Email of the day on the Wall Street leash effect

As you say, US indices seem to be in cyclical blow off and so in the end phase for this cycle. However, you also say that the move in the Japanese market is in the earlier stages. Question: will the Wall Street leash effect mean that the Japanese market move also ends when the US move ends even though it's in a much earlier stage?

Thank for you for this question which raises an important point about what to expect from the third psychological perception stage of a medium-term cyclical bull market.

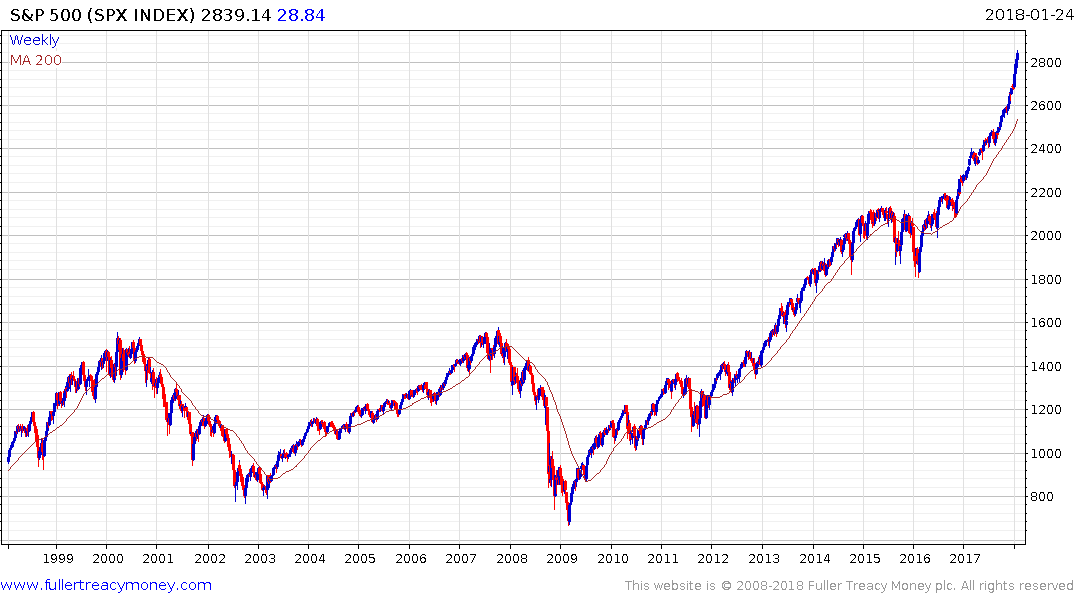

I believe Wall Street entered a secular bull market in 2012 when the S&P500 broke out to new all-time highs. That was the rationale behind writing Crowd Money. I wanted to put down a marker so that by the time 2035 rolls around I will have something to look back on to confirm, at least to me, what the dawn of a secular bull market looks like.

Generally speaking, we only get to live through two entire secular cycles. I arrived in London in the spring of 2000, so my first experience was of a stock market bubble bursting and 12 years of volatile ranging. At the same time, we were treated to an historically powerful bull market in commodities.

The lows in 2009 occurred during one of the most profoundly bearish periods for global equities. More than a few subscribers wrote in to say they had taken all their money out of the banks and buried it in the garden.

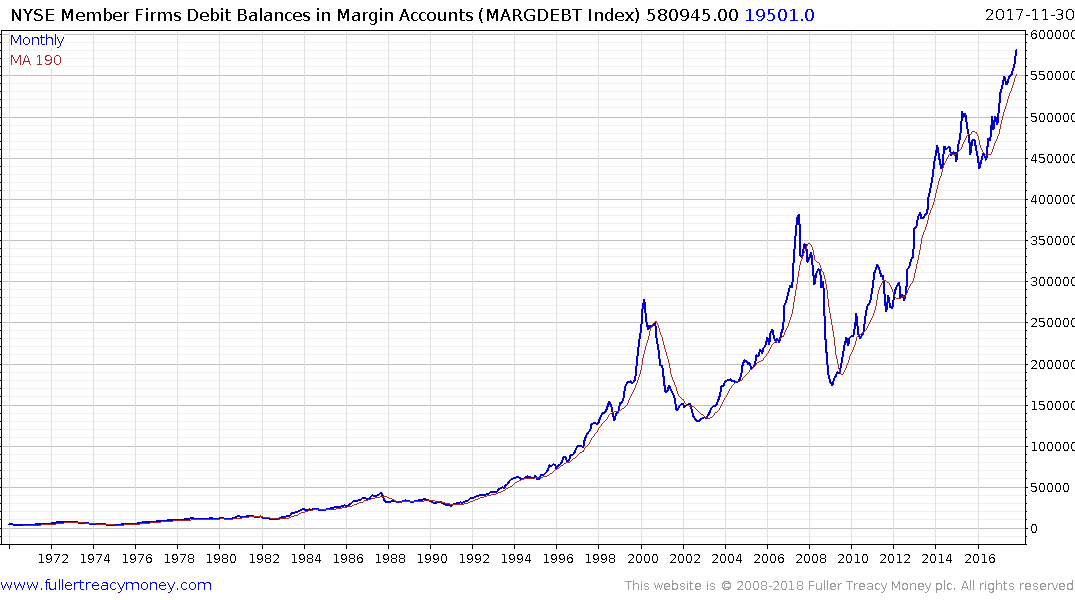

Generally speaking cyclical bull markets tend to be liquidity driven while secular bull markets are technological or economically development driven and therefore have the breadth to last far longer. The central bank response to the credit crisis and subsequent European sovereign wealth crisis was a liquidity response without historical comparison. Their actions bought an impressive cyclical bull market in risk assets that is now accelerating with the twin tailwinds of US deficit spending and synchronised global economic expansion. We are only now at the dawn of central banks beginning to remove that stimulus, with the Federal Reserve leading. Accelerations can persist for longer than we might imagine so now is the time to monitor charts closely.

