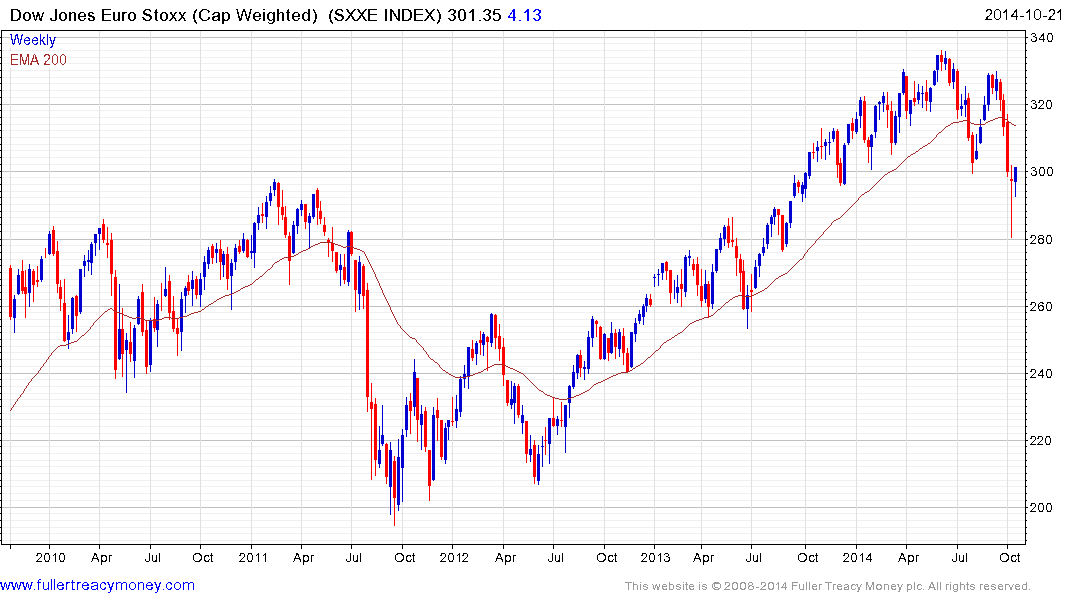

Euro STOXX Index

The ECB is slow to call its monetary intervention quantitative easing but the LTRO program and its successor amount to the same thing. The key difference between the Eurozone and the USA is that the Fed has the ability to expand its balance sheet and leave the additional money in the system while the ECB has so far been forced to completely unwind its programs once they conclude. Despite the fact that the ECB is more constrained in what it can do than the Fed, it is worth remembering that it has only one key mandate i.e. an inflation target of close to 2%. The Eurozone is a long way from that and lower oil prices make inflation even more difficult to achieve. The case for stimulus, simply to achieve its primary mandate, is well made.

From the Fed’s experience we can conclude that quantitative easing is best suited to boosting the price of fixed and financial assets rather than achieving outsized growth numbers. The ECB does not have a growth mandate but it does have a price mandate so QE is well suited to its objectives. The purchasing of Spanish and French bonds yesterday and Italian bonds today suggest the ECB’s stimulus is now underway. This is particularly noteworthy considering how abrupt the sell-off has been in Eurozone equities over the last month.

I clicked through the constituents of the Euro STOXX Index this morning for an impression of just how much damage has been done to the uptrend consistency of some of the Eurozone’s largest companies.

France listed Bollore is an example of a share which has experienced a Type-2 massive reaction against the prevailing trend as taught at The Chart Seminar. A deep oversold condition is evident and potential for a reversionary rally has increased. However the size of the correction suggests that a potentially lengthy period of support building will be required, once the short covering rally has run its course, before medium-term demand dominance can be reaffirmed.

There are a considerable number of equities that share this characteristic. This is why the role of the ECB in providing stimulus is so important. In a tightening cycle if we were to witness such trend deterioration we could logically conclude a bear market is unfolding. However, if the ECB follows through with the addition of €1 trillion, it is likely to tip the balance in favour of the bulls.

