Euro Area Warned That Shock-Proof Markets Won't Be Forever

This article by Alessandro Speciale for Bloomberg may be of interest to subscribers. Here is a section:

For a start, Britain’s Brexit vote prompted a quick response from the nation’s central bank, which cut the key interest rate, revived asset purchases and pledged to act again if needed.

“In the U.K., the Bank of England responded strongly to the outcome of the referendum, averting a tightening in financial conditions.”In the U.S., the financial shock stemming from Trump’s election came amid an economic upturn that cushioned the blow, and the expectation that however uncertain his policies might be, they would probably be good for companies.

“The rally in U.S. risky asset prices reflected the strong situation of the U.S. business cycle, reinforced by expectations about business and financial sector-friendly policies from the new administration.”

The study follows other theories over why volatility is so low, and concludes with a look at what this might mean for the euro area, should an avowed opponent of the single currency gain power, or should the debt crisis in a member country heat up again.

“The main lesson to be learned from a euro-area financial stability perspective is that similarly large economic-policy uncertainty shocks could, in the absence of offsetting shocks, seriously tighten domestic financial conditions and raise risk premia.”

So far this year, the currency bloc has managed to avoid anti-euro politicians coming to power in the Netherlands and France. If anything though, the region’s history has shown that the next crisis is always just around the corner. The next focal point could come as early as Monday, when euro-area finance ministers meet in Brussels to try yet again to break an impasse on lightening Greece’s debt burden.

“Monetary policy beats most other factors most of the time” is an adage David developed decades ago and it is no less true today. Negotiations about how to grant Greece’s next tranche of bailout funds without losing face, the Dutch election, French Election (presidential and parliamentary), the German election and Brexit negotiations all represent considerable sources of political and market uncertainty for the Eurozone.

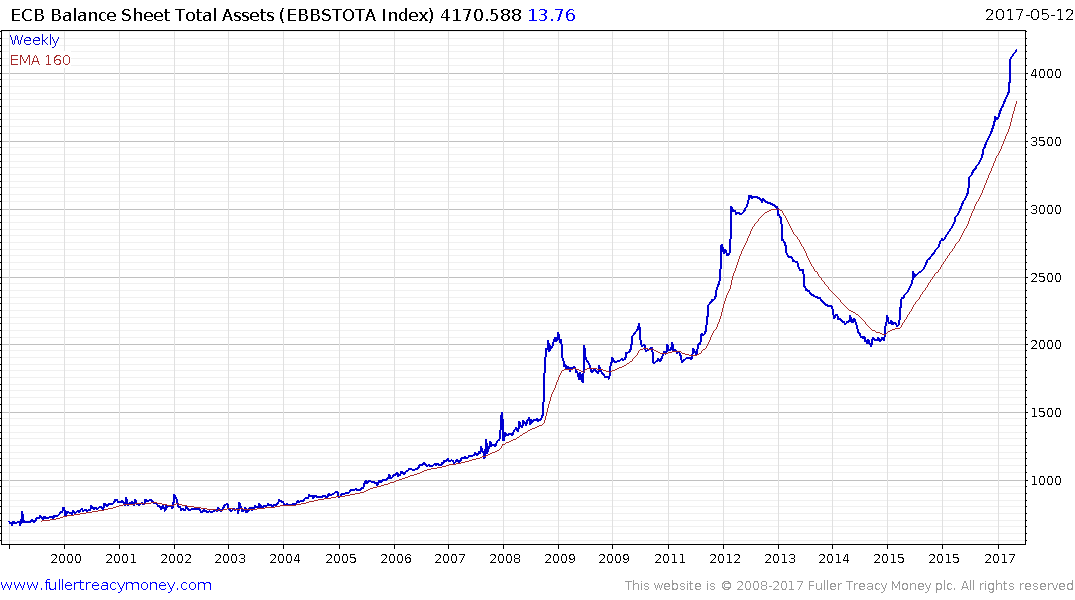

Against the background the ECB has been buying bonds at an accelerating rate with the result its balance sheet now totals €4.17 trillion. To put that figure in context, it is larger than the Federal Reserve’s balance sheet which is backed by a Federal taxation system. If we have learned anything from massive central bank intervention it is that the primary result is asset price inflation.

The Euro STOXX 50 Index has posted three significant peaks in the last 17 years with the most recent lower high in 2015. The Index has rallied impressively since December to close in on the 3800 level but a short-term overbought condition is evident at present suggesting the risk of some consolidation of recent powerful gains is looking increasingly likely. However provided the ECB is still buying bonds with such enthusiasm, any pullback should be limited to mean reversion.

Back to top