Euro-Area Yields Drop to Records as Dutch Borrow at All-Time Low

This article by Lucy Meakin and David Goodman for Bloomberg may be of interest to subscribers. Here is a section:

Government bonds across the euro region rose, sending yields from Austria to Spain to all-time lows, on speculation the European Central Bank will expand its asset-purchase program to include sovereign bonds.

Germany’s securities climbed as a report showed investment in the nation fell last quarter, putting the strength of Europe’s largest economy at risk. ECB Executive Board member Benoit Coeure said yesterday the central bank won’t make a hasty decision to add more stimulus and will hinge any measures on economic data. The ECB’s policies already include purchasing covered bonds and asset-backed securities. The Netherlands sold 10-year debt at a record-low auction yield today.

Bundesbank officials have been vocal public opponents of the ECB’s easing proposals since the onset of the sovereign debt crisis not least because of Germany’s relative economic strength. As a result it is particularly noteworthy that the recent announcement of additional easing measures was passed unanimously. German investment is slowing and the country needs some help from a loose monetary policy and weaker currency.

Jens Weidmann is unlikely to hold a press conference and announce his wholehearted support for increasing the money supply by 50% or for asset purchases. However by acquiescing to the need for additional support for the region’s economy the Bundesbank has little choice but to hold its nose and participate.

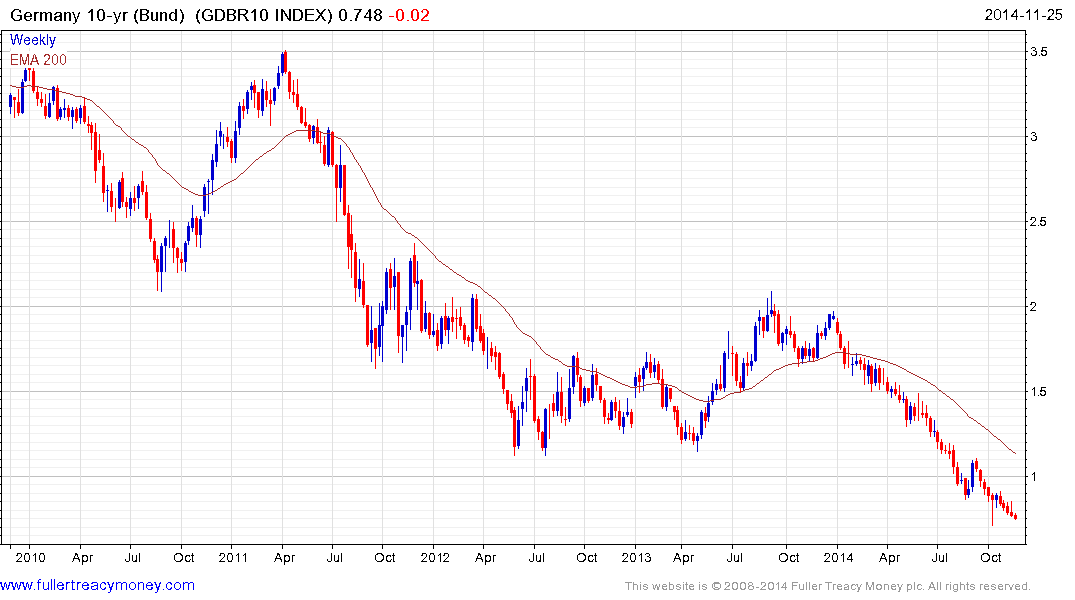

German 10-year Bund yields continue to trend consistently lower and a break in the progression of lower rally highs evident since Q32013 would be required to question potential for continued compression.

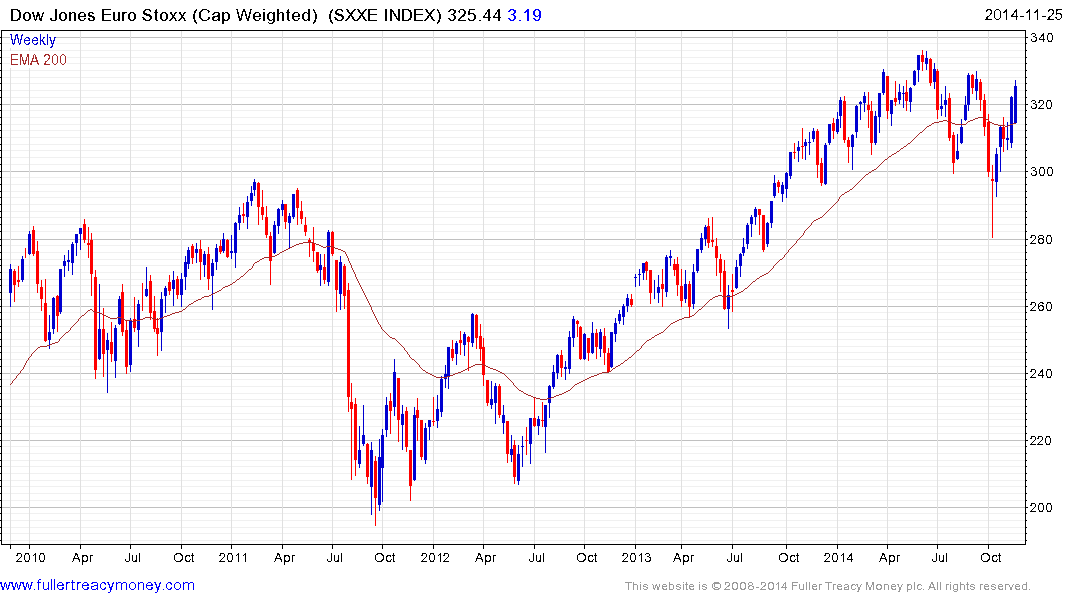

The Euro Stoxx Index has rebounded from the October low and is now testing the region of the September high. It will need to sustain a move above 330 to demonstrate a return to demand dominance beyond the short term and the most likely scenario right now is for some consolidation of recent gains.

.png)

When rebased to US Dollar’s the performance of the Index illustrates just how weak the Euro has been over the same period. With agreement on ECB easing, currency market volatility is likely to remain a concern for foreign investors in the Eurozone.

Back to top