Email of the day on the UK and FTSE-100

Good to have met you in Singapore last year and I hope this email finds you and your family in fine fettle in the US of A. I returned to Japan in 2003, and in my area I would have guessed that circa 30% of the cars here were foreign, mostly European, BMW, Mercs, VW, Porsche and Audis. I would now guess that the total is around 50% minimum, still dominated by the Germans but the number of Minis, Jaguars and Range Rovers I see on my local streets and Tokyo in general if duplicated globally must indicate at least a mini industrial revolution taking place in the UK !!!

?I believe that the Mini is under German management, and that Jaguar/Rover is under Indian management but that production of all still takes place in the UK. I also heard that Nissan has plans to produce its luxury line, the Infinity, at an extended plant in the north east. All this was happening before BREXIT and the decline of the Pound Sterling. Is Brexit combined with a weaker pound combined with a mini industrial revolution going to be the catalyst that finally moves the FTSE 100 up out of its 16 year trading range and into a new generational bull market like the US in 2013??

Food for thought !!

Thank you for this on-the-ground report from Tokyo where the strength of the Yen has acted as a support for imports for much of the last decade. You are correct that most of BMW’s Minis are manufactured in the UK and Tata Motors continues to manufacture Jaguars, Land Rovers and Range Rovers in the UK. The strength of these individual franchises is a testament to the durability of the brands following major management and ownership reshuffles. However the loss of most of Ford’s manufacturing was a blow which the arrival of Nissan might help to soften.

The decline of the Pound should be good news for major UK automotive exporting companies but is unlikely to have a direct effect on the FTSE-100 because the parent companies are not constituents of the Index.

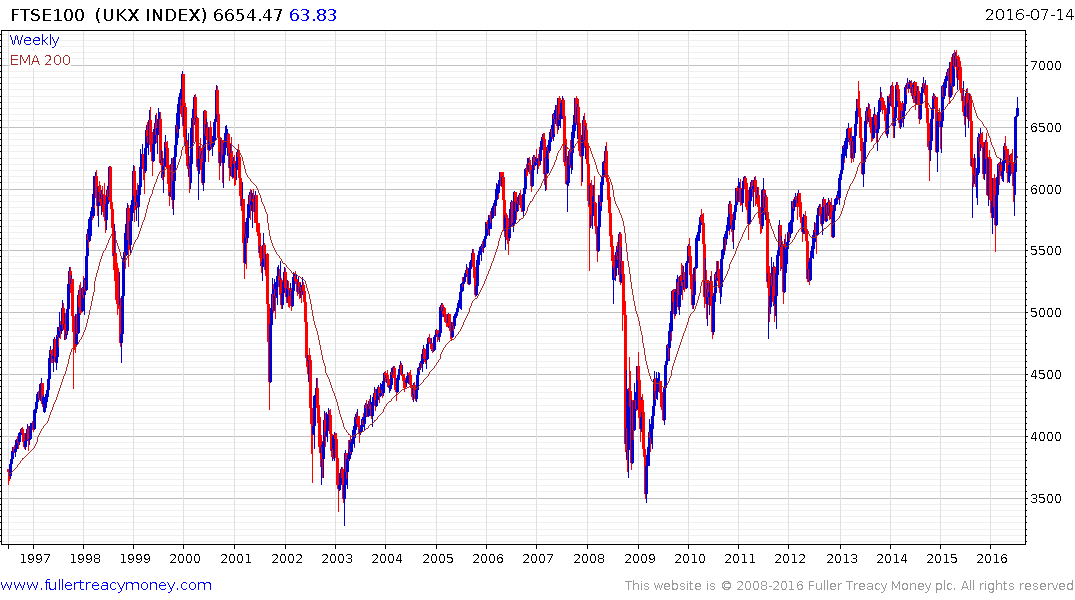

The FTSE-100 experienced a 20% pullback in 2015 and its rebound has been aided by the Pound’s devaluation. The prospects for a successful upward break which would complete the 16-year congestion area are probably dependent on the outlook for global growth improving because so many of the Index’s large constituents are not particularly influenced by the fate of the UK economy.

Energy shares Royal Dutch Shell and BP account for 15% of the Index. Pharmaceutical companies GlaxoSmithKline, Astra Zeneca and Shire represent another 10%. Consumer oriented companies Diageo, Reckitt Benckiser, Unilever and SABMiller account for another 10% and tobacco companies British American Tobacco and Imperial Brands represent another almost 7.5%. Additionally, HSBC with its global operations represents nearly 5.5%.

All of the above shares have benefitted from the decline of the Pound not least because they are consolidating foreign in earnings in a weaker currency. Generally speaking they also have attractive defensive characteristics such as strong records of dividend increases which are attractive to some investors, when yields on many sovereign bonds are trading in negative territory. Against that background the prospects of the Index breaking out of the long-term range are looking somewhat better than they have in some time, not least as central banks globally prepare additional monetary stimulus measures, with the coincident prospect of fiscal spending increasing in a number of jurisdictions.

Back to top