Emerging Markets Face SATT Problem to Rival Nasdaq's FAANG Woes

This article by Eric Lam for Bloomberg may be of interest to subscribers. Here is a section:

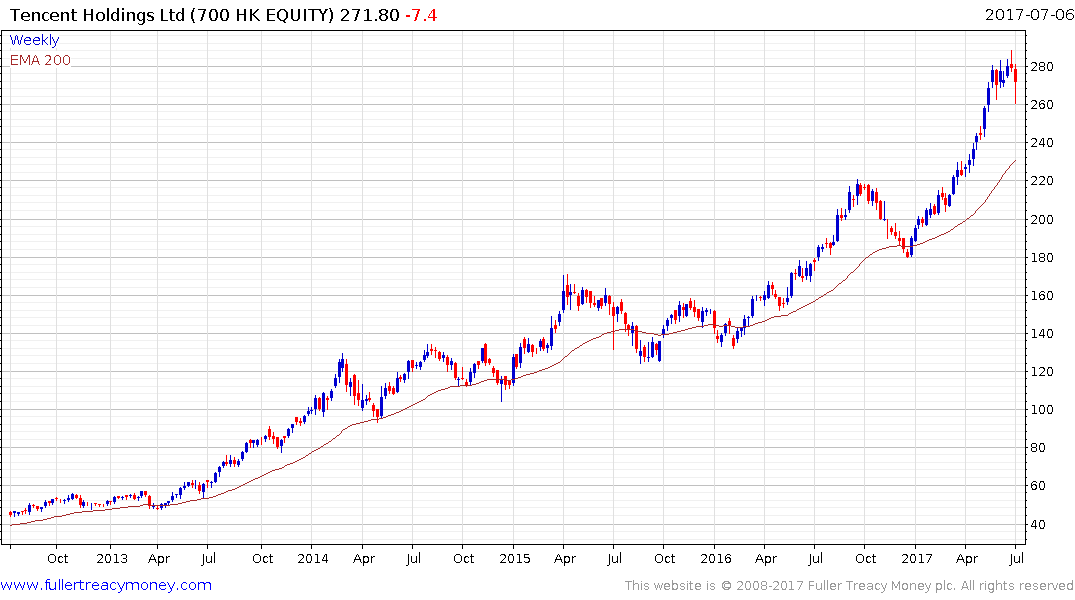

The Asian group is becoming more expensive, especially on a price-to-book-value basis, with a 77 percent premium to the wider index -- a 15-year high, Dennis said. That’s double the long-term average premium of 38 percent, he said.

Pictet Asset Management Ltd.’s Luca Paolini is also worried that a correction is coming after the MSCI Emerging Markets index’s surge. The gauge beat both the Nasdaq 100 and the MSCI All-World Index in the first half.

“If global equities do indeed witness a correction in the coming weeks, there are grounds to expect that emerging-market stocks’ outperformance will come to an end,” Paolini, London-based chief strategist with Pictet, wrote in a report.

Paolini downgraded Pictet’s view on technology stocks to single positive from double, as earnings momentum appeared to peak in May. He also suggested reducing holdings of emerging-market equities given the outsize technology exposure of the region relative to developed markets.

With some of the heat coming out of high momentum trades, that have driven performance this year, the potential for traders to look for additional sources of mean reversion trades has increased. There Is no denying that a number of Asian technology shares have been more than keeping pace with their US counterparts so they are at equal risk of mean reversion.

