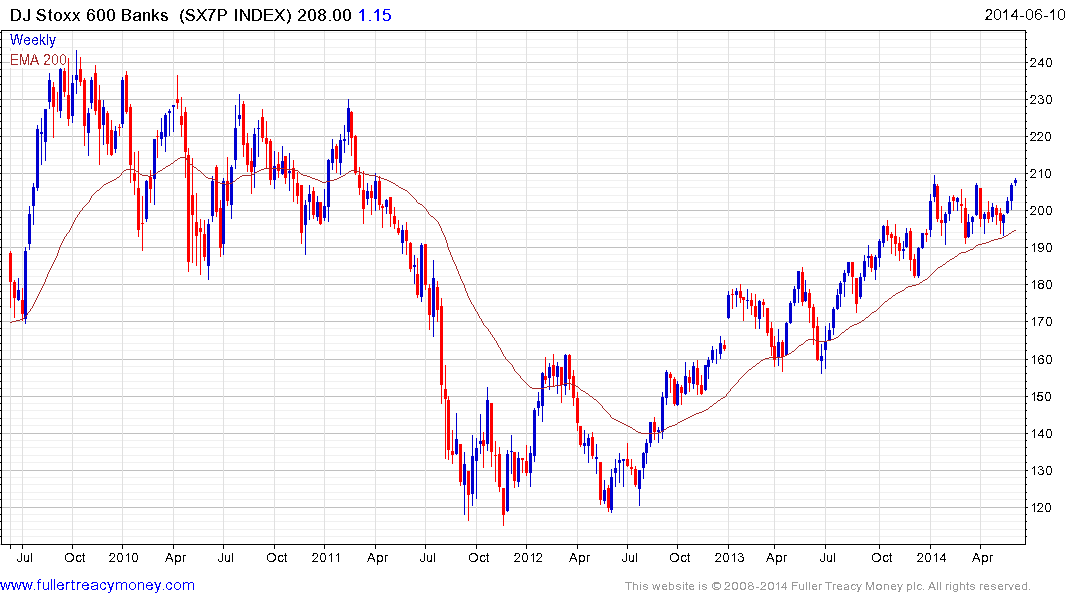

The DJ Stoxx 600 Banks Index has been trending higher since mid-2012 and continues to find support in the region of the 200-day MA on pullbacks. A sustained move below 195 would be required to question medium-term scope for additional upside.

Back to top