Espirito Slumps as Rioforte Said to Seek Creditor Protection

This article by John Glover, Joao Lima and Anabela Reis for Bloomberg may be of interest to subscribers. Here is a section:

Rioforte Investments SA, a holding company for Portugal’s Banco Espirito Santo SA, plans to file for protection from creditors, according to a person familiar with the matter.

Rioforte, which was due to repay 847 million euros ($1.2 billion) owed to Portugal Telecom SGPS SA today, will seek shelter in the Luxembourg courts, said the person, who asked not to be identified because the plan is private. The bank’s shares earlier slumped as much as 20 percent while its 7.125 percent notes were down 11.4 percent.

Investors are concerned that financial problems within the Espirito Santo group will spill into the bank and bondholders may be made to take losses in a rescue. Rioforte holds a 49 percent stake in Luxembourg-based Espirito Santo Financial Group SA, which in turn owns 20 percent of Banco Espirito Santo.

“People are panicking, they’re concerned that potential losses are more significant than we’ve seen so far,” said Ariel Bezalel, who manages the $3.8 billion Jupiter Strategic Bond Fund. “You can quite easily see a situation where the subordinated bonds get impaired but that’s the risk you’re getting paid to take.”

Bezalel said he has “a very small position” in the lender’s subordinated notes and likes its short-dated senior debt.

Investors are understandably worried that the Banco Espirito Santo situation will descend into a replay of the Cyprus bail-in where bond investors were forced to bear the cost of the bailout and shareholders were wiped out.

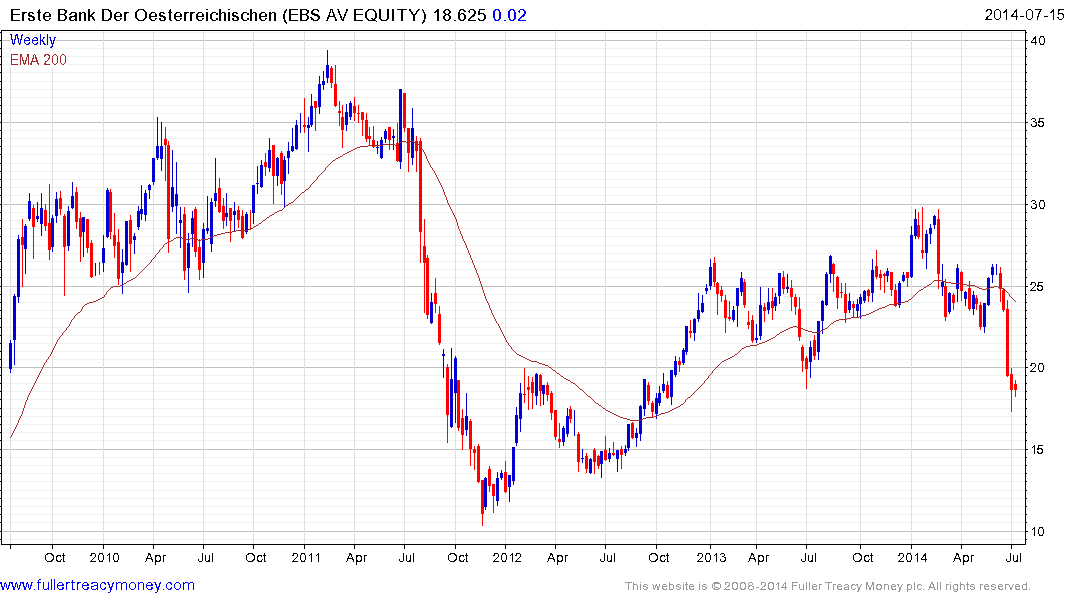

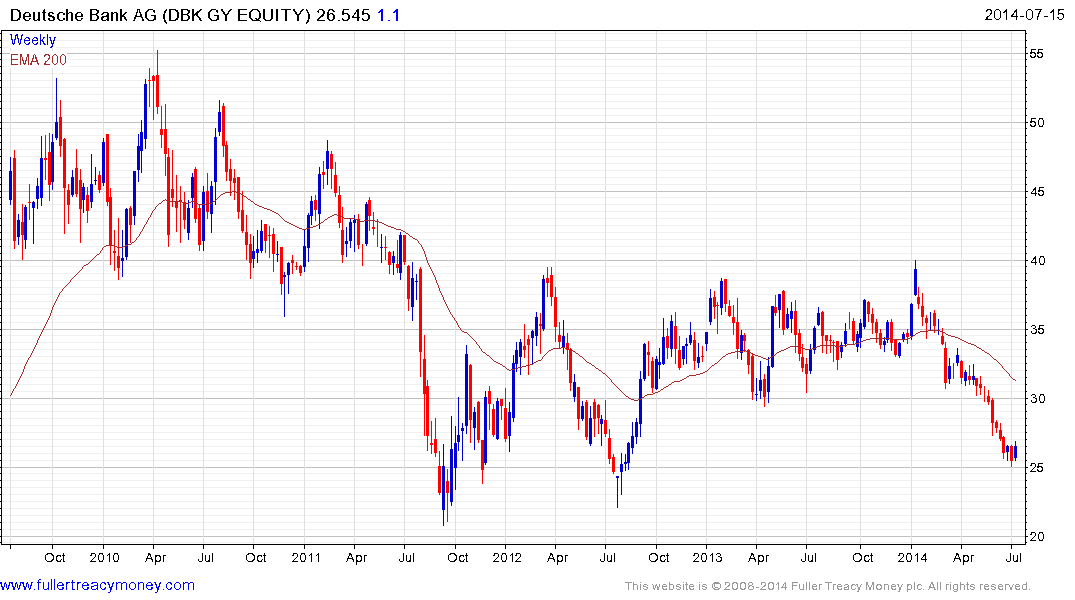

Against the background of accelerating downtrends in Banco Espirito Santo, Banco Comercial Portugues, Austria listed Erste Bank and the significant decline in Deutsche Bank’s shares over the last couple of months one might be tempted to conclude that the Eurozone’s banking sector has not improved since the depths of its crisis in 2011.

