Email of the day on volatility and the difference between trading versus investing

Just six or seven days ago you commented that the recovery could go on for two to three months, now (apparently) you are waiting for the Vix to hit 50 so indicating a bottom of the market.

Sometimes your commentary is as volatile as the markets you are reporting on!

Thank you for this email and I apologise for mixed messaging. Let me take this opportunity to try and be clearer.

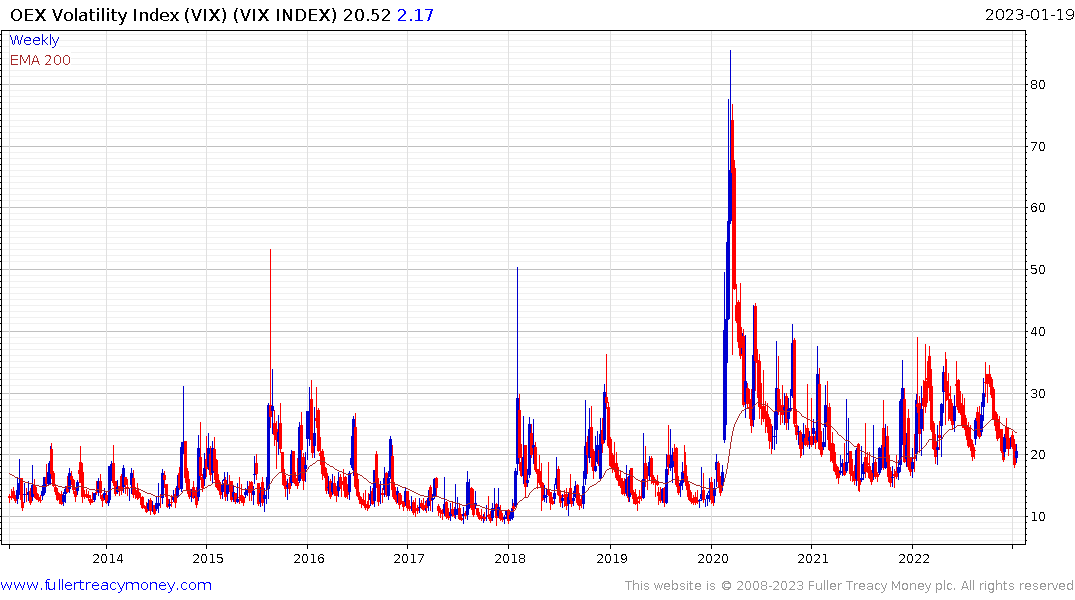

In last night’s audio and video commentary I highlighted the fact that major lows don’t generally form until the VIX Index spikes to around 50. By major low I mean the ultimate low in a medium-term downtrend; as in 18-month to 3-year bear market. Along the way there will be several short covering rallies and they can last for a couple of months at a time.

In last night’s audio and video commentary I highlighted the fact that major lows don’t generally form until the VIX Index spikes to around 50. By major low I mean the ultimate low in a medium-term downtrend; as in 18-month to 3-year bear market. Along the way there will be several short covering rallies and they can last for a couple of months at a time.

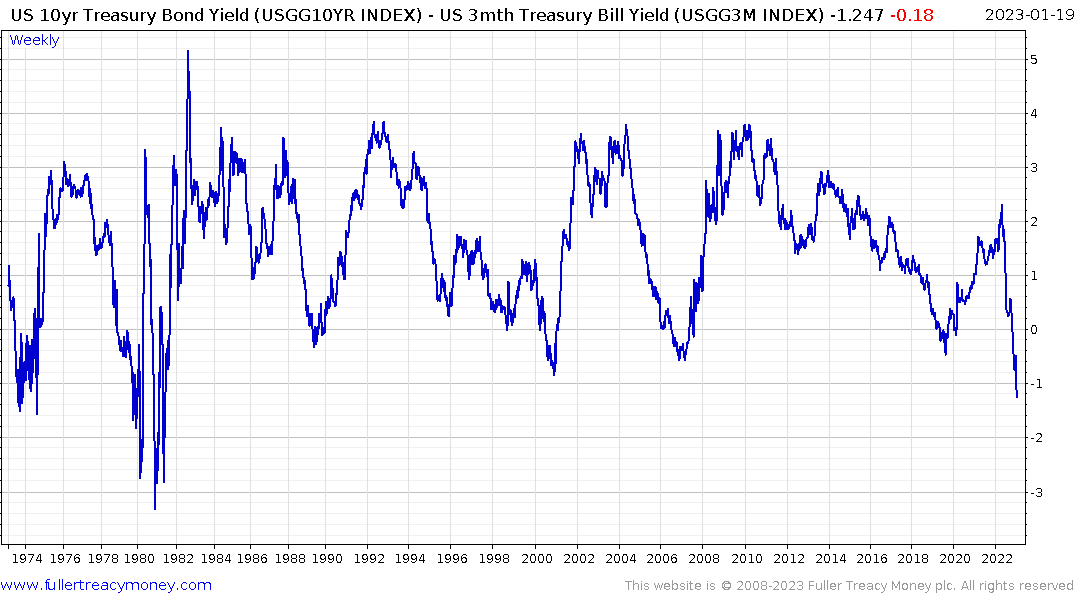

However, I want to make this point very clear. The 10-year – 3-month yield curve spread is at its most inverted since the early 1980s. A recession is inevitable. Stock markets generally do worst following the first interest rate cut, because central banks don’t ease policy until they have incontrovertible proof a contraction is already underway. 2022 was about valuation contraction. Earnings weakness is still in the future.

However, I want to make this point very clear. The 10-year – 3-month yield curve spread is at its most inverted since the early 1980s. A recession is inevitable. Stock markets generally do worst following the first interest rate cut, because central banks don’t ease policy until they have incontrovertible proof a contraction is already underway. 2022 was about valuation contraction. Earnings weakness is still in the future.

I have been trading the Nasdaq-100 on the short side since March of last year. I reversed my short at the beginning of January because it was oversold and I was willing to bet that we were due one of those rebounds now I am not so sure. I did not like the look of yesterday’s decline because the positive correlation between bonds and equities appears to be breaking down.

I have been trading the Nasdaq-100 on the short side since March of last year. I reversed my short at the beginning of January because it was oversold and I was willing to bet that we were due one of those rebounds now I am not so sure. I did not like the look of yesterday’s decline because the positive correlation between bonds and equities appears to be breaking down.

.png)

My highest conviction this year is that Treasury yields will compress to between 2 and 2.5%. That’s why I have loaded up on bonds in my investment portfolio and is why I am happy to ride out any volatility in precious metals.

On the one occasion the ECB shrank its balance sheet and the two occasions the Fed has done so, deflationary shocks have followed. I see no reason to expect that will not be the case now too.

The return of Chinese demand is what the bullish outlook is hanging on. Meanwhile both Europe and the USA have to figure out how to pay for the pandemic largesse. That’s not going to be short or easy. The US debt limit for example was hit today.

If yields contract that should benefit companies that rely on cheap financing. I’d be happy to be stopped out of my short, and have an in-the-money stop as of this morning, but I am in a show-me mood. To my mind, bonds, emerging markets, the UK and Europe, select commodities, are promising investment areas but they will not be immune from contagion. There is a lot of risk in the US market as the Dollar trends lower.

Back to top