Email of the day on whether technical analysis has predicative qualities

I’m confident that most subscribers admire your courage in publishing the uncomplimentary letter extoling the benefits of Bitcoin. Ten years ago, an early teenage, nerd neighbour, who was a Bitcoin investor gave me and some other local adults an introduction with the promise that Bitcoin was the money of the future. At that time, one calculated the number of Bitcoins required to buy a cup of coffee. Its usefulness seemed apparent. My partner was keen. My reticence won-out because I could see how easy it was to buy but I was not confident that I could get my money back.

Today, Bitcoin is obviously not money nor a substitute for money and will never become one. See attached article. How long it will continue to be an investible asset is also an open question. Your critic may be disappointed. Bitcoin may be a store of value; and its liquidity has improved but there will be similar and more convenient options. Unlike art it has no attraction other than its relatively unattractive store of value. It is purely a speculative venture dependent upon an increasing number of bigger fools while at the same time there is a diminishing number of potential buyers. One could never say the same about gold.

You politely ignored the correspondent’s criticism of your technical analysis that remains the principal reason for my subscription. Do you believe that T.A. has predictive characteristics?

Thank you for the associated article and your kind words. The best way to think about bitcoin or the other cryptocurrencies is as venture capital. Whatever portion of your portfolio you would normally devote to “make or break” opportunities, where you are willing to lose everything that is what you should think about investing in cryptocurrencies. That also fits the technical definition of gambling. The idiosyncrasy of the sector is that they are open to retail investors. Most venture deals, in the technology sector for example, are only available to much wealthier individuals.

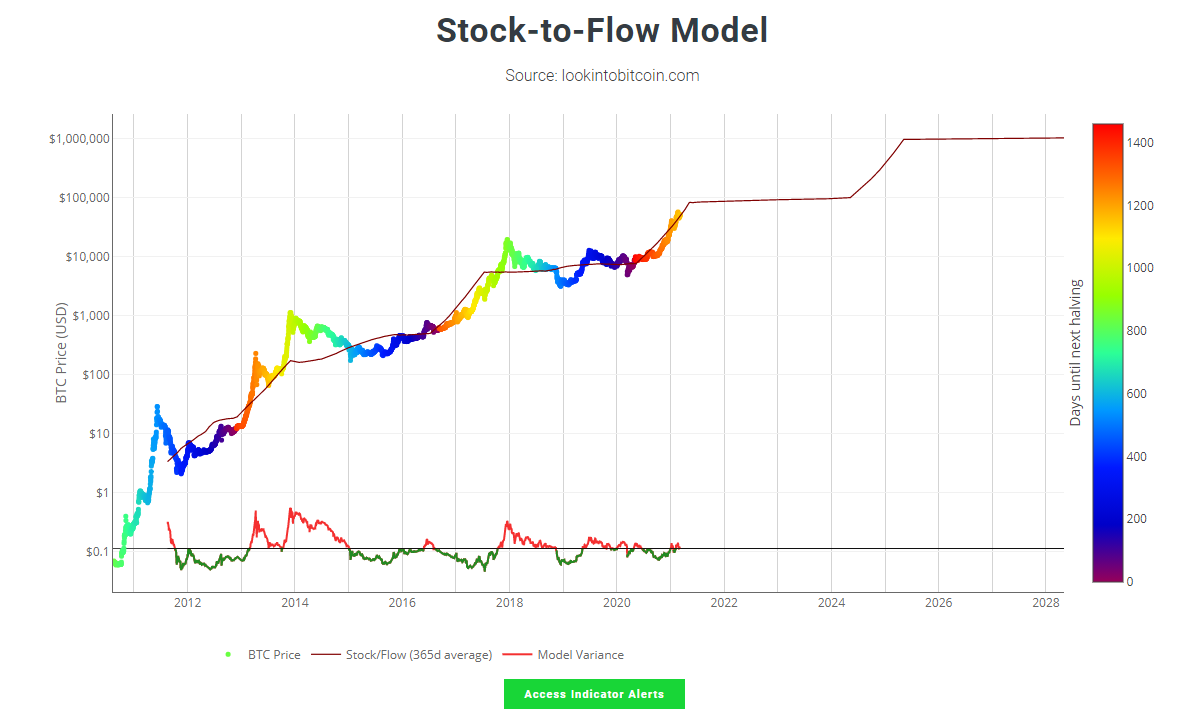

A subscriber kindly forwarded links to lookintobitcoin.com which has a number of very illuminating charts. Stock to flow makes intuitive sense to me because the halvenings are psychological events that deeply affect sentiment.

