Email of the on my ignorance from a bitcoin Holdr

I suggest though that you ignore Eoin Treacy on matters relating to Bitcoin and Cryptocurrency as he clearly has no idea what he is talking about. This became obvious to me the more of his videos that you have sent to me.

He talks about Bitcoin as if it a stock or currency and clearly doesn't understand the real value proposition here and why it actually has value. This is very obvious when he says things like you can hold gold in your hand but you can't hold Bitcoin.. This is completely ignorant of what Bitcoin is and how it works, yes it is digital but because of the encryption and the way the system works with mining/proof of work, each Bitcoin is a unique piece of information so when you have a key to a wallet it's just like you have the key to something physical. No one has access to it except you and it cannot be copied or duplicated or stolen or anything in any way, Eoin seems to misunderstand this, he is also forgetting that most gold in the world is not held in your hand it's stored in a vault somewhere subject to seizure or it's a digital representation of gold not the actual underlying that you can hold.

He then continues this faulty thinking and misunderstanding by concluding with completely ludicrous fear mongering ideas like what if the power grid goes down it will destroy a lot of Bitcoins. No, it won't you ignorant buffoon, first there is no way to "destroy Bitcoins" they are stored in the Blockchain and never leave it, that is all they do and were meant to do, store value and move around. You could lose access to your coins by losing the keys but technically the coins are still there sitting securely in your wallet it would be entirely your fault for losing your keys. In the situation of the power going down the Bitcoin network would continue running in other countries and then it would catch up when the power comes back on, nothing would be lost except the mining revenue of the miners who had no power.

If there was a worldwide situation like what he mentions an EMP or a Solar flare then we would have much bigger problems then Bitcoin going down. It would take down all communications all banking services all vehicles all important infrastructure like water cleaning and pumping etc, anything electronic which in the modern world is practically everything, it would be chaos. But yea it would get Bitcoin! so don't risk any money on it! It actually wouldn't as if everyone lost power at the same time all miners would go offline and then as power was slowly restored worldwide miners would rush to go back mining since the network would have ground to a halt, there would be easy money to be made mining without competition for as long as you can. The network would be back online and functioning properly in a matter of hours after the internet is back on and if someone like a bank or government tried to deliberately mess with the blockchain while most miners etc are offline then when the rest of the world comes back online, we would immediately backdate to the last known block before the power down and discount the manipulation that occurred while everyone was offline.

Eoin’s technical analysis style is odd as well as I said before he seems to think Bitcoin is a stock or trades like a stock, his technical analysis is basically, look at this moving average we may go down and hit it or we may not. It is useless and cannot predict what is going to happen to prices. In fact, I believe nearly all standard indicators are useless as they are all lagging behind price, the only way to get an edge in technical analysis in my opinion is to use PA, price action methods.

He's also forgetting (or doesn't know) the fact that Bitcoin is even harder money than gold because of the mathematical hard cap on total amount of coins and that it's also a naturally deflationary asset as coins get lost or go out of circulation over time. Gold is still inflationary as more is mined every day and we have no idea how much actually exists on earth or on asteroids etc. Taking this in mind we shouldn't be surprised to see Bitcoin going higher and higher every cycle, how could it not? especially considering the current macro environment of unlimited QE and worldwide uncertainty.

Anyway, there's my rant for this week,

I was not smart enough to buy bitcoin when I first heard about it in 2013. There is no getting around that fact. Even if I did buy at $100, I am too much of a sceptic to have held all this time; particularly during the 90% drawdowns. Anyone who has held through these traumas is unlikely to ever sell. That’s why supply is so concentrated in the hands of a very small number of players despite the international hoopla about bitcoin.

I would point out though that I have traded cryptocurrencies successfully over the years. In fact, I’ve never lost money trading crypto, which is a testament to just how big the bull market is. However, just because it is a big bull does not mean it has been divorced from crowd psychology. In fact, that means it is more tightly intertwined with the emotions and actions of the crowd. Afterall it is still people buying bitcoin and the other cryptocurrencies.

The most important point no one seems to talk about, and is uncomfortable for lots of investors, is that not every asset with limited supply is valuable. Art is the obvious example. Some artists are incredibly favoured by patrons, others are not, and many of the measures for determining value are subjective.

This interview with Dr. Daniel Kim, kindly forwarded by a subscriber, points out a number of the failings of bitcoin. Supply is controlled by China. There could be a hard fork enforced by the shutting down of the internet in China. There are also increasing efforts to identify the chain of custody which means some bitcoin will be worth more than others because of the taint from criminal activity. The counterargument to everything he said is Kim is a proponent of Monero.

If the worst possible event happens, it is not a counterargument to say other assets will also be affected. That’s not how a non-correlated asset works. The benefit of gold is it will still be gold if the power goes out.

The bitcoin Holdrs, those who will never sell and were early investors, are similar to DeBeers. The early miners in Kimberly in South Africa simply went around picking up diamonds off the ground. As the cost of mining increased, the ability of small miners to compete decreased and capital intensity took over. That created concentration of ownership and the focusing of wealth in a small number of hands.

Today diamond mining is incredibly capital intensive and the high price has encouraged competition from manmade diamonds where the cost of production is falling. Mined diamonds are still valuable, have limited supply and massive marketing budgets. However, the cost, quality and energy/carbon imprint of alternatives is getting better all the time. That’s an inevitable trend as the carbon cost of mining increases; it bolsters alternatives.

The whole diamond argument has been playing out for two hundred years but software iterates at an exponential pace. The prize is so large and the resources required to develop alternatives is so low that that biggest threat to bitcoin is obsolescence.

