Euro Drops After ECB Official Pledges to Speed Up Bond Purchases

This article by Rachel Evans for Bloomberg may be of interest to subscribers. Here is a section:

Improving economic data from the euro area has fueled speculation policy makers may curtail asset purchases before a September 2016 end date, lifting the euro from a 12-year low.

ECB President Mario Draghi attempted to quell such talk last week, saying the program would be implemented “in full.”

The euro fell versus 15 of 16 major peers as Coeure’s comments about injecting money more quickly into the euro-zone economy emerged early Tuesday in the text of a speech delivered in London the day before. ECB Governing Council member Christian Noyer said separately in Paris on Tuesday that the central bank is ready to extend QE if needed.

“The euro has looked pretty shaky after those comments, especially that they’re front-loading the effort of QE,” said Fabian Eliasson, head of U.S. corporate foreign-exchange sales at Mizuho Financial Group Inc. in New York. “The overall direction is fairly skewed toward the downside.”

Having embarked on an 18-month process of re-expanding its balance sheet, it would be cavalier of the ECB to think that it had achieved success in reigniting economic activity after only three months. There is little prospect of the ECB ceasing its purchase program as long as the size of the balance sheet is still below €3 trillion but they may alter the types of instruments they purchase.

The Euro rallied by 10¢ between its March/April low and last Friday; closing the majority of its oversold condition relative to the 200-day MA in the process. It is now pausing in the region of the round $1.15 and a sustained move above that level would be required to question current scope for a further test of underlying trading.

With the Euro pulling back, Eurozone equities which have also been in a process of mean reversion are now rallying. Germany’s DAX Index had pulled back by approximately 10% in the month to mid-May but has stabilised above 11,000 and a sustained move below its recent lows would be required to question current scope for additional higher to lateral ranging.

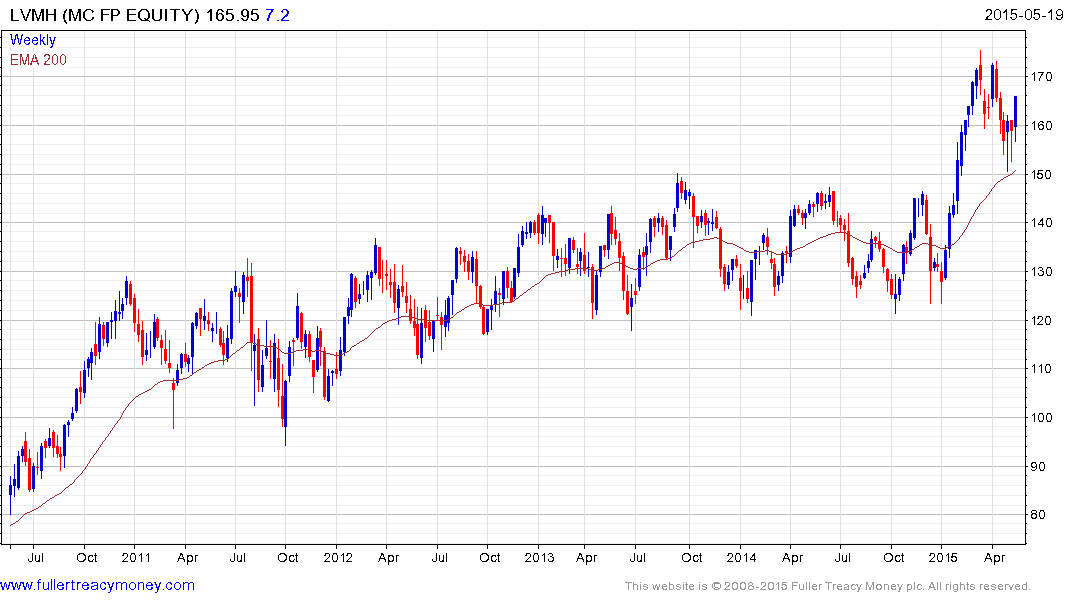

Major European exporters such as Volkswagen, Bayer and LVMH have all found at least near-term support in the region of their respective 200-day MAs.

Gold has not been immune to the Dollar’s rally and pulled back today from the region of the 200-day MA. It will need to sustain a move above $1225 to confirm a return to demand dominance beyond the short term.

Back to top