Email of the day on what to do in the third psychological perception stage of a bull market:

After listening to the latest Long-Term Outlook broadcast in which you reiterated your view that we were in the final phase of a cyclical bull market and that while it was a time to be watchful, it was not a time to sell, I could not help thinking back to 2008 when David, in his daily audios, said on several occasions that he did not think the sub-prime crisis would amount to much.

Unless I'm much mistaken, he continued to make this comment until at least June. Around June 2008, I bought Citibank at $33 (equivalent to $330 today) yielding 7.5% - a bargain. They fell to $27 and I bought some more. Unfortunately, I lacked the guts to buy when they fell to $1 but I did add to my holding as the price steadied and rose - not much because I remained cautious (scared to death to be more truthful). Only this year has my Citibank investment moved into profit. I make these comments because as Sam Goldwyn famously said, 'forecasting is difficult, particularly when it's about the future'.

Like anyone else, I have no clue as to the timing, the depth or the length of the next correction or crash. However, without income flowing in from any source other than investments, I am now beginning to prune - or intending to prune: selling, as you know, is harder than pulling hens' teeth.

Why do I want to prune now? Because I do not want to be trying to raise cash when markets are plummeting. Some would argue that one should just hold through the corrections and crashes and I would agree with that - to an extent. My caveat would be that one must have cash to take advantage of the market swoons when they occur. If one remained fully invested from 1999 to the current time and lacked cash to add to the market in 2009 or 10, one's returns would not look overly good. So, I intend to increase my cash reserve now, probably top slicing tech, resources and China. If I wait for someone to ring a bell, or point out that chart patterns are deteriorating, the probability is that it will be too late.

Thank you for this generous email which highlights a range of emotions and experiences that I believe will be valuable to the Collective. I agree breaking up is hard to do but the best time to take profits is when the market is accelerating higher. At least when you are taking profits, you are not buying more which is one of the biggest mistakes a long-term investor can make in an accelerating market.

We all want to learn from our past experience. For you that is a commitment to get out in time, before a potential crash leaves you chasing the market lower and feeling forlorn for having missed the opportunity. For my part, the visceral experience of the 2008 crash has left me with an acute sensitivity to anything that might upset the trend. That is why I began to talk about the transition to the Third Psychological Perception stage of the cyclical advance last September and we know that often climaxes in an accelerated blow off.

The greatest challenge with learning from our experiences is to know when the best time is to employ those lessons. This has been an historically impressive advance off the lows in 2009. In all that time it would have been easy to jump at shadows and exit early. Just as we do not know when the next more serious pullback will occur, we do not know how much higher the market will go first, which is of course why selling is difficult. We can only rely on the reality provided by markets. So, let’s address the consistency characteristics because they will deteriorate before we get outright top formation completion.

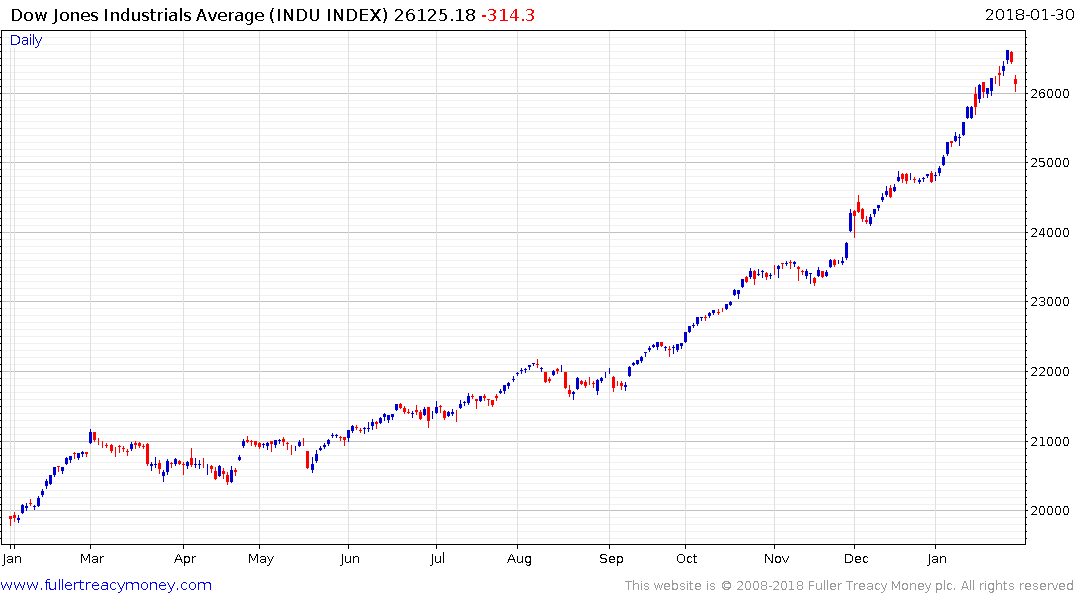

The Dow Jones Industrials Average accelerated higher with its largest constituent, Boeing, and is due some consolidation. It has now pulled back by more than 500 points from the peak on Friday, so this is a larger reaction than any seen since April of last year. At the peak on Friday the Index was approximately 14% overextended relative to the trend mean so it has plenty of room in which to consolidate but if we get more than a 3% pullback it would be the largest reaction since 2016 which would be an inconsistency.

Generally speaking we expect trends to get more consistent as they progress because they encourage more people to participate. If we then get a loss of momentum, that begins with an acceleration, followed by a larger pullback, it could represent the beginning of at a medium-term top. If the buy-the-dips strategy that has prevailed over the last 15 months is to be sustained the Dow Jones will have to rally tomorrow. Just what President Trump has to say in tonight’s State of the Union address is likely to have an influence on that outcome.