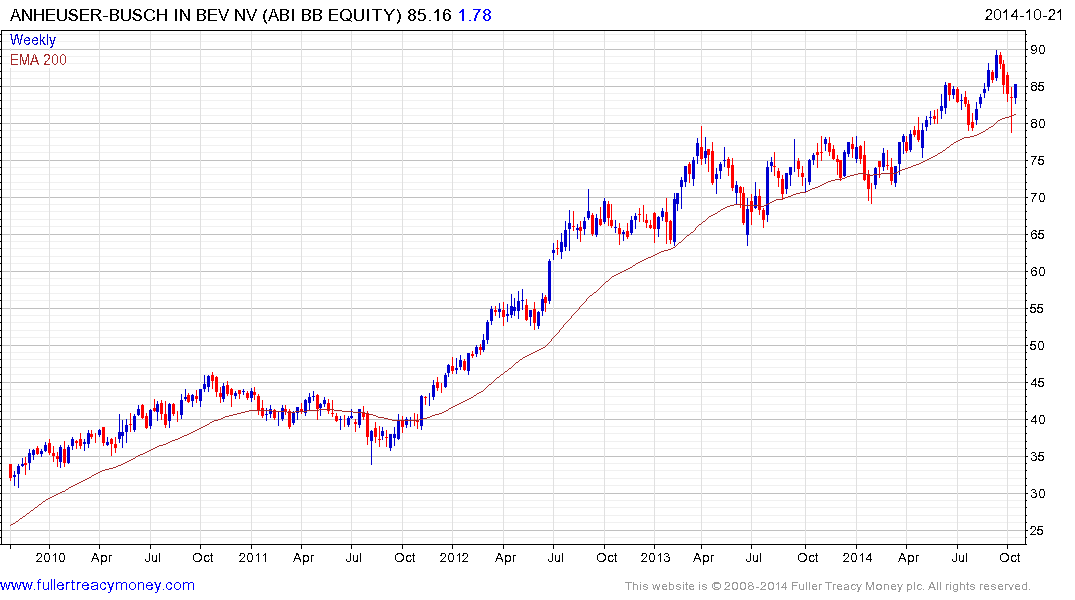

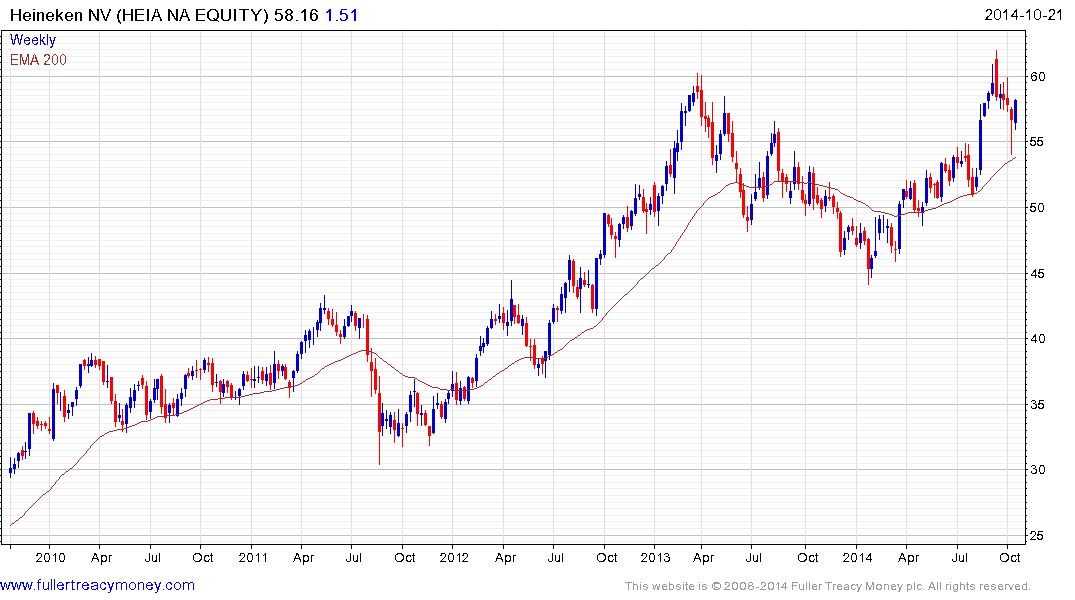

Nevertheless, the better risk-adjusted way of addressing the market is to give the benefit of the doubt to relative strength leaders who will also benefit from central bank largesse.