However, the Euro STOXX Banks Index tells a different story. The deterioration of the above shares has definitely weighed on the Index but it is still almost double the level it traded at in 2012. If the medium-term uptrend is to continue to be given the benefit of the doubt it will need to continue to hold the 140 area.

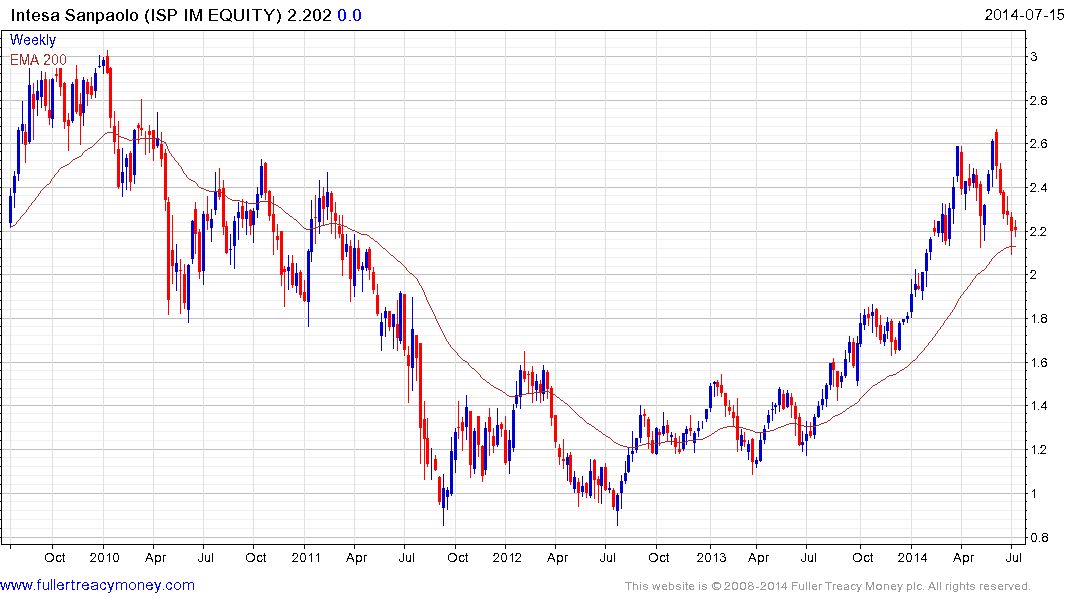

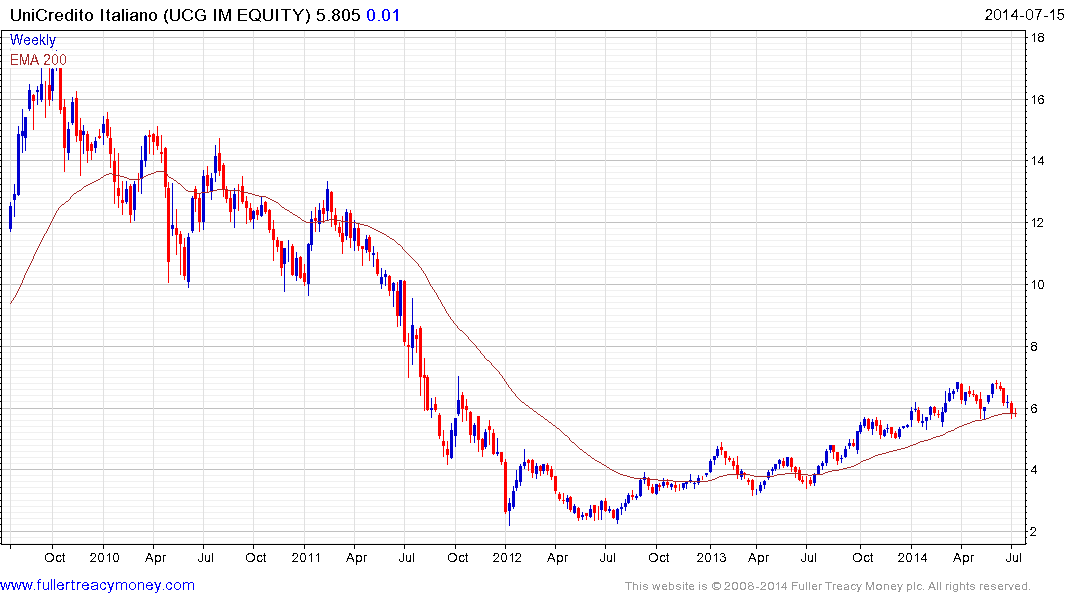

Following a click-through of the sector, the fact that major constituents such as Banca Intesa Sanpaolo, Natixis, BBVA, Credit Agricole, Unicredito Italiano and Unione di Banche Italiane are all now trading in the region of their respective 200-day MAs following reversions to the mean is noteworthy. Banco Santander Central Hispano continues to pull back to the mean.

The deteriorating situation for a small number of banks has already had a contagious effect on the Eurozone’s banking sector but it is not appropriate at this stage to tar them all with the same brush. Each should be evaluated on its individual merits and provided the above shares continue to hold in the region of their MAs, their medium-term uptrends can continue to be given the benefit of the doubt.

Additionally this situation is worth monitoring because in the event that a worst case scenario does not evolve, accelerating downtrends can be quickly reversed with sharp short covering rallies.

Back to top