Euro Climbs as Draghi Cites Autumn Decision on Bond Purchases

This article by Stefania Spezzati for Bloomberg may be of interest to subscribers. Here is a section:

The common currency broke through $1.16 after Draghi said at a press conference that the euro’s recent re-pricing has received “some attention” without specifically saying he was concerned about its strength. Bonds rose, led by Italy, which has been a key beneficiary of the bank’s asset-buying.

“Draghi had a chance to talk the euro down and he didn’t,”Athanasios Vamvakidis, a strategist at Bank of America Merrill Lynch, said in emailed comments.

The euro advanced 1 percent to $1.1635 as of 4:00 p.m. in London, after reaching $1.1658, the highest since August 2015.The currency has advanced more than 10 percent this year, partly on speculation that a tapering of bond purchases is drawing closer.

The euro earlier declined as the Governing Council repeated that it expects borrowing costs to stay at present levels for an extended period of time and that it is prepared to increase the size or duration of the asset-purchase program should the economy take a turn for the worse.

Spanish and Italian bonds outperformed, with yields falling around seven basis points, as they won a summer respite from any ECB discussion on curbing bond-buying. The ECB has favored buying Italian securities in recent months as it combats a shortage in the euro region’s sovereign debt.

“Draghi seemed to try and downplay the anticipation for September and suggested they may try to drag this decision out,”Richard Kelly, Toronto-Dominion’s head of global strategy in London, said in emailed comments. “He also made pretty clear that there is little appetite for any significant tapering at this stage.”

Mario Draghi may have attempted to leave his options open but the market is increasingly of the opinion the ECB is closer to tapering than it might like to admit. That has contributed to the Euro’s strength over the last month.

€1.15 has represented the upper side of the Euro’s two-year range against the Dollar for more than two years. Today it hit the highest closing level since January 2015 and while short-term overbought, a clear downward dynamic would be required to check the advance.

The Euro STOXX 50 Index was unable to hold its intraday rally and continues to range in what appears to be a consolidation in the region of the trend mean.

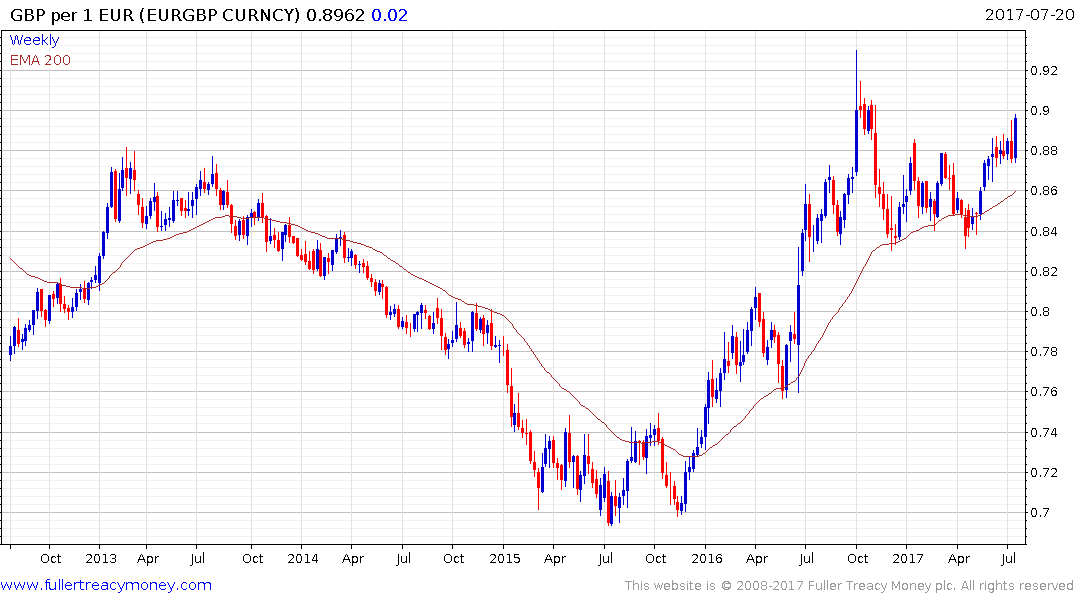

Meanwhile the Pound has been very choppy against the Euro with last week’s three consecutive days of strength completely countermanded this week.

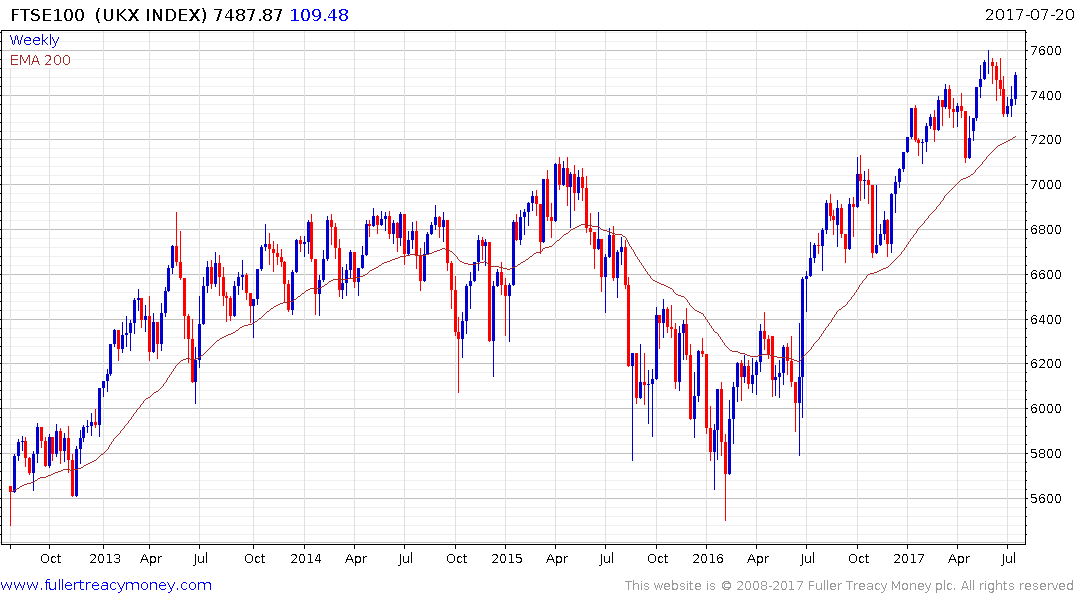

The FTSE-100 continues to hold a progression of higher reaction lows and bounced over the last couple of weeks from the region of the trend mean.