Among Eurozone based Autonomies both Belgium listed Anheuser Busch InBev and Netherlands listed Heineken found support last week in the region of their respective 200-day MAs.

France listed Essilor International (lenses) rallied to break a more than year-long progression of lower rally highs in August and found support in the region of the 200-day MA last week.

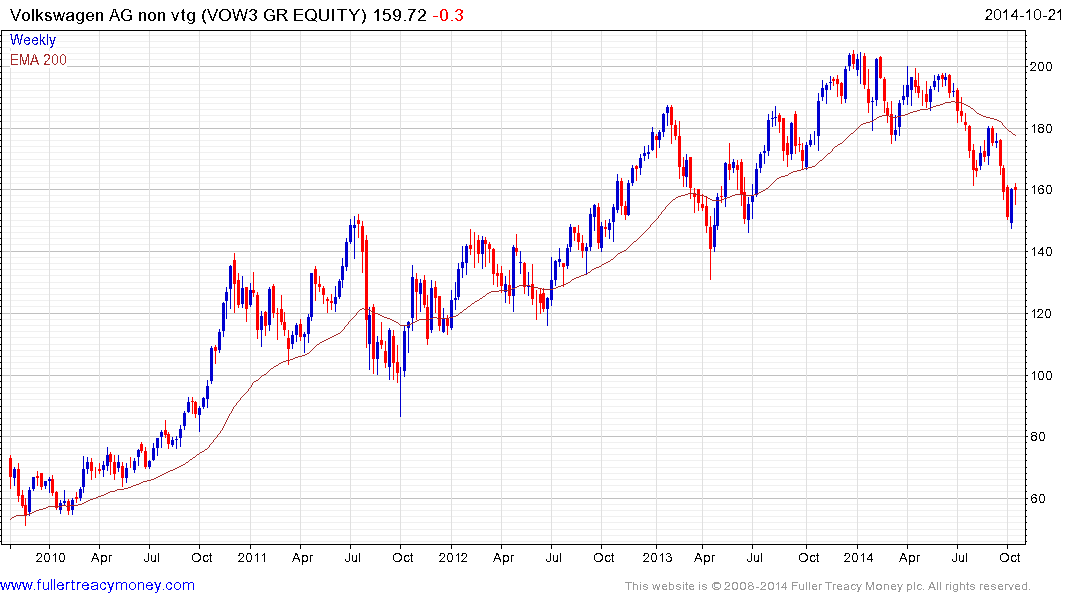

Both BMW and Volkswagen have some of the region’s more attractive valuations but they have less consistent trends than the above shares.