The next big problem for global markets is unlikely to be in US mortgages specifically even though prices are above the 2007 peak. Of the 40 or so houses on both sides of the block I live on, 5 have sold in the last 12 months and for progressively higher prices. That tells me the market is hot as buyers try to lock in still relatively low mortgage rates.

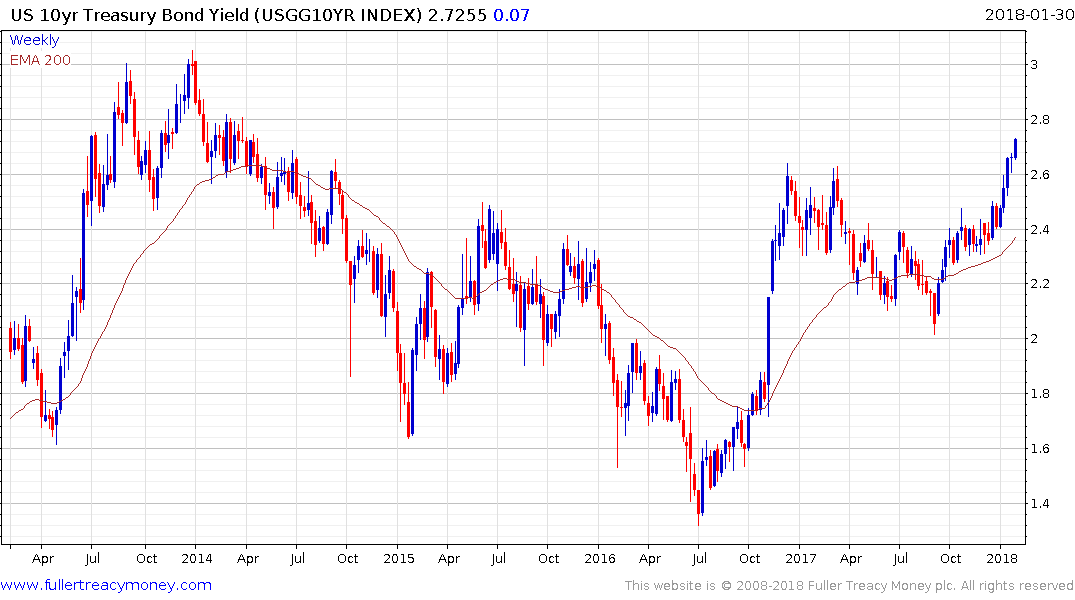

The 10-year Treasury yield continues to rally towards 3% which represented support for the market following the taper tantrum. Back then the Fed was only talking about reducing its stimulus, now it is both raising interest rates and reducing the size of its balance sheet concurrently, albeit at a slow pace. This represents a much bigger impact for the market which has not yet been fully priced in. If we are looking for where the next big problem will be then the bond market has to be a prime candidate.

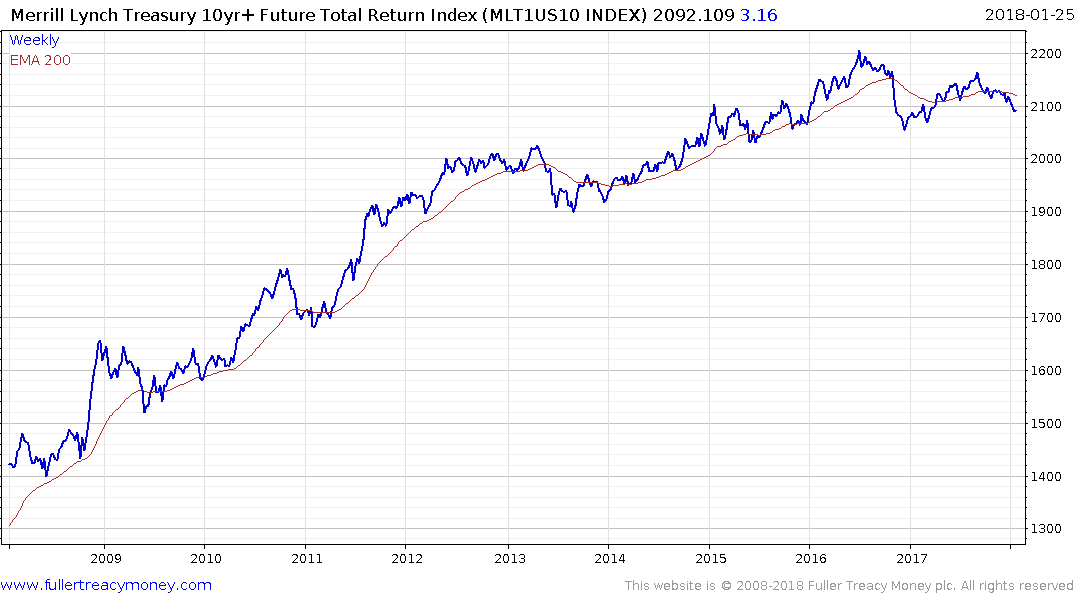

If we look around the world the Merrill Lynch 10yr+ Treasury Futures Total Return Index has one of the most impressive uptrends in history but increasingly has the clearest evidence of any asset class of developing type-3 top formation characteristics. The end of the bull market in bonds, is a real possibility over the course of this year and commonsense dictates that it will result in at least an adjustment period for stock markets considering the magnitude of the change.

Treasury yields rising are getting a lot of headlines but high yield spreads are still very low, the yield curve spread is still positive, unemployment is low and the participation rate is trending higher. While stock markets were in negative territory today, leaders like Amazon and Facebook closed up on the day. All of these factors point to a pullback rather than an outright top right now but this remains a situation where it would be advisable to show distain for complacency.

Back to top