Euro-Area Inflation Picks Up to Fastest in More Than a Year

This article by Catherine Bosley for Bloomberg may be of interest to subscribers. Here is a section:

Euro-area inflation hit the fastest pace in more than year, some good news for European Central Bank officials debating the future policy path just as turmoil in Italy revives memories of the debt crisis.

The 1.9 percent rate, effectively in line with the ECB’s goal, was up from just 1.2 percent in April and above the 1.6 percent reading forecast by economists. The core measure rose to 1.1 percent, also better than anticipated.

Stronger-than-anticipated figures in Germany and Spain on Wednesday hinted at an upside surprise, with the rate in the former reaching a 15-month high. The euro stayed higher after the euro-zone data, and was up 0.1 percent to $1.1681 as of 12:24 p.m. Frankfurt time.

While higher oil prices played a part, the inflation pickup is welcome news for the ECB, which holds its next policy meeting in exactly two weeks’ time.

The ECB is very unlikely to raise rates before it has ended its QE program. The uptick for inflation, particularly in Germany, is going to influence the decision whether to in fact cease purchases in September while the uncertainty in Italy is also going to be a competing factor.

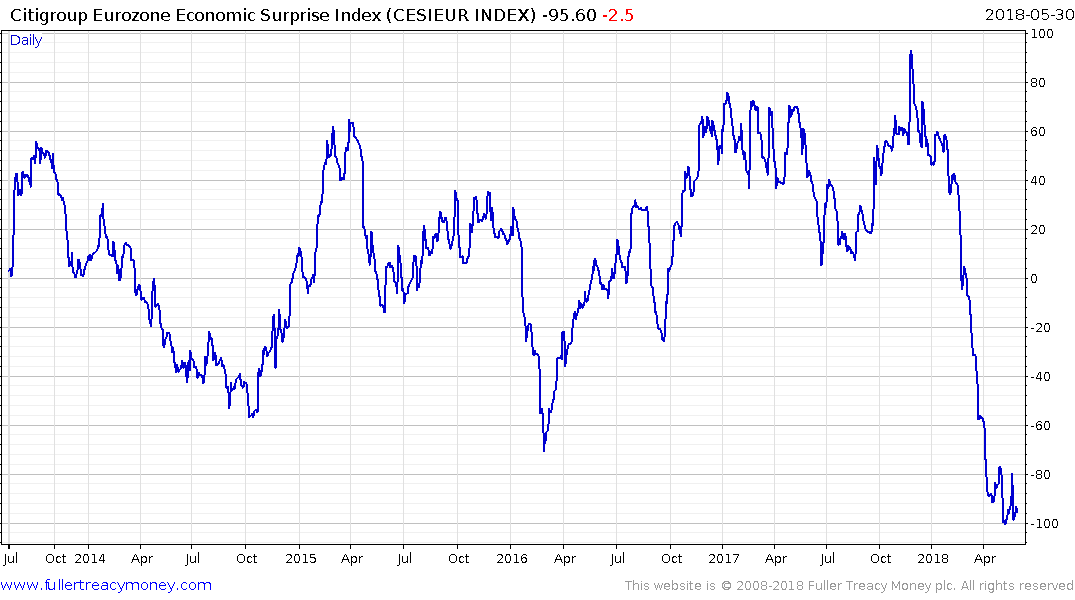

European economic activity has not been coming in at levels that met the bullish expectations set by economists at the beginning of the year and inflationary pressures rising will mean that economies are going to need to grow faster if the real rate of expansion is going to be sustained. That is likely going to be the deciding factor for the ECB in how it tilts policy.

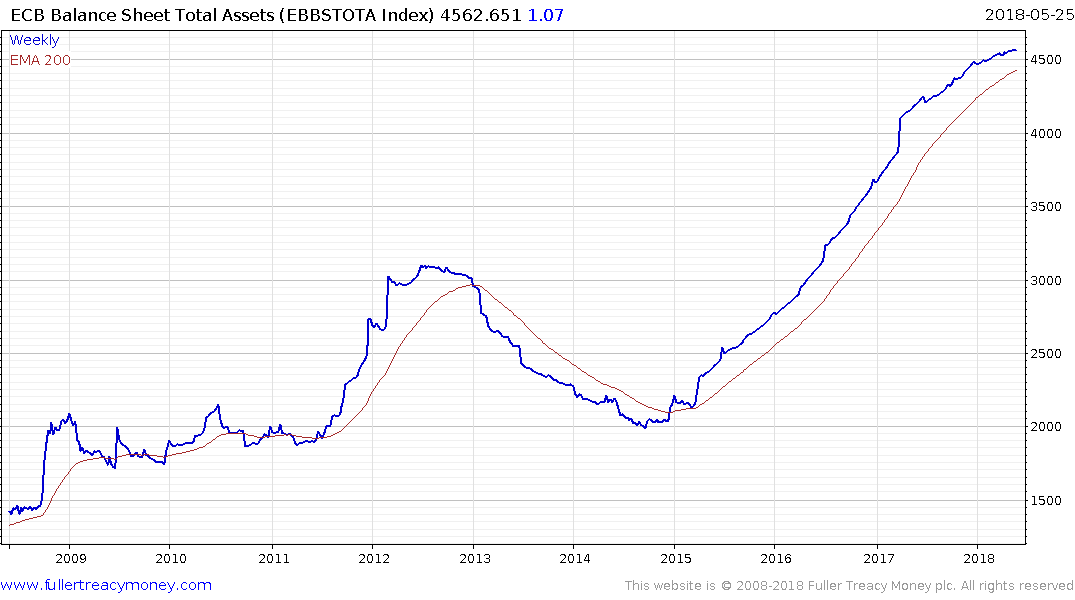

It will also have a visceral institutional memory of the deflationary pressures caused by removing the original QE program between 2013 and early 2015. That suggests there is very little prospect of the size of its balance sheet being reduced any time soon.

The Euro has posted a steep decline over the last couple of weeks and is now steadying from the region of $1.15. The short-term progression of lower rally highs is being tested but a sustained move above the trend mean will be required to question the supply dominated environment.