EU Banks May Need Rescue Funds Equaling Twice ECB Capital

This article by Boris Groendahl for Bloomberg may be of interest to subscribers. Here is a section:

The Brussels-based SRB, the resolution authority for 142 banks including Deutsche Bank AG and BNP Paribas SA, will use the minimum capital requirement set by the European Central Bank as a proxy for capital that would be needed to absorb losses in a crisis, Koenig said in an interview this month. The ECB last year set an average requirement for the highest-quality capital of 9.9 percent of risk-weighted assets.

Requiring banks to have at least that same amount again in loss-absorbing liabilities will ensure that they can recapitalize themselves quickly after restructuring, Koenig said. This minimum requirement of own funds and eligible liabilities, or MREL, is calculated at the “30,000-foot level,” and more precise levels tailored to each bank will follow after the ECB sets new capital requirements and changes are made to capital, bank-failure and insolvency rules, she said.

“We want to avoid confusing the markets by saying, this is our decision this year, knowing that it will be different next year,” Koenig said. “So we take an indicative step this year. For next year, we hope that some of the dust has settled.

When reading about the increasingly high obstacle of regulation, higher and higher capital requirements for banks and stricter requirements for what constitutes Tier 1 capital I am put in mind of the adage that “generals are always fighting the last war.” These are policies that would have been appropriate before the crisis in order to mitigate risks. They represent a barrier to lending activity today that deters banks from acting as liquidity providers, regardless of where short-term interest rates are set.

That is the paradox central banks are attempting to deal with because the political backlash against loose regulation following the credit and sovereign debt crises was so intense that governments cannot be seen to give any advantage to the financial sector regardless of how badly it is needed.

These are medium-term considerations that act as a barrier to recovery but also suggest the ECB is not about to remove stimulus anytime soon and may even have to intensify its efforts.

Yesterday’s indication by the Fed that interest rates increases will be few and far between is good news overall for the stock market since the liquidity on which leverage and margin depend is not about to be withdrawn in an abrupt manner.

.png)

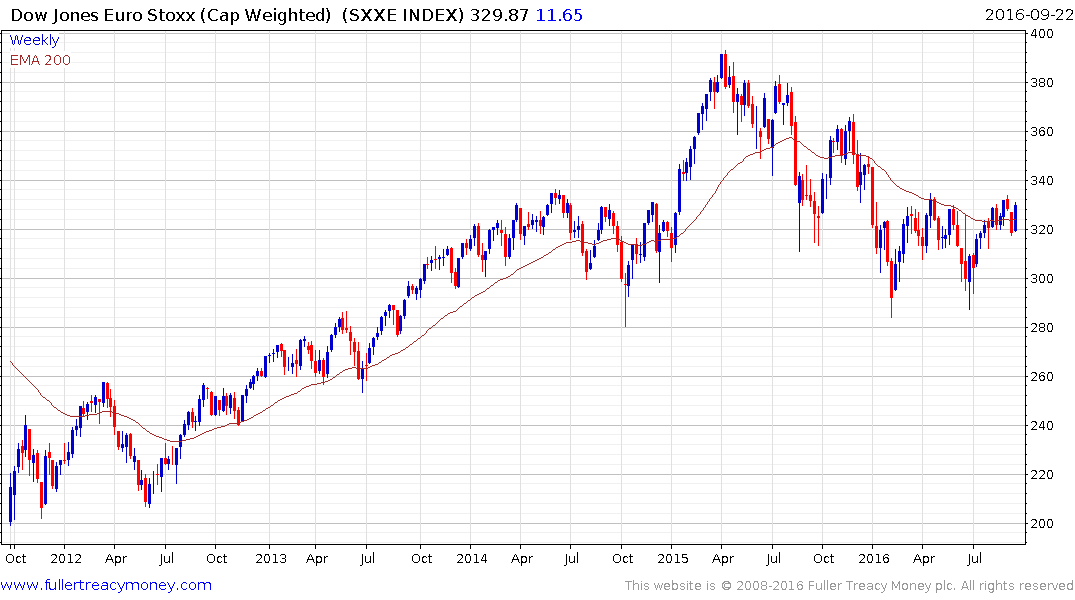

The Dow Jones Euro STOXX Banks Index firmed today but will need to sustain a move above the trend mean to signal a return to demand dominance beyond short-term steadying.

.png)

The ratio of DJ Euro STOXX Banks Index / DJ Euro STOXX Index still has work to do before we can conclude banks have returned to medium-term outperformance.