![]()

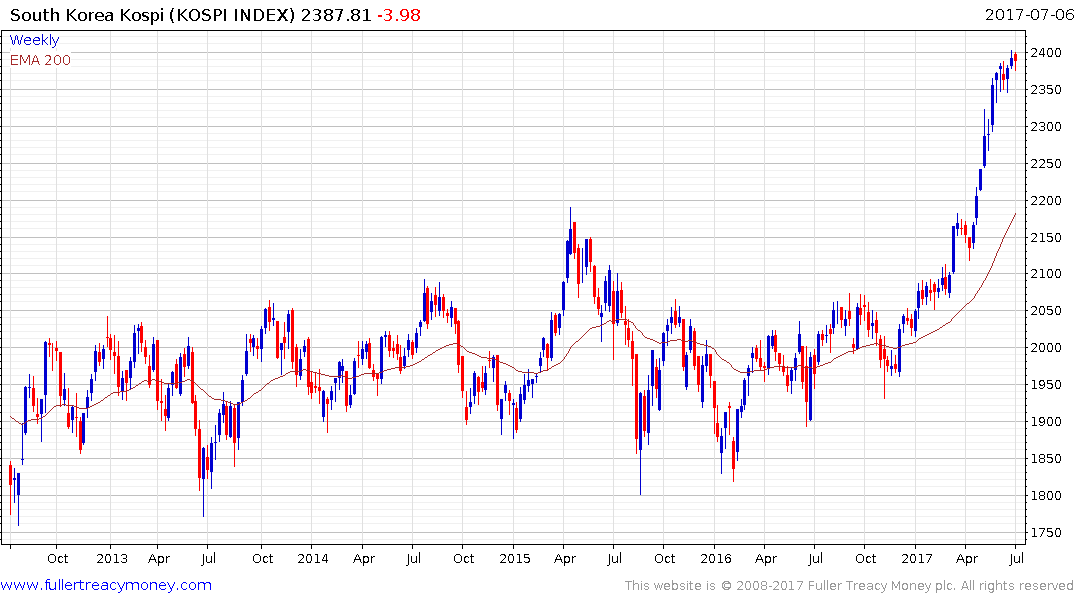

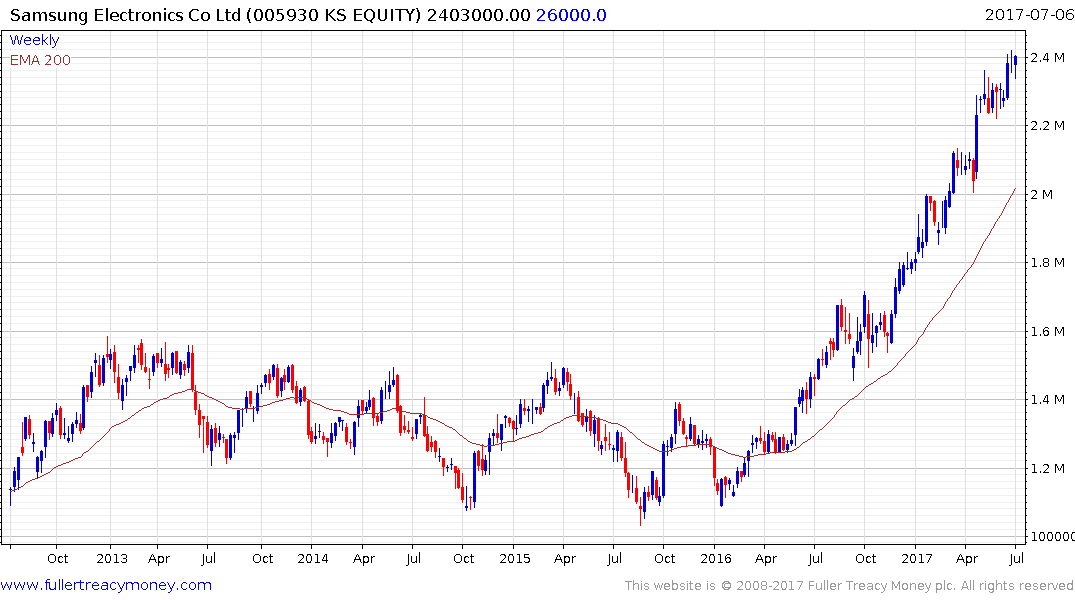

Samsung Electronics and Taiwan Semiconductor represent significant weightings in their respective domestic markets and have contributed to recent impressive breakouts. That suggests if they enter corrective phases they could represent lead indicators for the South Korean and Taiwanese indices to experience some consolidation of recent powerful gains.