EU gets tougher with sanctions on Russia - but there is a twist

This article by Suzanne Lynch for the Irish Times may be of interest to subscribers. Here is a section:

EU gets tougher with sanctions on Russia - but there is a twist – This article by Suzanne Lynch for the Irish Times may be of interest to subscribers. Here is a section:

All three sectors affected by the sanctions are protected in some way. The restrictions on energy, such as the banning of the sale of equipment that can be used in the energy industry, do not apply to gas, Russia’s main export into Europe.

The arms embargo prohibiting the sale of weapons to Russia only applies to future sales, allowing France to proceed with the sale of two warships to Russia.

The fact that Russia produces most of its own military equipment and arms also means that its arms industry is unlikely to be severely affected by the sanctions. Similarly, the move to prohibit Russian banks from issuing debt and stock on EU capital markets contains potential loopholes.

One possibility is that Russian banks’ EU subsidiaries may be able to circumvent the rules and channel funds back to their parent company.

This was rejected by EU officials yesterday who said that, because the EU subsidiaries do not regularly engage in these kinds of bond issuances, any move to raise debt for the parent company would be easy to monitor.

However, with subsidiaries still permitted to transfer other funds to their parent companies, and Russian banks dependent on EU and US debt for less than 10 per cent of their funding, the impact of the restrictions on Russian state-owned banks is likely to be limited.

The country’s largest bank Sberbank, is not included in the US sanctions, though it is understood to be included in the EU’s list, which will be published later this week.

Europe is getting tougher with Russia but the above article highlights how intertwined the Eurozone’s economic interests are with its Eastern neighbour. The severity of sanctions has increased but important business interests continue to be preserved, not least for energy companies seeking to exploit shale gas resources.

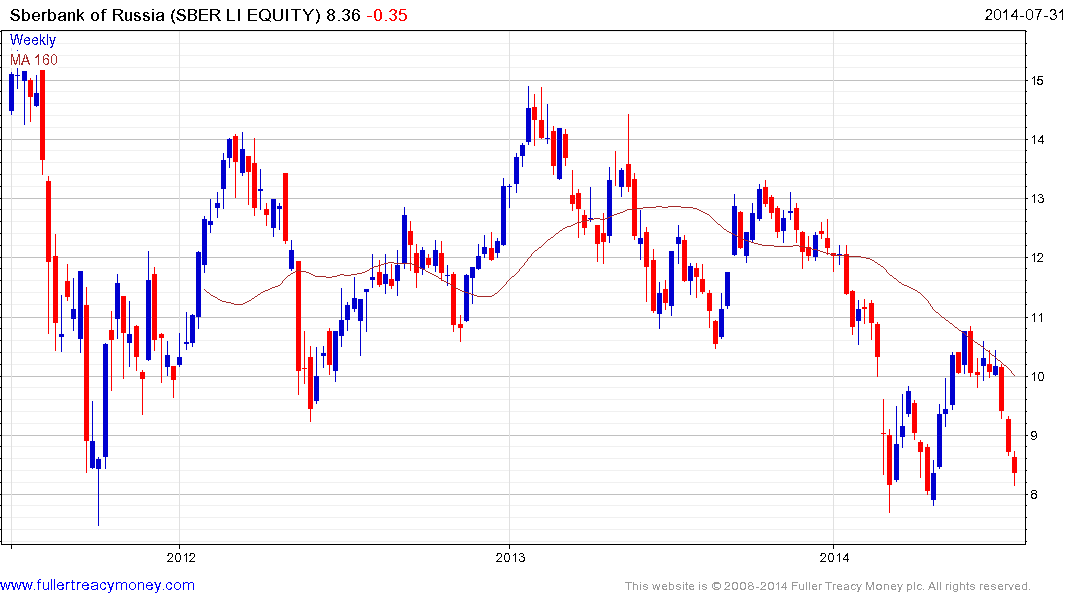

Nevertheless, the trend of these sanctions is clear and there is no evidence yet that tensions in the region are about to ease. Sberbank is an important barometer for the Russian market.

The London listed, US Dollar denominated, share encountered resistance in the region of the 200-day MA from June and has returned to test the lows near $8. A sustained move back above the MA will be required to question medium-term supply dominance.