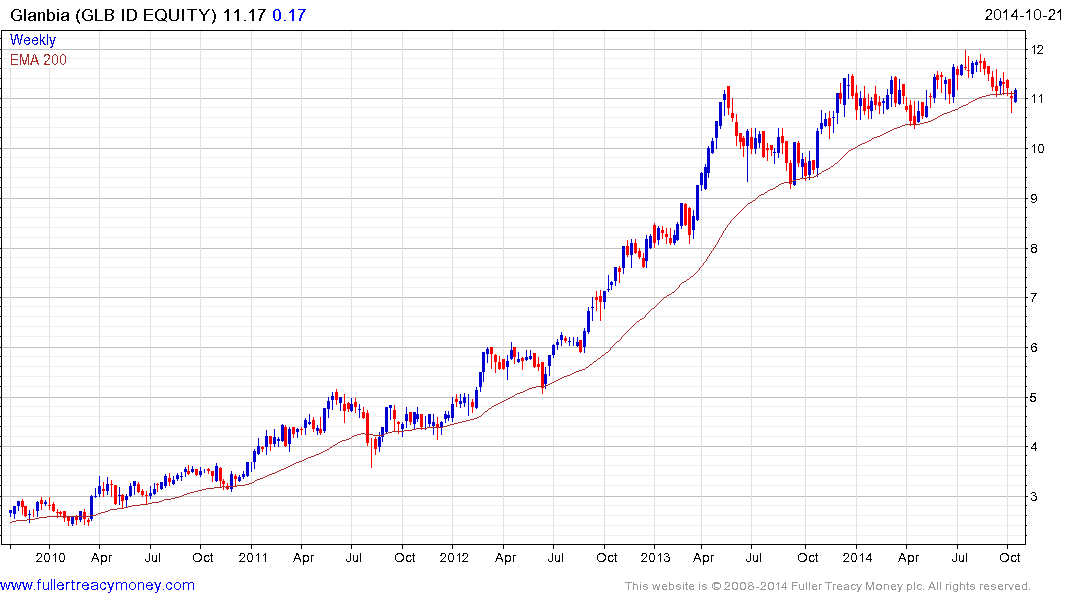

Ireland listed Glanbia isn’t large enough to be an Autonomy but it is an major exporter from the Eurozone and continues to find support in the region of the 200-day MA.

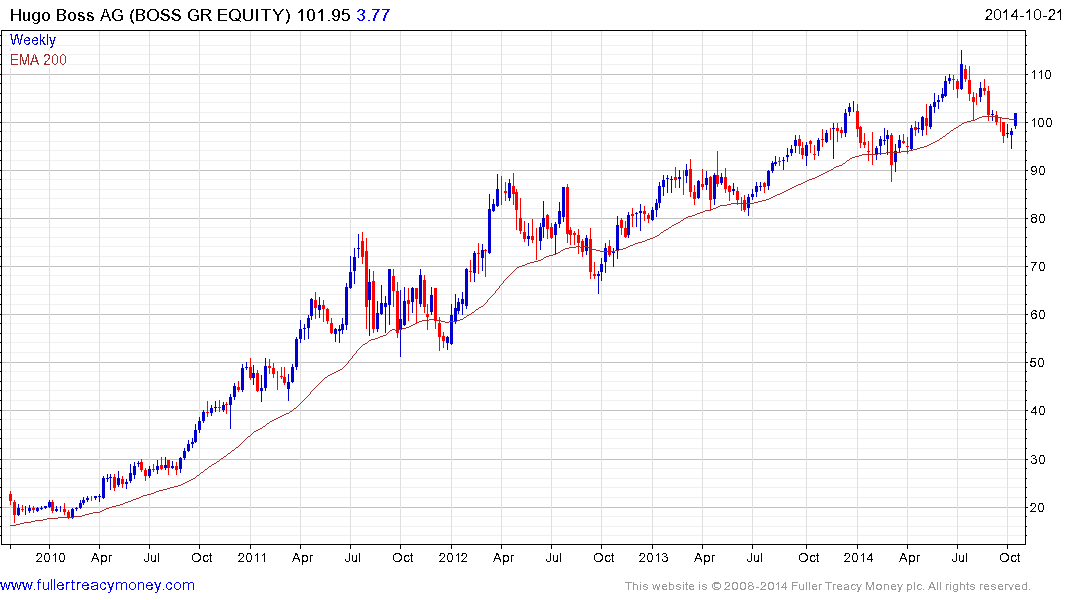

German listed Hugo Boss also remains in a relatively consistent uptrend.

Spain listed Iberdrola (wind farms) found support last week in the region of the 200-day MA.