The secular bull market that began in 1980 was characterised by disinflation. Inflation had been so high in the 1970s that the cost of developing technological solutions was acceptable and exploring foreign venues for manufacturing were much more attractive. The fall of the Iron Curtain sent the globalisation movement into overdrive. Technological innovation occurs largely independently of the business cycle so cost savings were delivered consistently and accelerated with the introduction of the internet. That disinflationary focus was reinterpreted as deflation during the credit crisis. The lengthy balance sheet repair process highlighted the uneven fruits of globalisation and technological innovation with the result that people are now voting along populist lines in the hope of achieving a better pay check. That is stoking inflation pressures.

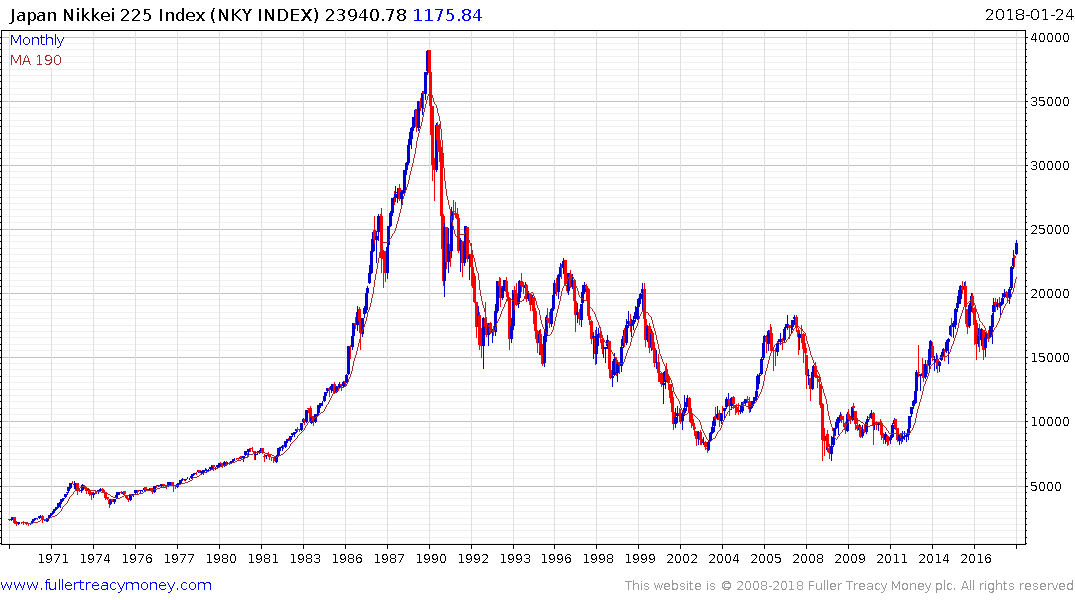

No country has tried to foment inflation for longer than Japan. They tried everything they could from the busting of their bubble in 1989 until now to create inflation and failed. Some might say they were not aggressive enough but we can’t ignore the fact they were trying to create inflation during one of the greatest periods of disinflation in history. It is therefore reasonable to conclude that with Japan now completing a decades long base, while at the same time satellite nations like Taiwan and South Korea and completing long-term ranges that this is where we should be particularly alert for signs of nascent inflation.

With the Nikkei trading above 23,000 for the first time since 1991, I believe it has finally overcome its challenges and is back on a sustainable expansionary footing. A sustained move below 20000 would be required to question the view it is back on a secular expansion.

The secular bull market in Japan is evolving with a significant lag to Wall Street, not independently of it. The factors driving these long-term expansions such as the adoption of capitalist policies over much of the world and improving governance are lifting billions of people out of poverty and into the middle classes. First unconventional oil and gas and now energy storage options are revolutionising the energy sector while the pace of technological innovation in other sectors is equally rapid. This is particularly true of the healthcare sector where we are truly at the dawn of personalised medicine. These are very long-term themes and there is no secular bull that is not punctuated by an occasional medium-term correction, often associated with recession.

There is no sign of recession right now but stock markets are accelerating so we know that a reversion towards the mean is inevitable at some stage. If that move is led by Wall Street it will have a knock-on effect for just about everywhere else, but most particularly among markets that accelerated the most. It has the capacity to lead to a choppy medium-term correction that could last months or even a couple of years with higher volatility. For any base formation completion to be convincing the breakout has to hold. For Japan that is a lot closer to current levels than Wall Street. Another way of thinking about it is that is has, so far, gone up less so it is less overextended.

The big uncertainty for many is that the size of the liquidity provision in the aftermath of the credit has been so large and lengthy that is has created imbalances. I think there is a lot of weight to that argument and the associated leverage in the system is high as a result. That holds out the prospect that the next recession, when it comes, will have an outsized effect on valuations but the enduring strength of the secular advance means that it will afford investors an attractive long-term entry point.