Email of the day on unconventional monetary policy

I thought the report by Deutsche Bank on the policy tools available to central banks to support economies was interesting. Certainly, there is a lot of debate over whether the tools used to stave off recession and mitigate deflationary pressures following the financial crisis are losing their efficacy. As we saw earlier this year, the adoption of negative interest rates by the BOJ and ECB actually had the surprising effect of pushing the yen and the euro up. Of course, this was not helped by the U.S. Fed reducing its forecast of the number of interest rate rises this year from four to two. However, the knee-jerk reaction of pushing these currencies up following the latest stimulus packages tells us that one of the key objectives of QE and negative rates, that of making a currency more competitive, is no longer guaranteed. Slow growth has become a fact of life in the post-crisis era. The attempts to raise inflation expectations have also been largely futile. It is very telling that the recent pick-up in core U.S. and Japanese inflation rates as well as the rally in commodities have not led to a sustained rise in bond yields. If there is another ‘black swan’ type of event, the central banks may well have to resort to one or more unconventional measures cited in the report.

Thank you for a thought provoking email. There was a certain consensus earlier this year that the Dollar’s appreciation was inevitable despite the fact it was getting in the way of the Fed’s stated aim of raising rates. The reliance of the BoJ and ECB on negative rates at the discount window rather than outright money printing together with the US Treasury’s desire to see a weaker Dollar both conspired to take the impetus out of the greenback’s rally.

Medium term there are very definite tailwinds for the US Dollar and the chart of the Dollar Index which is primarily Euro and Yen has first step above the base characteristics.

However concentrating on the outlook for these major currency pairs obscures a potentially more important story going on in commodity and Asian currencies.

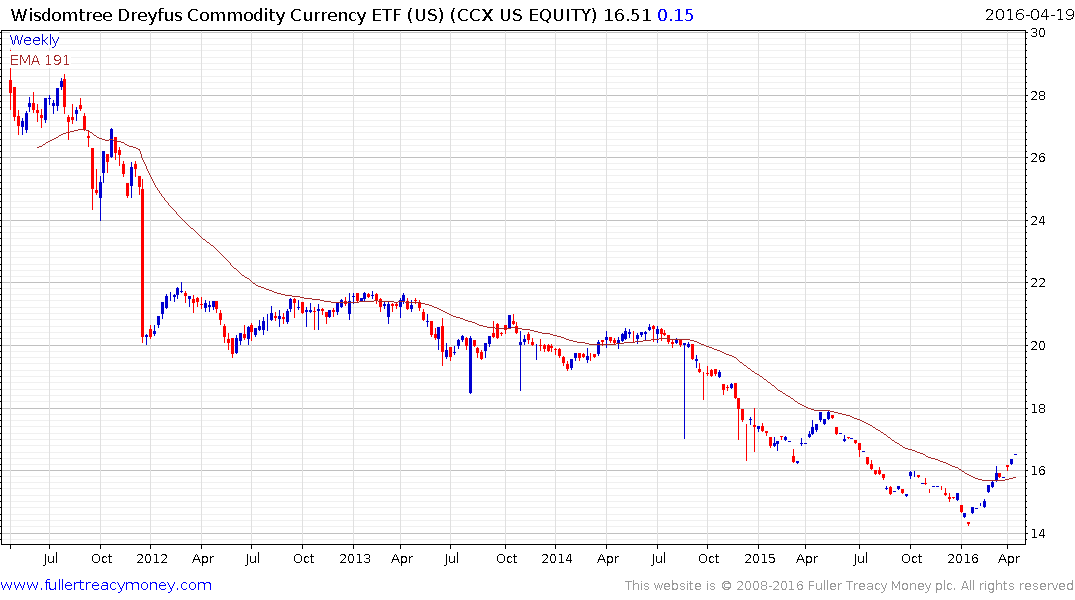

For example the Wisdomtree Commodity Currency ETF invests in Norwegian Krone, South African Rand, Chilean Peso, Russia Ruble, Canadian Dollars, Brazilian Reals, Australian Dollars and New Zealand Dollars. The fund’s market cap has collapsed over the last few years but as an index of commodity currencies it is a useful barometer. The fund has now broken a lengthy progression of lower rally highs and a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

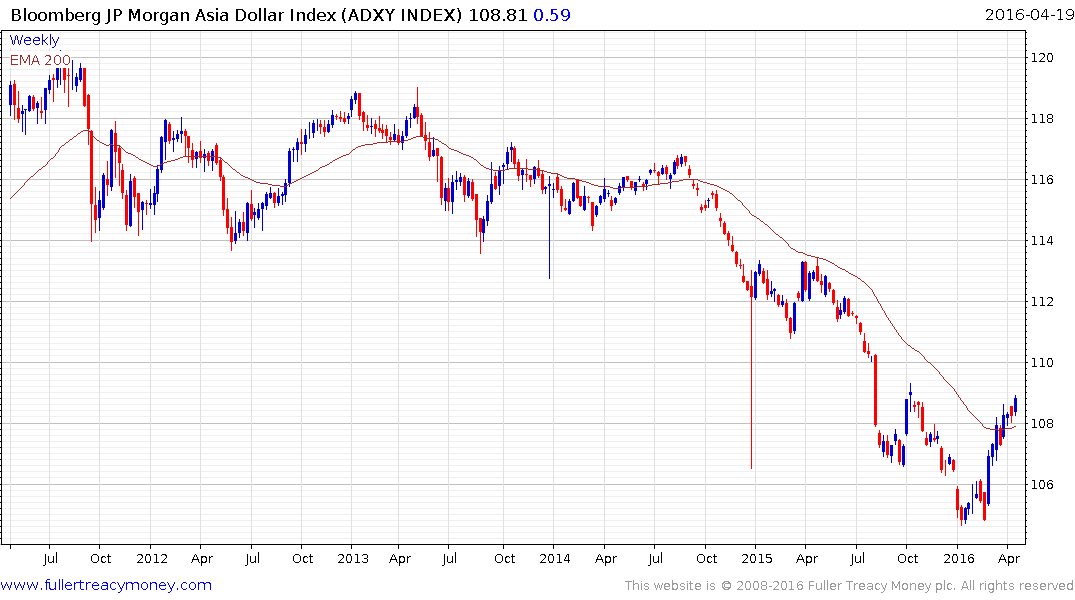

Despite limited scope for an additional rally in the Renminbi, the Asia Dollar Index has now broken a three-year downtrend.

The majority of investors are likely to continue to focus on the outlook for the major currency pairs but the competitiveness gained by the Asian and commodity related markets, following steep devaluations, is likely to be attractive characteristic from the perspective of globally oriented investors.