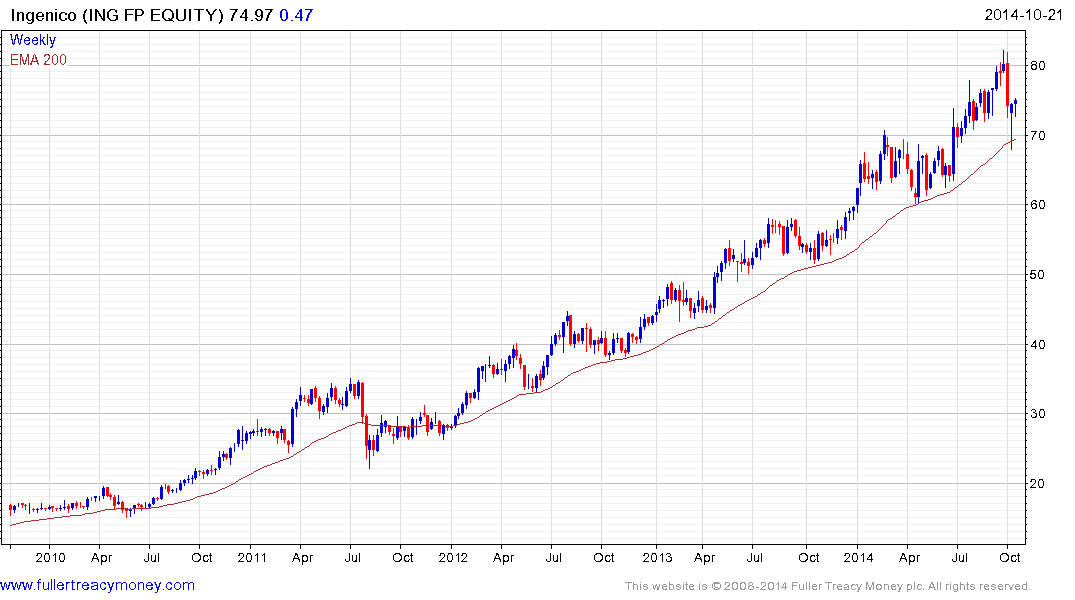

France listed Ingenico (transaction management software) also found support last week in the region of the 200-day MA.

Finland listed Nokia has a similar pattern.

France listed asset manager Natixis also shares this characteristic.

German listed Symrise (speciality chemicals, fragrances) experienced one of the shallower reactions and remains in a consistent uptrend.

Spain listed Viscofan (packaging/canned vegetables) is pressuring the upper side of a two-year range and also found support last week in the region of the 200-day MA.

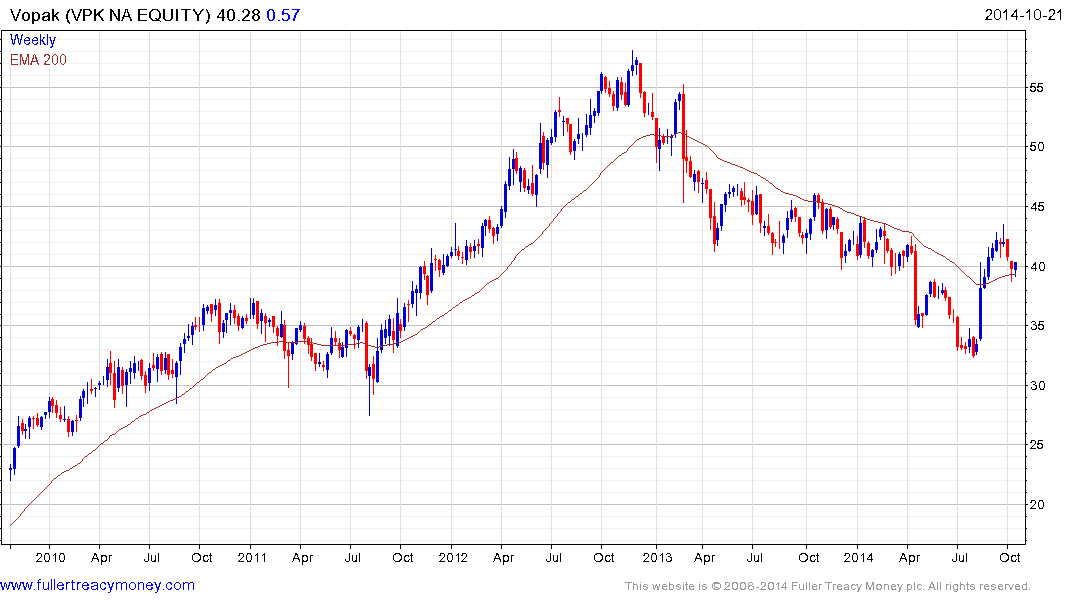

Netherlands listed Vopak (Rotterdam tanker terminals) rallied to break an 18-month progression of lower rally highs in September on expectations that Europe may need additional seaborne oil and gas shipments as a result of increasing geopolitical stress with Russia. The share found support this week in the region of the 200-day MA.

The Euro STOXX Index has 294 members but these represent some of its relative strength leaders. Assuming that the ECB’s monetary intervention continues into the medium-term, downward pressure on the Euro, low interest rates and abundant capital should all be of benefit to the above shares many of which have substantial export oriented businesses. The downward pressure that one can expect to see in the Euro may increase the attraction of currency hedged instruments from the perspective of foreign investors.

Back to top