Ermotti Rues EU's Future While Diamond Sees Benefits of Brexit

This article by Francine Lacqua and Christian Baumgaertel for Bloomberg may be of interest to subscribers. Here is a section:

Bob Diamond says Brexit is bringing the Continent together, or at least benefiting its banks. That prompted Sergio Ermotti, days after Germans gave Angela Merkel a weaker mandate, to say the European Union is broken.

Ermotti, head of Switzerland’s UBS Group AG, warned Europe is doomed to fall behind the U.S. and Asia unless the EU breaches the “taboo” of closer federalism. He struck a gloomy note in response to Diamond, the ex-Barclays Plc boss turned optimistic investor in Greek and Italian banking, who called Brexit a “net positive” for European bank reform moments earlier.

What I found most interesting today about Macron’s speech on EU reform was he made special mention of his belief mutualisation of debt across the EU was unnecessary; not to mention untenable considering the current political environment in Germany.

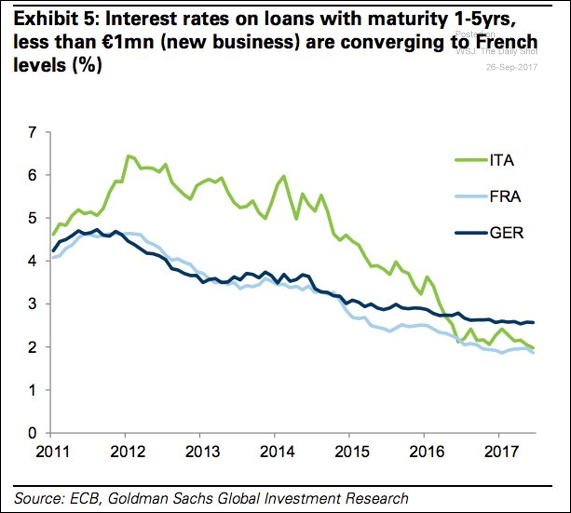

That means the onus of responsibility for ensuring the health of the region’s banks will continue to fall on the ECB which has already stated it will provide as much liquidity as possible. Meanwhile the rate on loans is converging which is a sign that the liquidity the ECB is providing is reaching at least some of its intended targets.

The Euro Stoxx Banks Index remains within an almost decade long volatile base formation but has held a progression of higher reaction lows since the middle of last year. A sustained move below the trend mean would be required to question medium-term scope for additional higher to lateral ranging.

Bob Diamonds’ Atlas Mara, which is a pureplay on African banking found support near $2 at the beginning of the year and is now trading above its trend mean suggesting a return to demand dominance following a steep decline following its IPO.