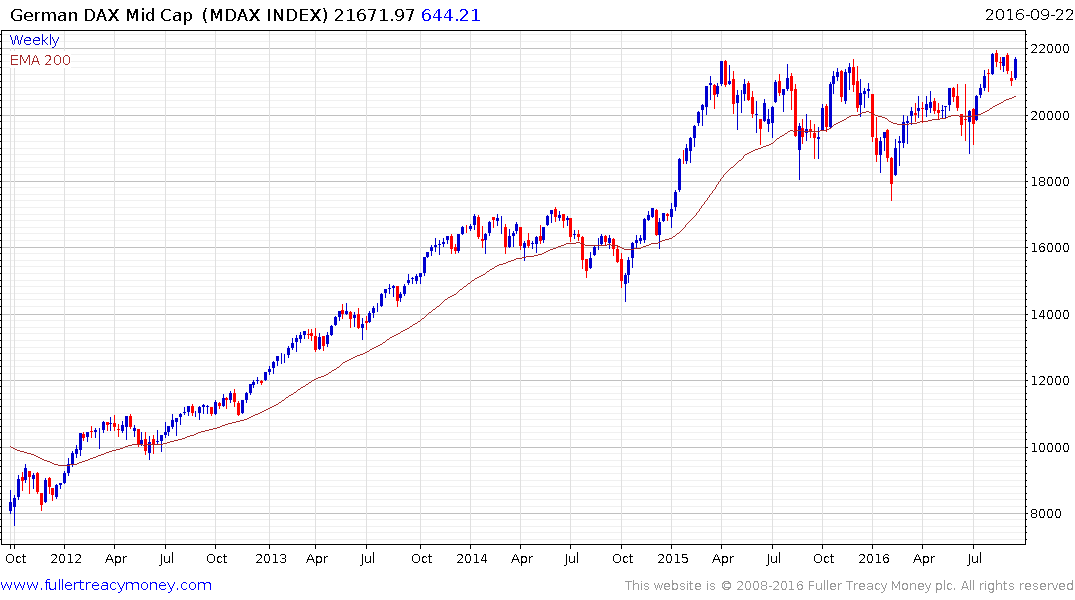

Importantly, the German DAX Index, broke a medium-term progression of lower rally highs in August and firmed this week from the region of the trend mean to confirm demand dominance. A sustained move below the psychological 10,000 would be required to question recovery potential.

The MDAX Index of Midcaps is leading and is now testing the upper side of an 18-month range.

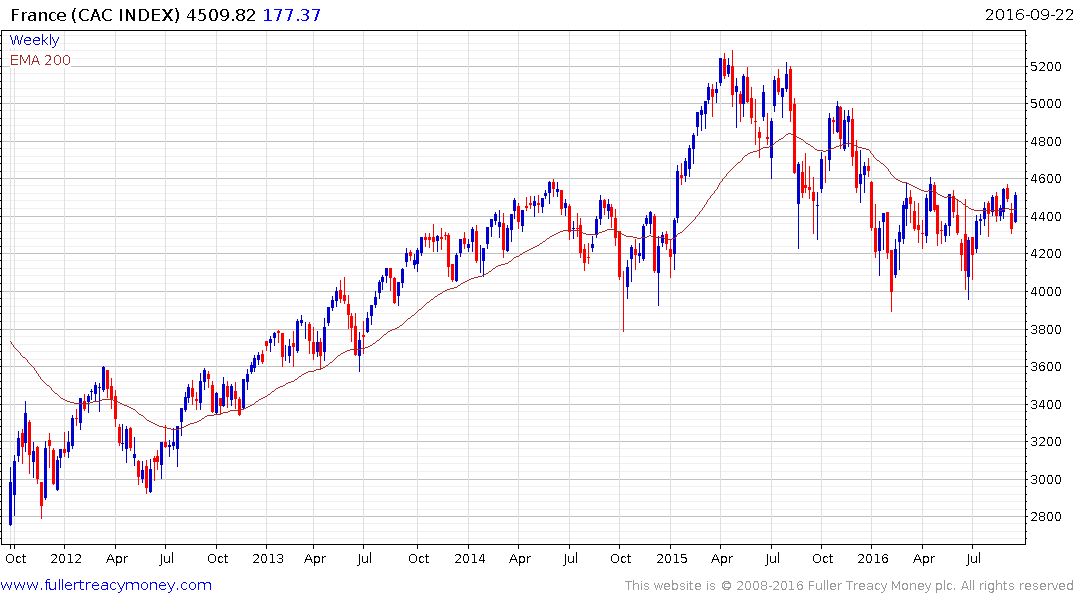

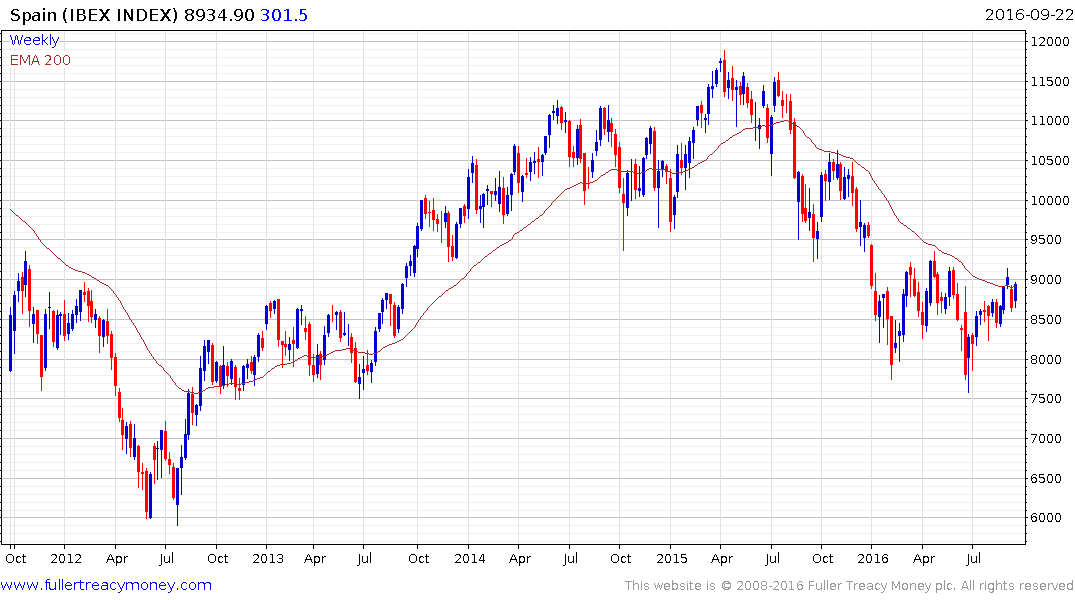

Both the French CAC and Spanish IBEX are testing the upper side of their respective ranges and the region of their trend means. Sustained moves above them would signal returns to demand dominance beyond the short term.