Euro Rallies to Two-Week High as Greece Softens Stance on Debt

This article by Andrea Wong for Bloomberg may be of interest to subscribers. Here is a section:

The euro rose to the strongest level in almost two weeks as Greece’s government was said to retreat from a demand for a debt writedown, boosting optimism the region won’t face a renewed crisis.

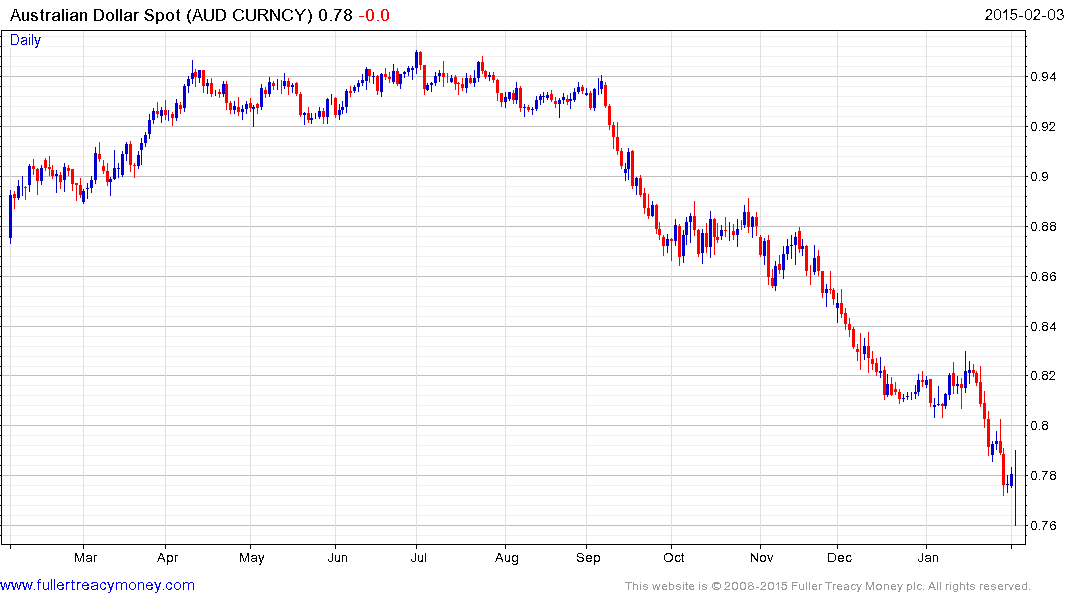

Australia’s dollar tumbled to the weakest level since May 2009 after the Reserve Bank of Australia joined a growing number of central banks that are boosting monetary stimulus to address slowing economic growth and inflation. Denmark’s central bank sold a record amount of kroner last month to protect its peg to the shared currency, while Russia’s ruble gained.

“The tone of the political comments from both the Greek and euro-area leaders has become a bit more agreeable and less confrontational,” Nick Bennenbroek, head of currency strategy at Wells Fargo & Co., said in a phone interview from New York. “Partly this is a market-driven, technically inspired move.”

The 19-nation euro gained 1.1 percent to $1.1470 at 12:05 p.m. New York time, after slumping last month to the weakest level since 2003. The currency added 1.1 percent to 134.58 yen.

The euro advanced versus most of its major peers after Greece’s Finance Minister Yanis Varoufakis outlined plans to swap some Greek debt owned by the European Central Bank and the European Financial Stability Facility for new securities, according to a person who attended the meeting and asked not to be identified because they weren’t authorized to speak publicly.

The rebound in oil prices following a steep decline has resulted in short sellers coming under pressure. One of the other big short traders has been to bet against the Euro over the last month as it sank 15¢ since late December. These are big markets and a large move in one may inspire traders in another to introduce stops. At least some short positions were closed and/or reversed in the Euro over the last two days suggesting at least a partial mean reversion rally is underway.

The Euro fell for six consecutive weeks before finding support near $1.11 last Monday and rallying on Tuesday. Today’s rally takes the bounce to the largest since March and represents a major inconsistency for the short-term portion of the decline. The trend mean represented by the 200-day MA is currently in the region of $1.25. While it is difficult to make a bullish case for the Euro in anticipation of the ECB increasing the supply of the currency by 50% over the course of the next 18 months; that purchase program will not begin until late March. In the meantime there is ample scope for an additional unwind of the short-term oversold condition.

The Australian Dollar has also fallen to a deep overextension relative to the 200-day MA and was only a couple of ticks away from posting an upside key day reversal this afternoon. Additional follow through tomorrow would confirm a low of at least near-term significance.

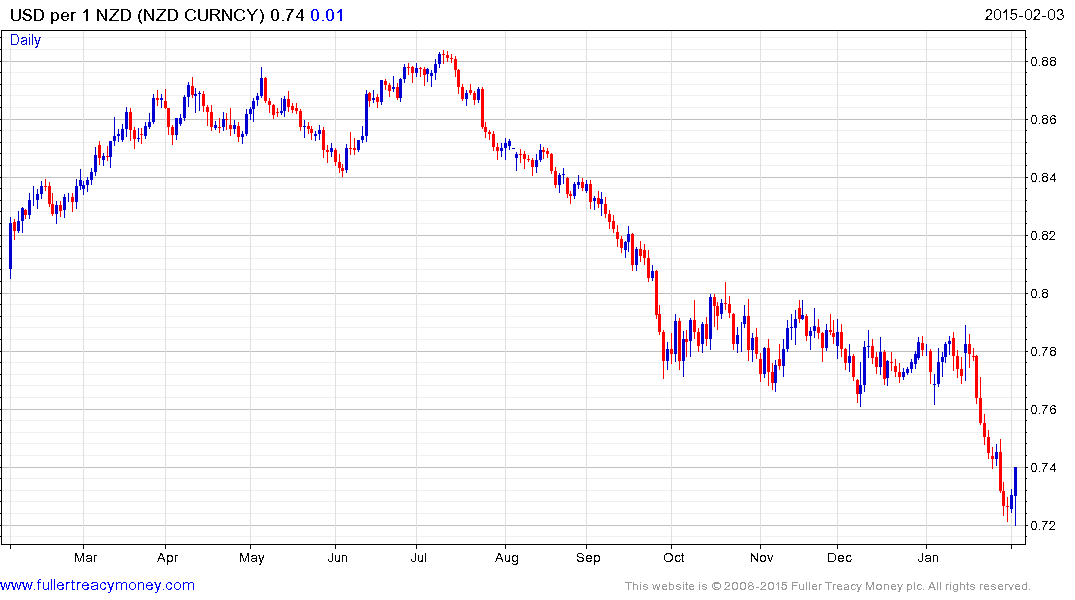

The New Zealand Dollar posted an emphatic upside key day reversal today against the US Dollar. This suggests a reversion back up towards the mean, currently near 80¢, is an increasingly likely possibility.

Back to top