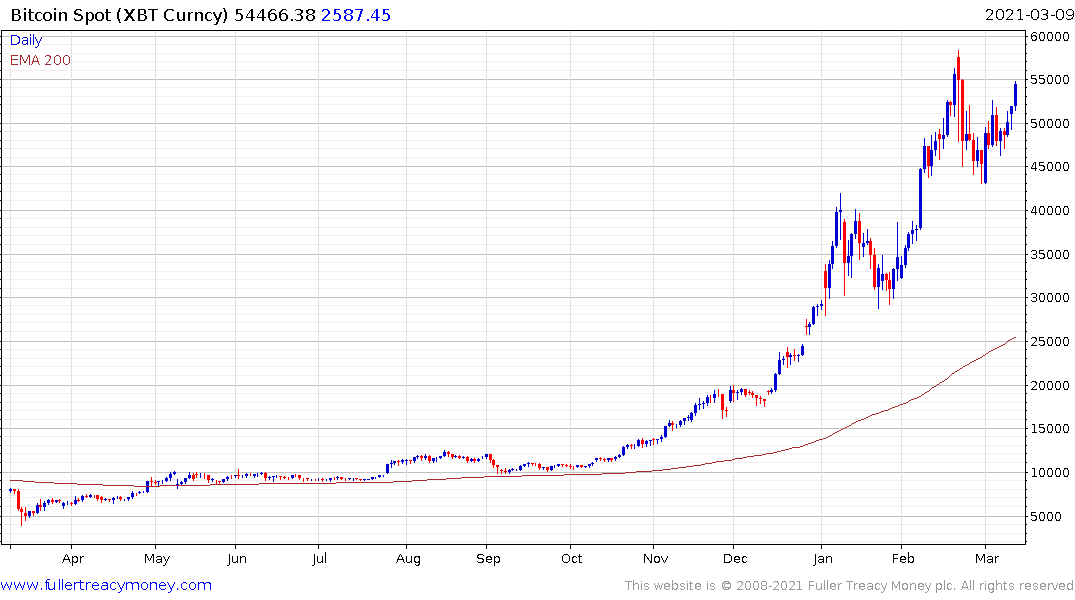

The boom and bust nature of bitcoin means that it is prone to massive upswings and declines. The 100-day MA has offered support on subsequently declines so it is a natural area to expect support to be found. Declines from the peaks can be in the order of 80% to 90%. That also means that the price has to become exceptionally overextended to be able to fall that amount and still hold the upward bias. The 1000-day MA is currently at $9990 so if the price were $100,000 it could fall 90% and still hold the MA.

That’s not a prediction. Markets can do anything and very often do. Targets tell us more about the person making the prediction than the market. We can only tailor our approach to deal with reality.

With the risk-on rally regaining traction over the last 24 hours, the next bitcoin breakout to new highs is looking more likely. I talked about bitcoin being a lead indicator for the stock market earlier this year. That view is gaining traction. Both Tesla and bitcoin are lightning rods for speculation. They are most sensitive to speculative flows and tend to offer exaggerated timing signals for the wider market.

To answer your question about the predicative qualities of technical analysis. Yes. I’ve been reading charts for 20 years. I’d be in trouble if I didn’t think there was value in the approach. However, not every chart is easy to read. That’s why this service has always focused on consistency. We encourage everyone to act like the judge at an international beauty contest.

A consistent trend is the most predictable thing in the market because it reflects the ebb and flow of a supply/demand deficit or surfeit. As long as the trend is in motion the sequence will repeat.

Base formation completions signal the beginnings of new trends and consistent trends are the easiest risk-adjusted ways of participating with markets. When trends lose consistency, it is time to be vigilant. When that is twinned with tightening monetary policy you need to be worried about market peaks.

Back to top