My view has not changed since 2013, there is value in the proposition of alternative transfer networks. However, bitcoin is very unlikely to be the foundation of a new financial system. It is too slow and inelastic to have broad market utility.

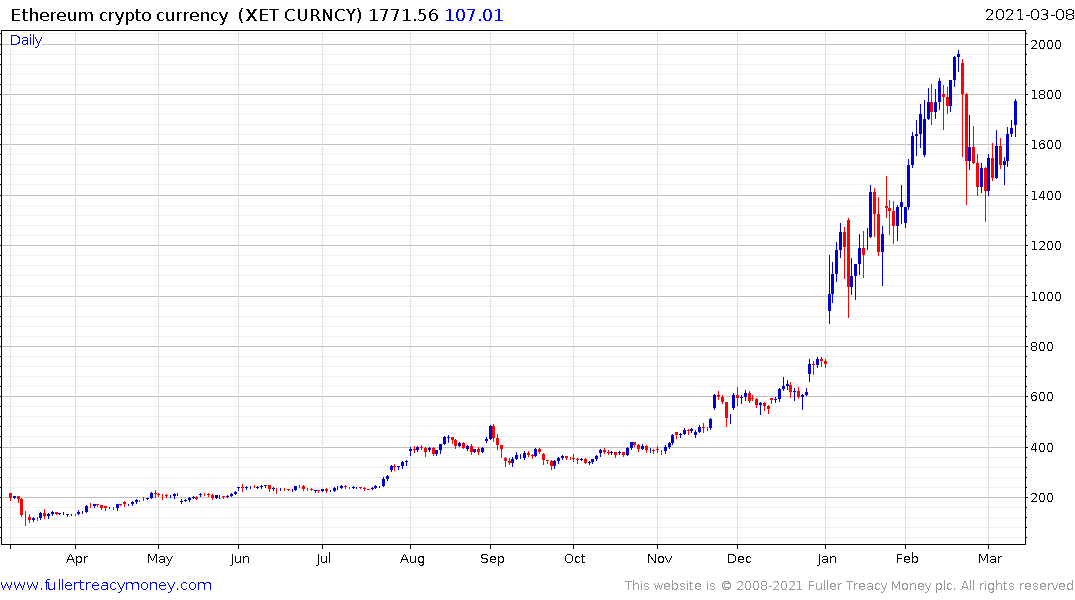

I sold my Ethereum because stops are largely ineffectual in fast moving markets and it was a leveraged position. Sentiment is rapidly approaching euphoria and that tells me a lot of people already have positions.

Today’s upward dynamic on the back of the anticipated hard fork in July, to usher in a potentially deflationary proof of stake protocol, suggests I sold too early.

Here is a section from a related article:

EIP-1559 is Ethereum’s most anticipated update since the launch of Serenity in December. It will see a portion of the gas fees on every transaction get burned, reducing the supply of ETH. Beiko told Crypto Briefing that EIP-1559 could be thought of as an “ETH buyback” proposal earlier this year. EIP-1559 could make ETH a deflationary asset.

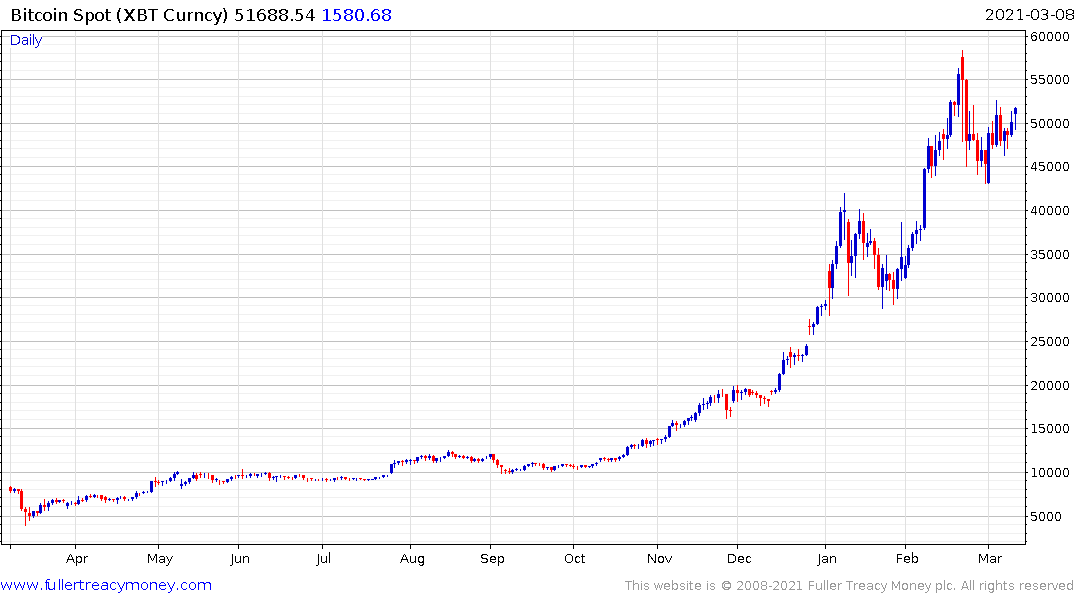

The bitcoin trend is still reasonably consistent. It has been characterised by a series of ranges one above another and that remains the case. As long as the $40000 level holds, this could still be a consolidation.

Nothing has happened to challenge my conviction that investors are as likely to panic out of an asset as they are to panic in. The crypto boom/bust cycle has not been vanquished.

Back to top