Email of the day on trading/investing in volatility

Following yesterday's mention of the VIX Index how can a private investor buy it and put it away at this relatively low level? It seems to me that one can only purchase it on a very short term basis.

Thank you for this question and it’s not an easy one to answer. ETFs are doomed to lose money until the brief time volatility spikes higher specifically because of the time value of money arguments discussed yesterday. They suffer from exactly the same problem as the commodity futures ETFs which fall because the contango is realised whenever the contracts roll.

The ProShares VIX Short-term Futures is an example of that phenomenon where it has lost a significant amount of its value since inception.

Buying front month calls is one option but suffers from time value decay so you need to have some luck that the stock market will decline within your timeframe unless you are simply buying them for insurance.

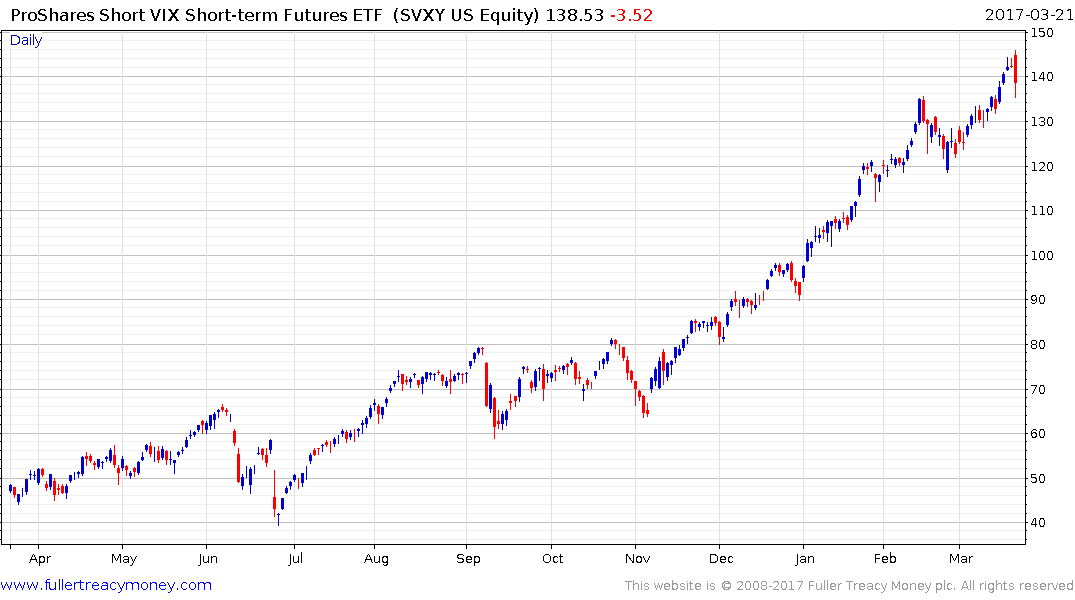

Perhaps the best way to play volatility, although it is fraught with leverage, is to buy the ProShares Short VIX Short-term Futures ETF (SVXY) following a stock market shakeout. It shorts volatility on a leveraged basis and therefore picks up the contango created by time decay. For even more risk tolerant traders there is the Ultra version (UVXY) which uses even more leverage.

It is worth highlighting that the SVXY posted a downside key reversal today.

Back to top